Overview

Capchase provides non-dilutive capital to scaling SaaS / recurring revenue businesses to help accelerate their growth.

Capchase have made +$2bn available to small businesses in the past 2 years, with +5,000 months of runway created, having supported over 3,000 companies and partners. Clients have, on average, experienced a 53% faster ARR growth using Capchase Financing.

Capchase automates the application and approval process but also offers up a dedicated consultant who can guide you through any questions you might have relating to how their debt financing works, the capital available to you, repayment terms or the platform this is all surfaced on.

Once approved, you will then have a Growth Advisor provide on-going support and guidance as and when you require to best support you and your business

The team is available to help at any point, so feel free to ask them anything.

Capchase + Xero

Through Xero's platform, you can now access Capchase funding to support your growth.

It is Fast Connect your banking, accounting, and subscription management platforms via integrations with the leading providers in the Capchase app, and they’ll provide you with a detailed funding proposal within a day.

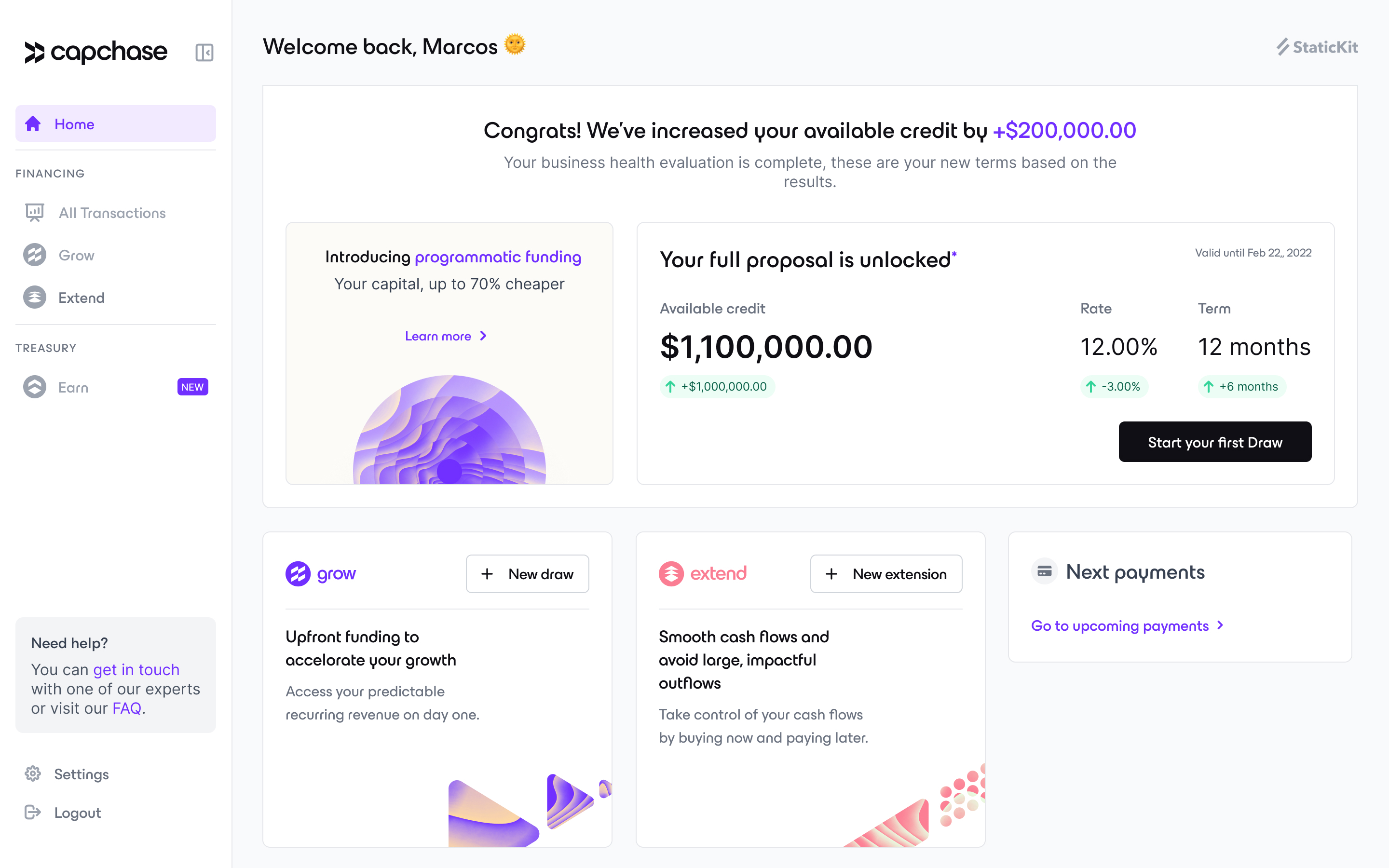

It is Flexible Your credit limit adjusts dynamically based on your growth. Anytime you bring in additional revenue, your limit will increase—you’ll never be penalized for your growth. No restrictions on use of capital—once you receive a credit limit, our capital is available for general use—no questions asked.

It is Transparent There is a single, flat discount fee - no origination, maintenance, or ongoing facility fees. No hidden costs - no warrants, covenants, concentration limits, or security interest whatsoever.

Getting started

Connecting to Capchase through Xero is fast, simple and transparent.

Step 1

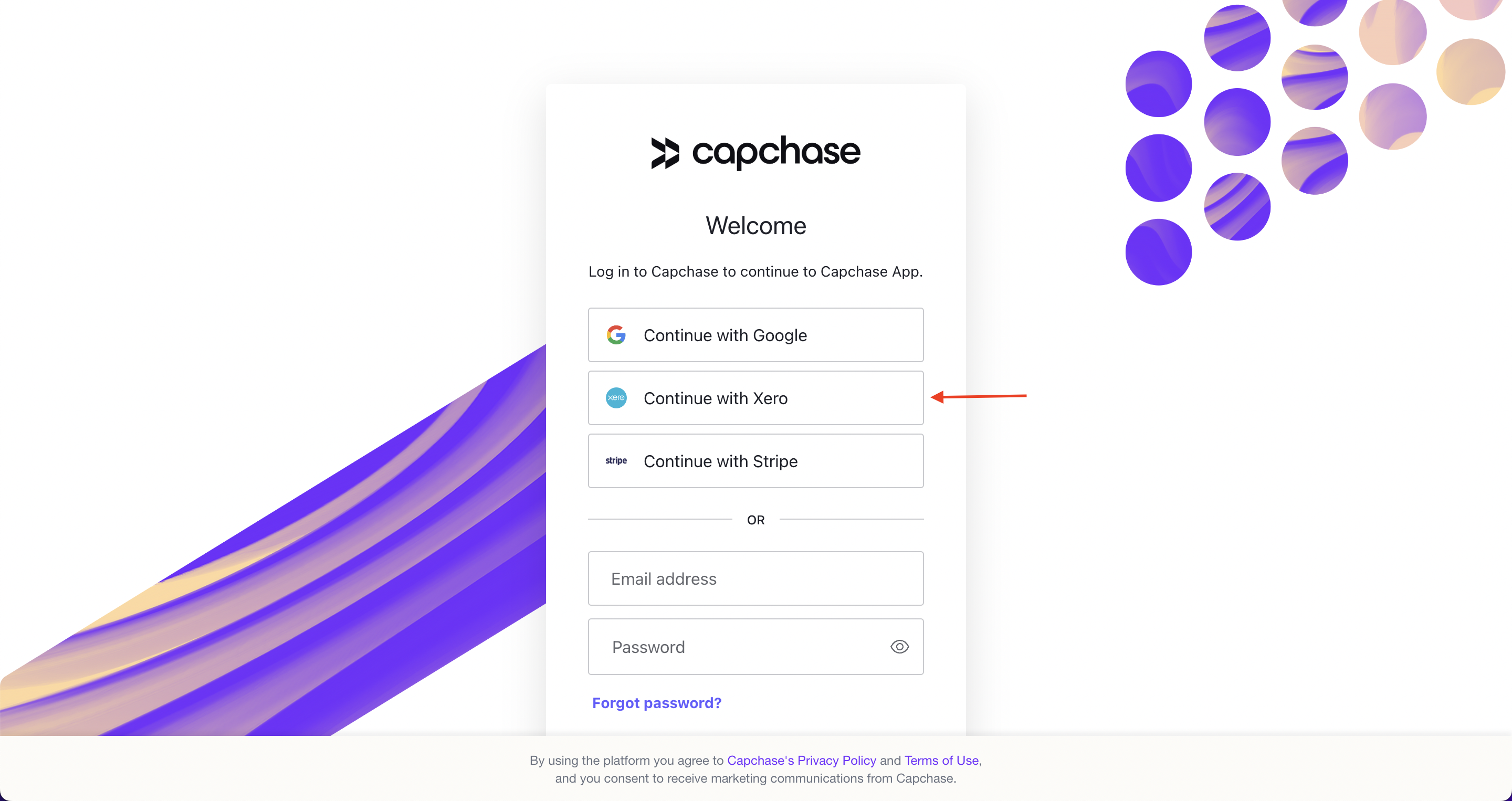

Access Capchase via the Xero App Store.

Step 2

Use your Xero account to sign in via our Single Sign On solution.

Step 3

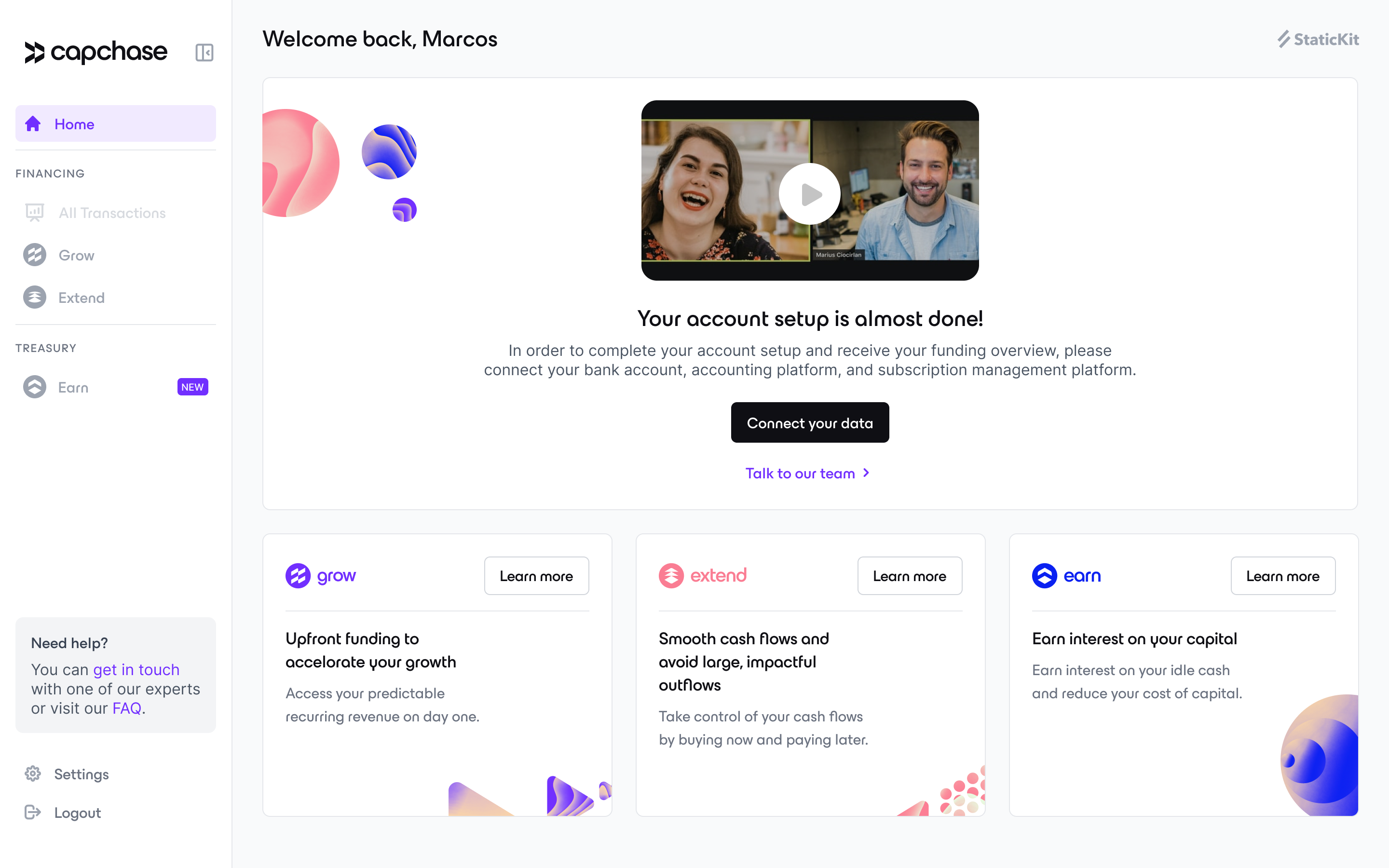

Review your profile and update any missing data points. You'll need to sync your banking, accounting and subscription data for the Capchase underwriting team to review and be able to offer you the maximum capital and best support terms.

Step 4

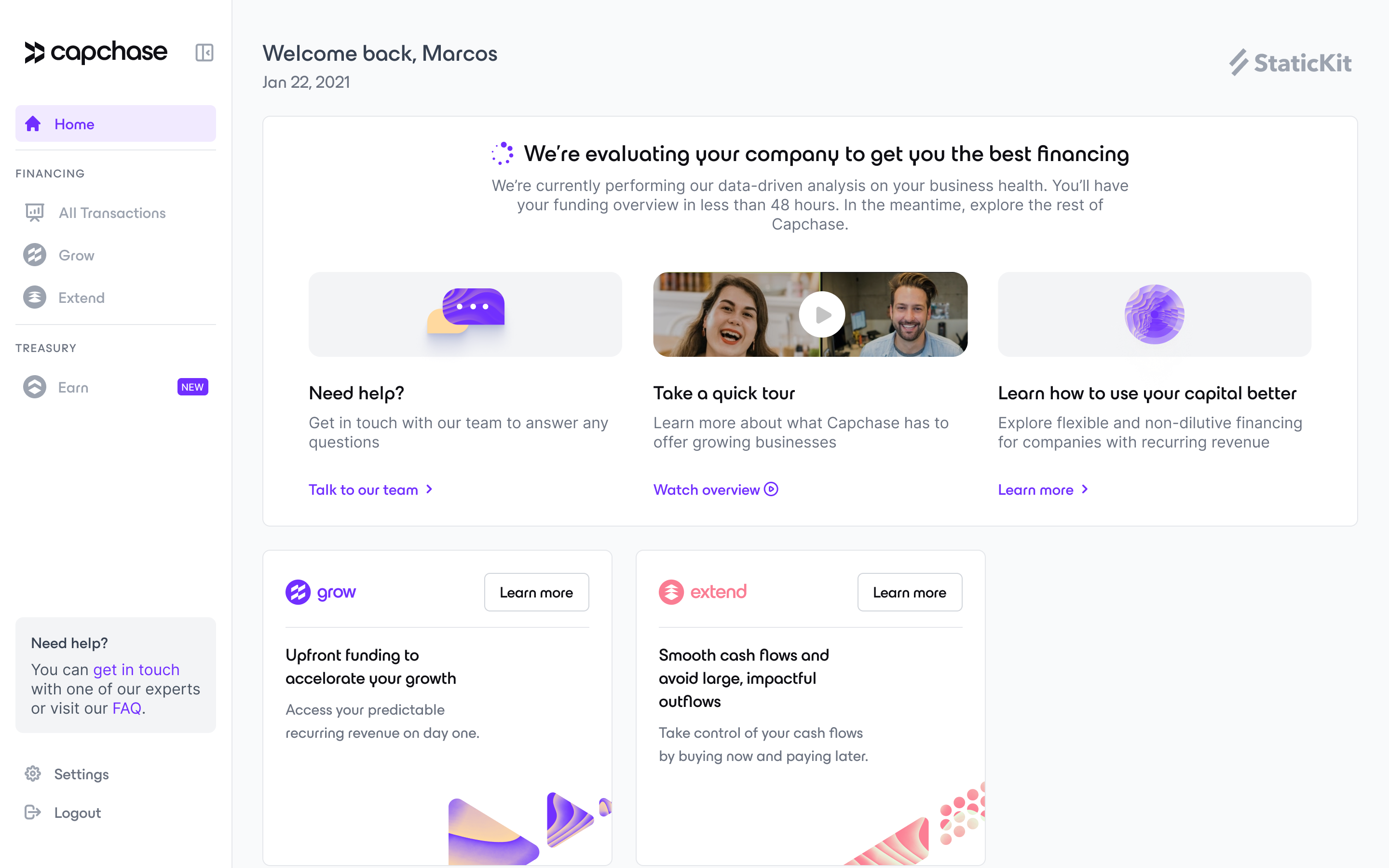

Wait for the offer

Step 5

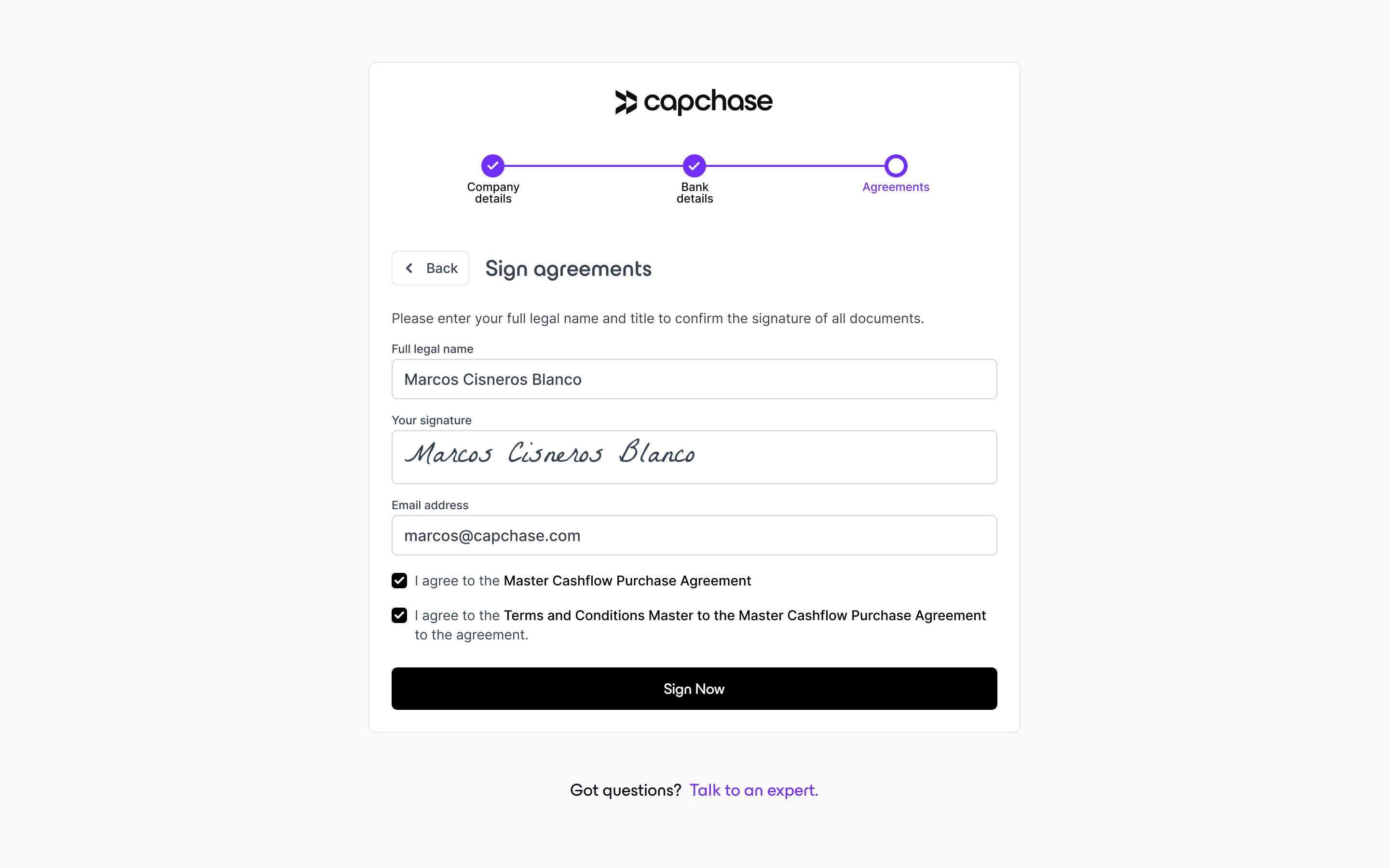

Receive an email notification to your registered email that your offer is ready. Simply log in to the Capchase portal directly to review your offer. If you are happy with the terms, you can head straight into the required paperwork which can be completed in a few clicks. If you want to talk to someone about the offer, you can immediately contact your account executive who can walk through the offer with you before you make any commitments.

Step 6

The important bit - contracts! Provided in a very simple e-signature way with downloadable copies, you will need to review the terms of the credit agreement and sign that you are happy with the terms in order to access your funding.

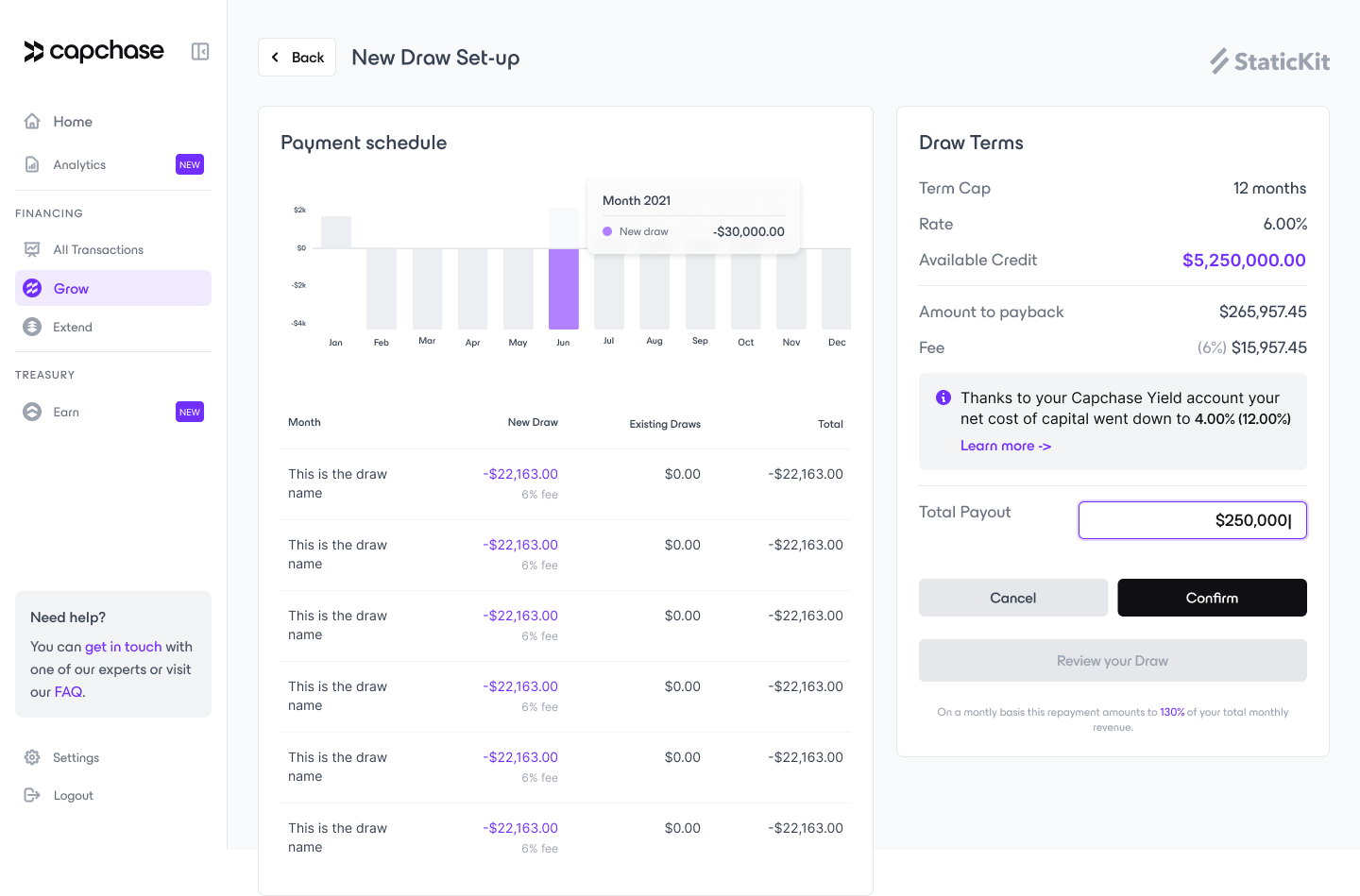

Step 7 - THE FUN BIT......TIME TO DRAW

Immediate access to draw down as much, or as little, of the credit your business has been approved for. Remember as your business grows, your credit facility with Capchase will grow with it. Your repayments and draw history will be readily available on your Capchase dashboard which you can access any time.