Overview

Tripcatcher is for individuals, accountants, bookkeepers, and companies where users drive their own or company vehicles for business.

Mileage can be recorded manually through the Add Trip form on the phone app and web app. Tripcatcher uses Google’s functionality to select locations and calculate distances travelled. Mileage on the go can also be captured through GPS. The GPS tracking uses a manual start and stop, it is not automatic.

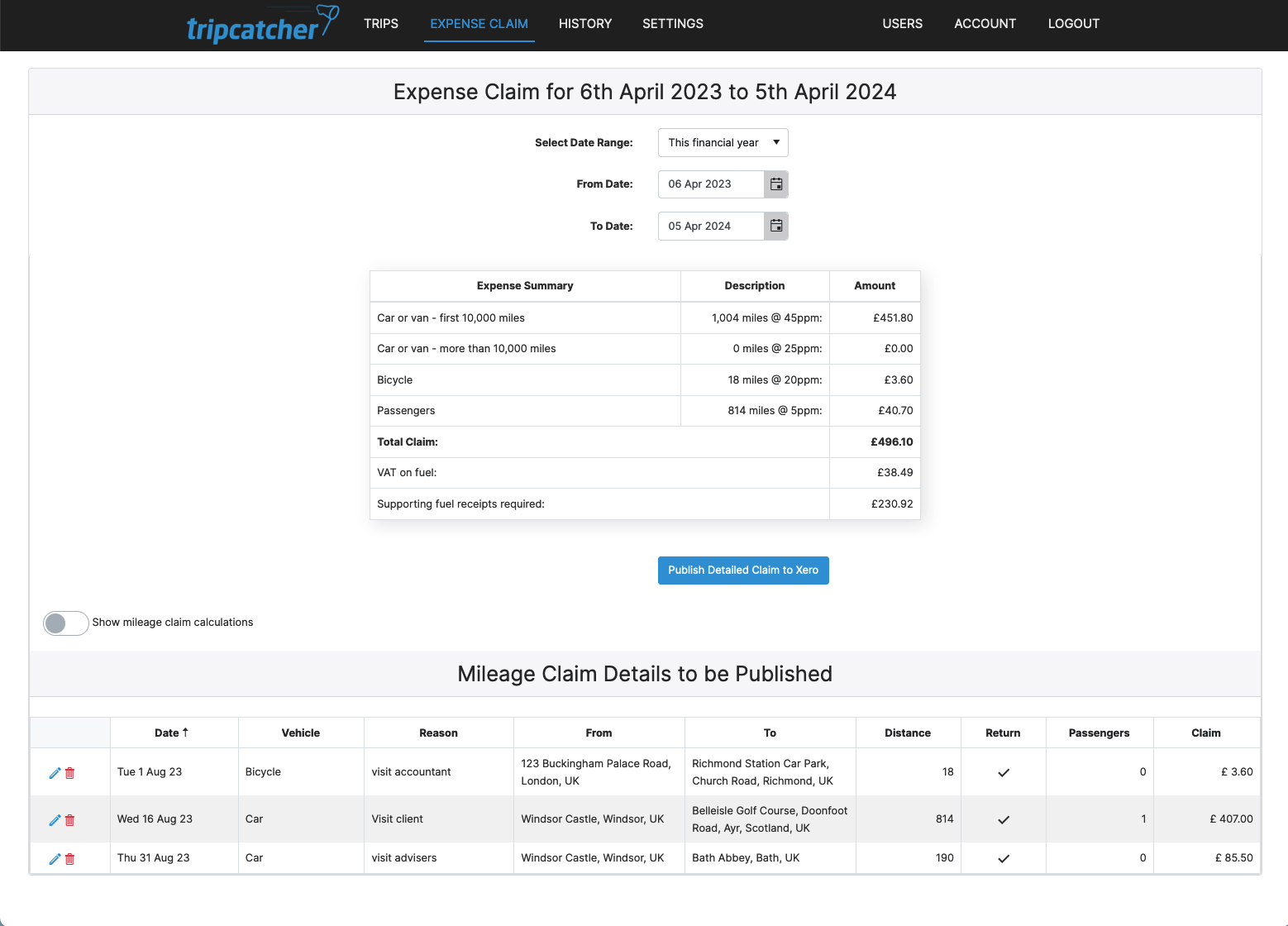

Tripcatcher users can, when claiming their business mileage, use the HMRC-recommended rates

- 45ppm (reducing to 25ppm after 10,000 miles) for cars and vans,

- 24ppm for motorbikes

- 20ppm for bicycles

- 5ppm per passenger

Company car users can claim mileage using the HMRC Advisory Fuel Rates and Tripcatcher also allows users to set up bespoke rates.

The benefits of using Tripcatcher with Xero for claiming mileage include:

- The integration with Xero cuts down on data entry

- Claim all your business mileage easily with favourite places, favourite trips, default settings and more

- Save money especially when claiming the VAT on mileage expenses through Tripcatcher

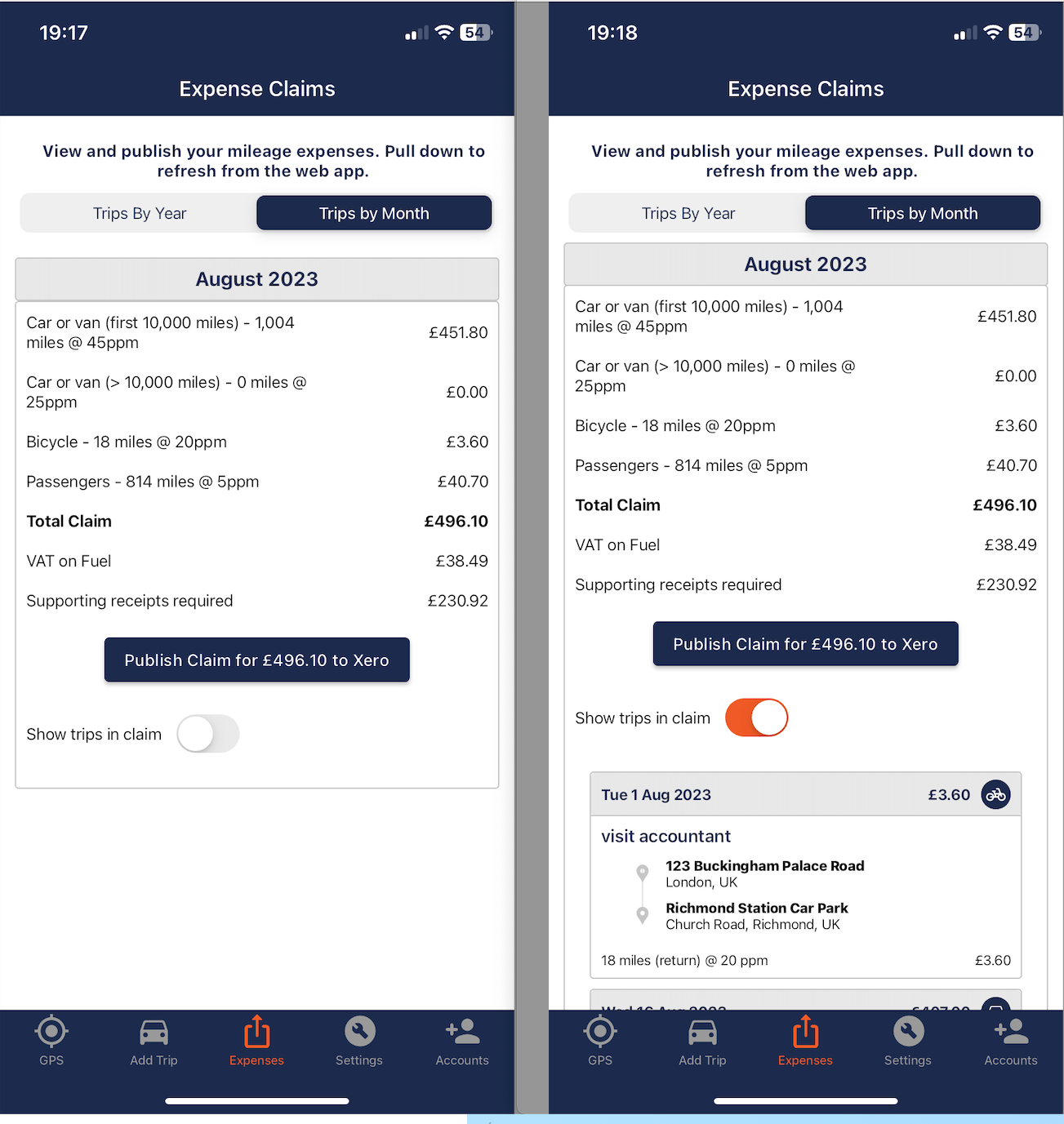

- Record and publish mileage to Xero, on the go, with the iOS and Android apps

- Easily manage your users' mileage expenses through the "Users dashboard”

- Tripcatcher is continually being improved based on customer feedback

Tripcatcher + Xero

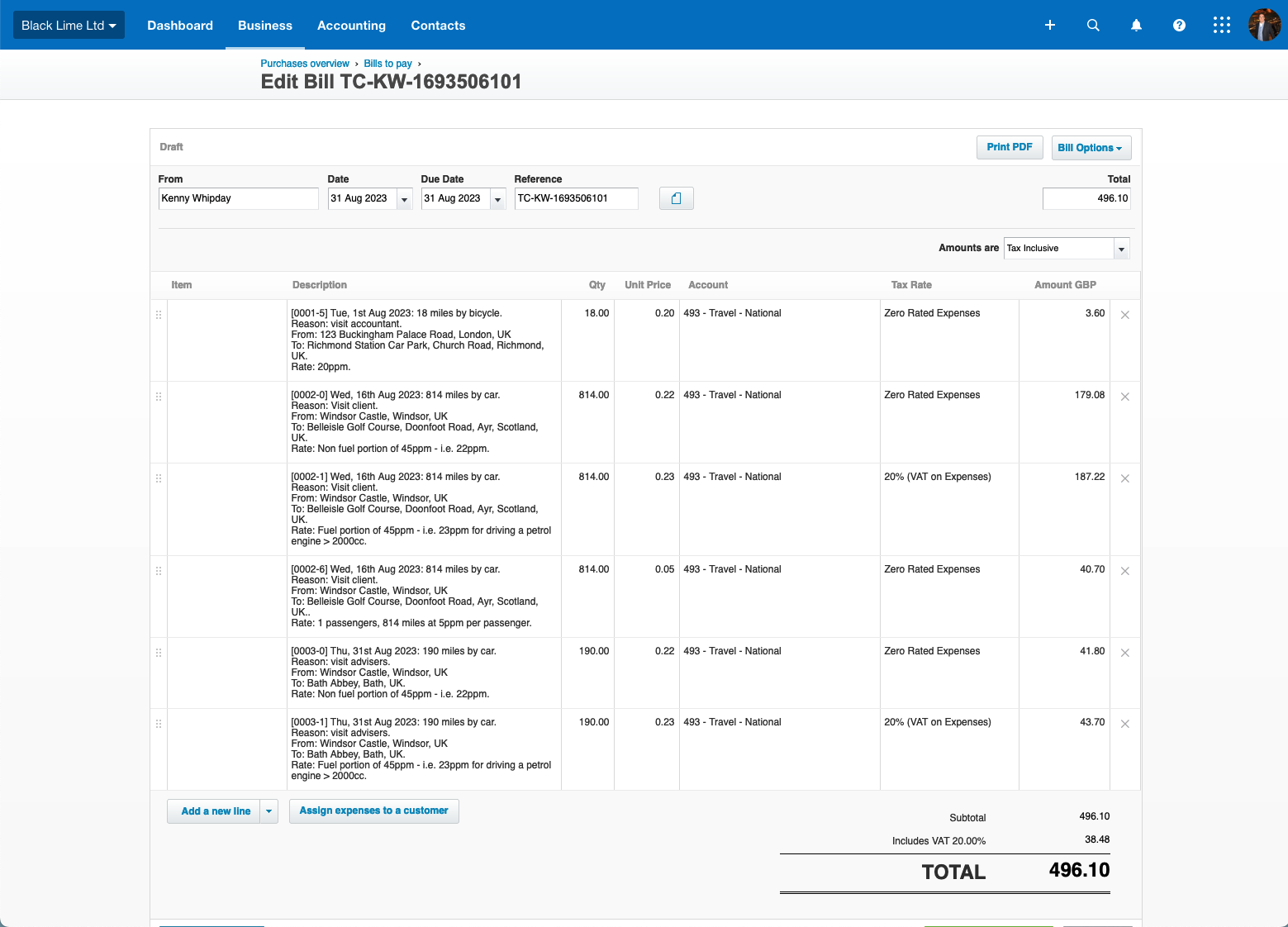

Tripcatcher publishes your mileage expenses to Xero Bills or Classic Expenses using your selected account codes.

The HMRC Advisory Fuel rates are also used to calculate the VAT on mileage expenses which feeds into your Xero VAT report.

Pricing plans

This app includes a free 14 day trial

Tripcatcher

- + £1.95 /additional user/month

- Unlimited trips

- HMRC rates for private and company cars

- Bespoke rates for private & company cars

- Claim VAT on mileage

- Claim for passengers

- HMRC rate change at 10,000 miles

- Admin dashboard

- Phone and web app

- Add and remove unlimited users

- Connect to multiple Xero orgs

- Publish to Xero Bills and Classic Expenses

- Also publish to Dext, PDF and Excel

Getting started

When you “get the app” through Xero, you will be taken through a number of steps integrating Tripcatcher with your Xero account.

If you want to connect Tripcatcher to other Xero organisations you can easily do this through the Tripcatcher Settings page.

The link below provides instructions on this and how to connect your Tripcatcher users to Xero.