Overview

Relay is a no-fee, online business banking and money management platform built to solve the unique cash flow challenges faced by small businesses and the back-office busy work that their accountants and bookkeepers take on.

Our banking features and accounting software integrations solve all the pesky problems that traditional business banks cause for you: vague and incomplete transaction data, broken bank feeds and risky, unreliable methods for accessing client bank accounts.

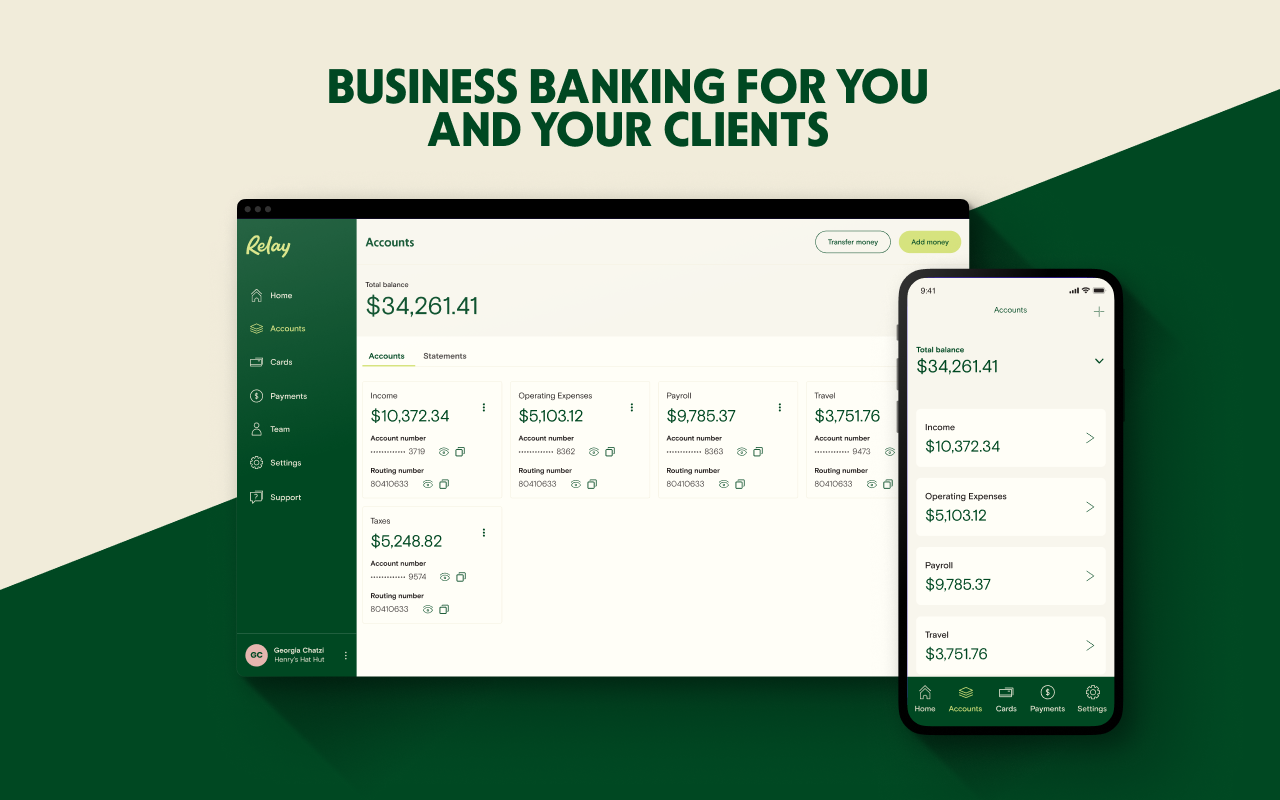

With Relay, each of your clients will get:

- No account fees or minimum balances that tie up cash flow

- FDIC insured via Thread Bank and Evolve Bank & Trust

- 20 checking accounts to compartmentalize income and expenses

- 50 physical or virtual and physical debit cards to organize spend

- ACH, wire, or check deposits and payments

- Personalized customer support by email, chat and phone

You, the advisor, get business banking features that streamline your back-office:

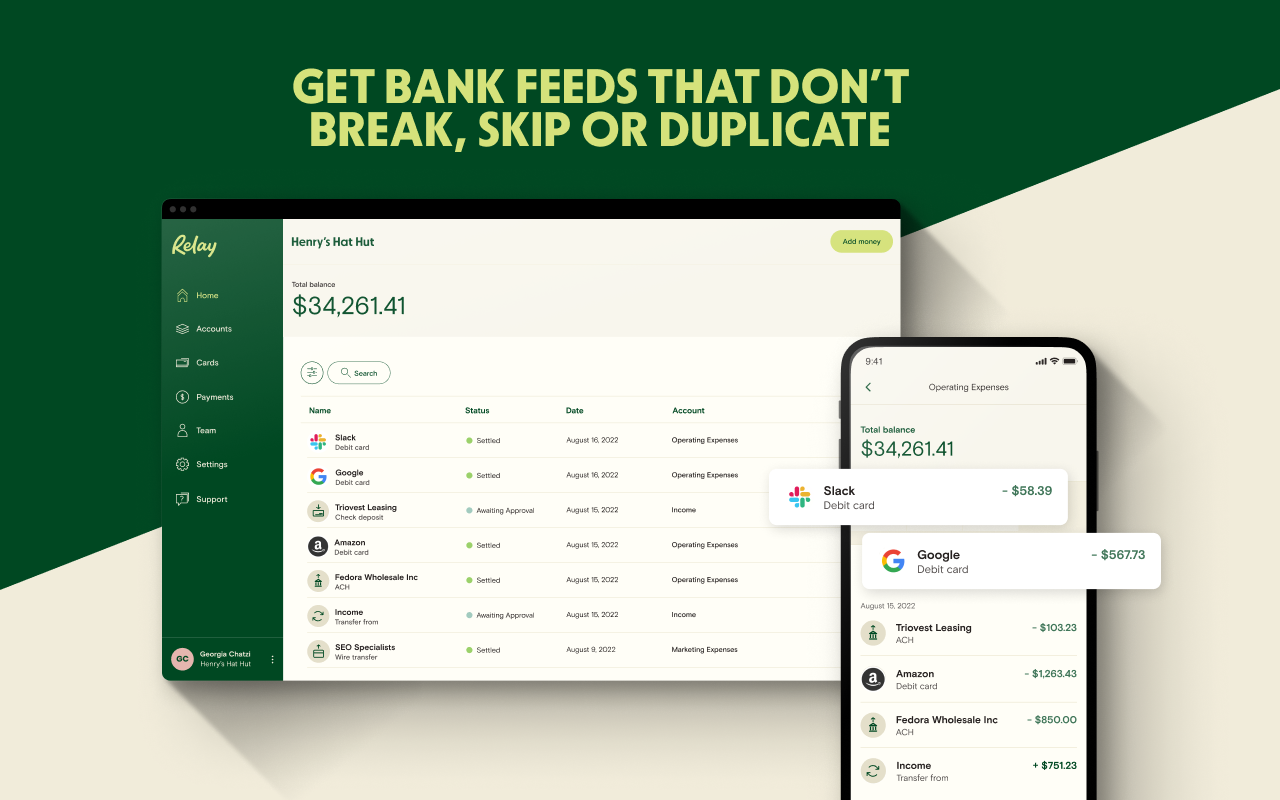

- Reliable bank feeds that don’t break, skip or duplicate

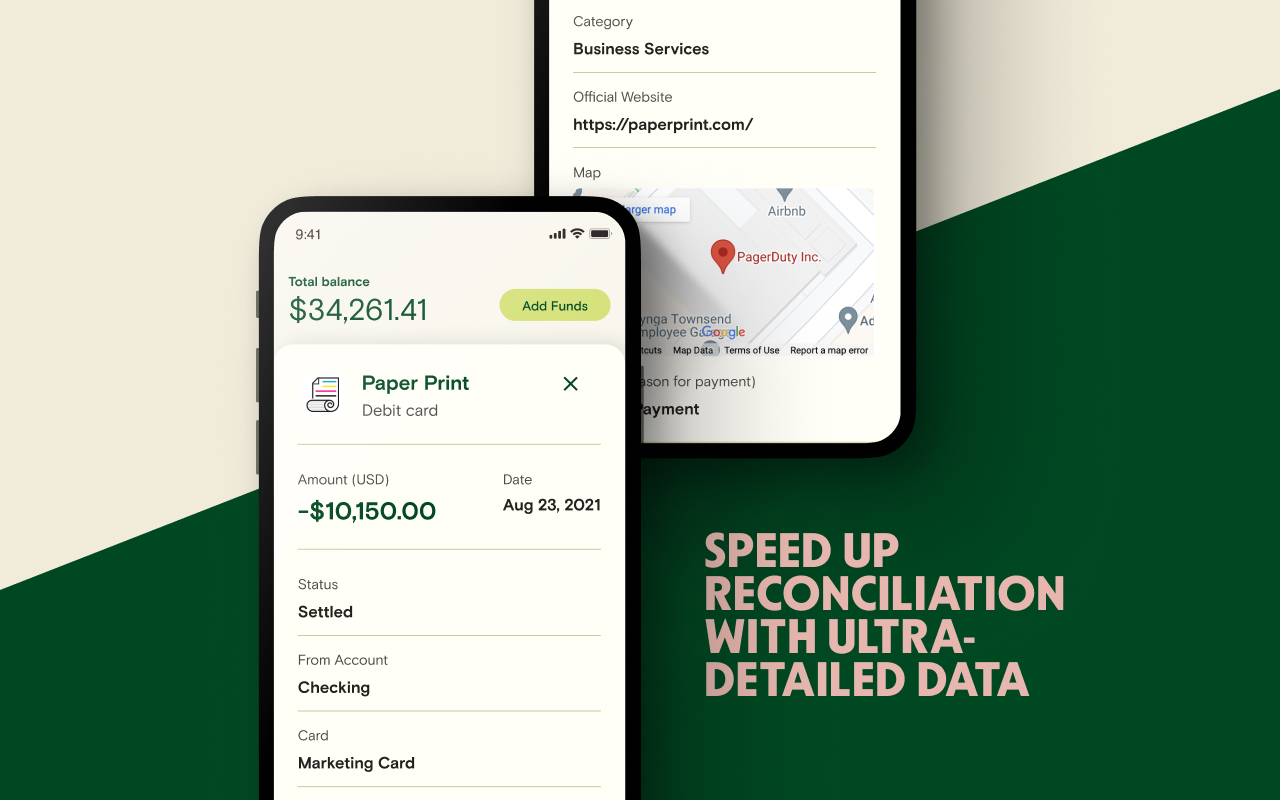

- Speedier reconciliation with ultra-detailed transaction data

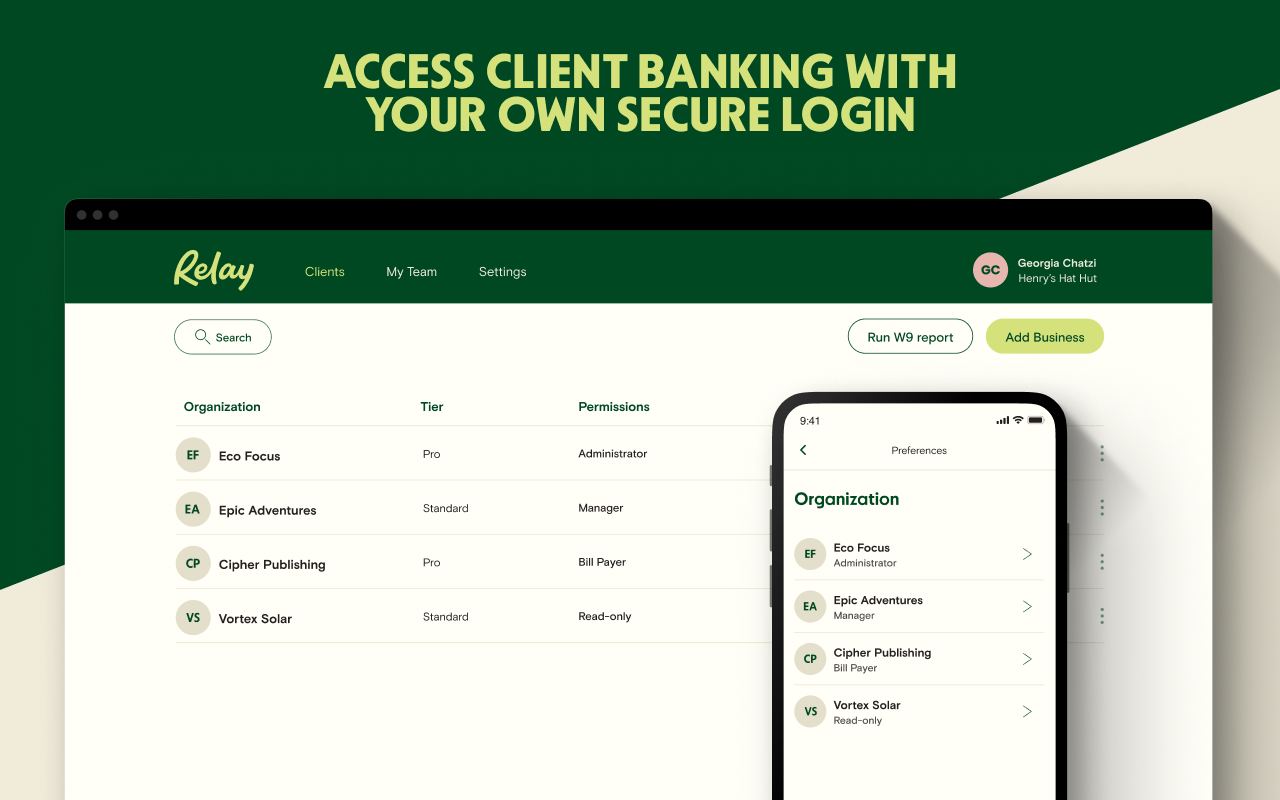

- Safe, hassle-free access to client banking via your own role-based login

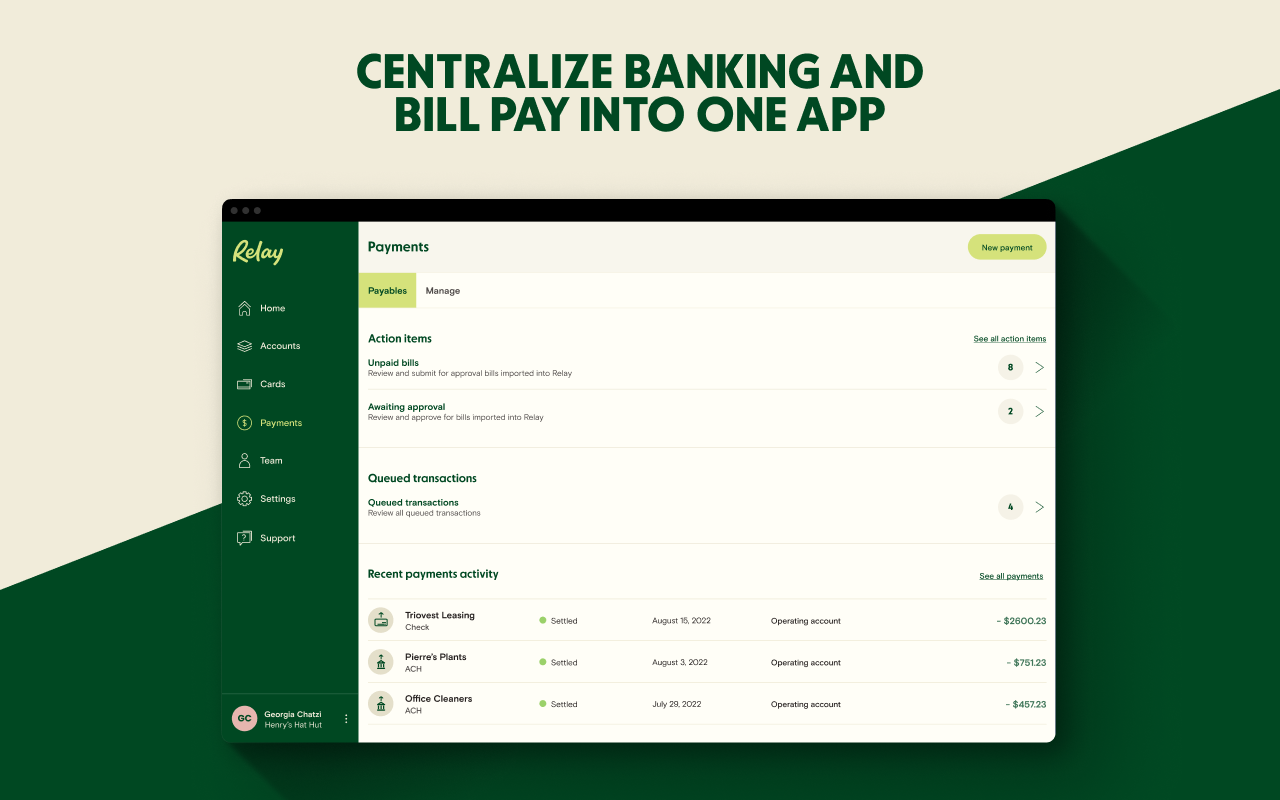

- Simple, convenient accounts payable features baked into client banking

Disclaimer: Relay is a financial technology company, not an FDIC-insured bank. Banking services and FDIC insurance are provided through Thread Bank and Evolve Bank & Trust; Members FDIC. The Relay Visa® Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa® debit cards are accepted.

Relay + Xero

Relay syncs ultra-detailed transaction data into Xero to help you reconcile accounts faster and with less back-and-forth with clients.

Debit card transactions have clean, standardized vendor names and they’re pre-categorized for you. Outgoing ACH, check and wire payments all include a “reason for payment,” and incoming check deposits include a picture of the check.

Plus, with Relay Pro—a subscription-based accounts payable add-on—centralizes accounts payable and client banking. With Relay Pro, you can:

- Auto-import unpaid bills from Xero into Relay Review, approve and pay all bills from a single Relay dashboard

- Create single- or multi-step approval rules for bill payments

- Consolidate payments to the same vendor into a single transaction

- Auto-sync paid bills as “paid” back to Xero for one-click reconciliation

Getting started

Connect Relay to Xero in a few easy steps:

- Go to Settings > Integrations in Relay

- Select Xero from the list of integrated apps

- Log in to Xero and select the organization you would like to connect to Relay

- Select the Relay checking accounts you would like to sync with Xero