Overview

Airwallex’s local payment network enables business owners, finance teams, and employees to operate without the constraints of traditional banking and geographical boundaries.

Accept debit card, credit card, and ApplePay payments from customers online in 50+ currencies across 170+ countries and bypass foreign transaction fees.

Aside from just payments, Airwallex offers a full suite of tools for businesses, including multi-currency domestic and international accounts, corporate cards, expense management, and more.

When you connect your Airwallex account to Xero, your transaction data will flow automatically into a live bank feed for effortless reconciliation. It’s the easiest way to keep track of monthly expenses, invoices paid and payments received.

Airwallex + Xero

Set up the integration in minutes and get a view of all your received payments, card transactions, payouts, bills, expenses and Airwallex currency balances within Xero’s general ledger.

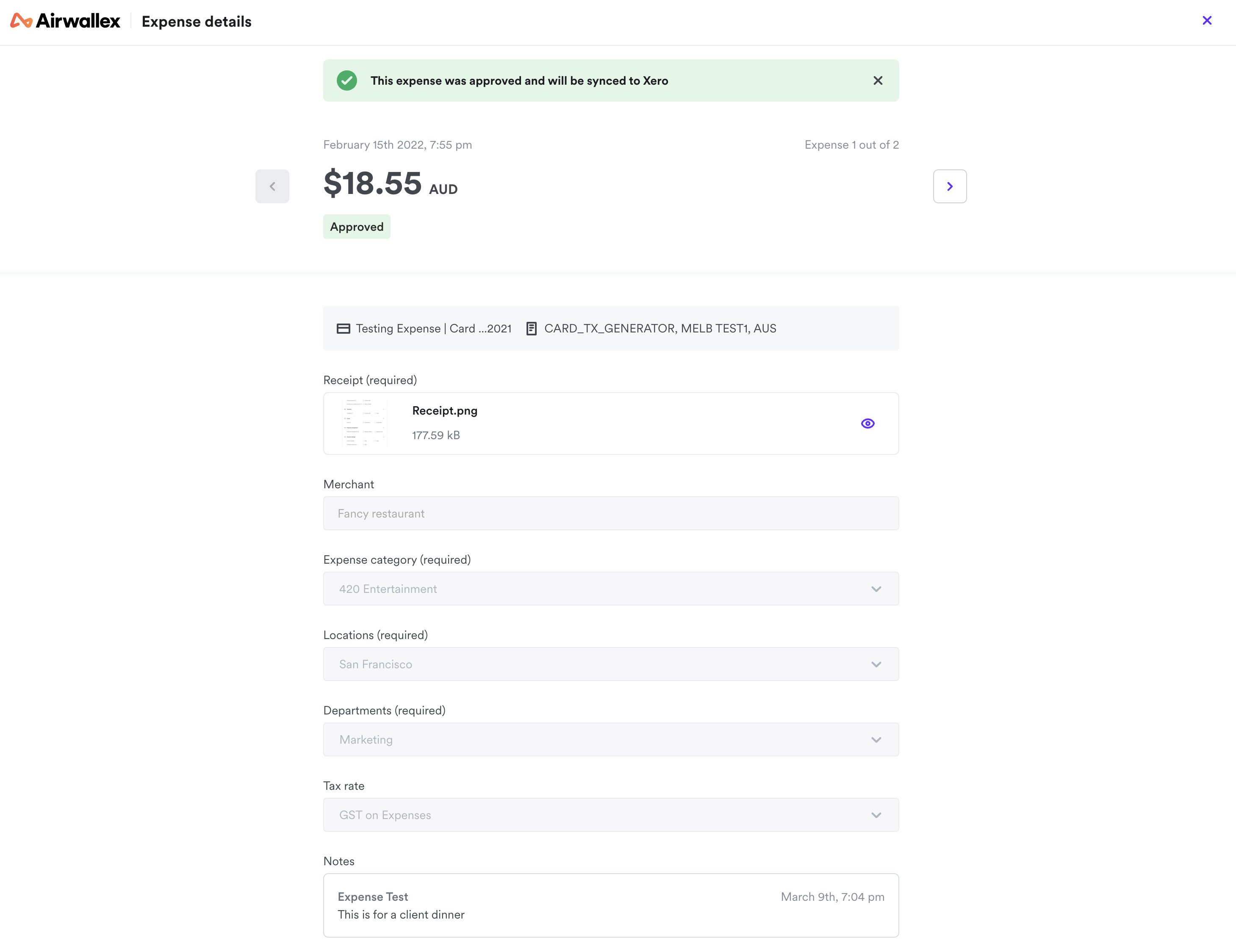

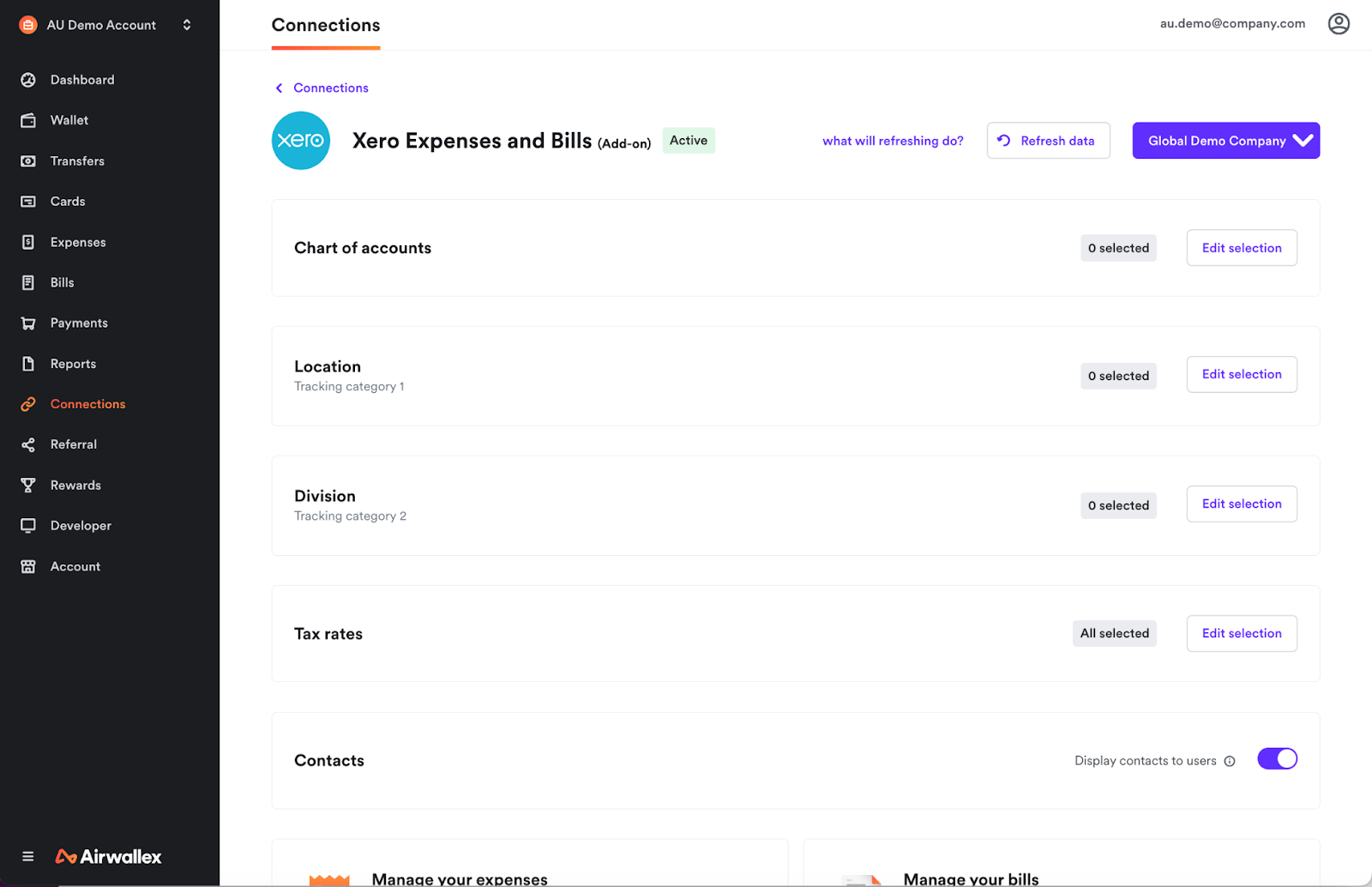

Expenses and Bills:

- Import your Xero chart of accounts, tracking categories, tax rates and contacts into Airwallex for employees to tag their expenses and bills against.

- Upload vendor invoices and submit bills in Airwallex, or alternatively import bills from Xero to pay in Airwallex.

- Automatically sync your Airwallex expense and bill data into Xero for easy reconciliation.

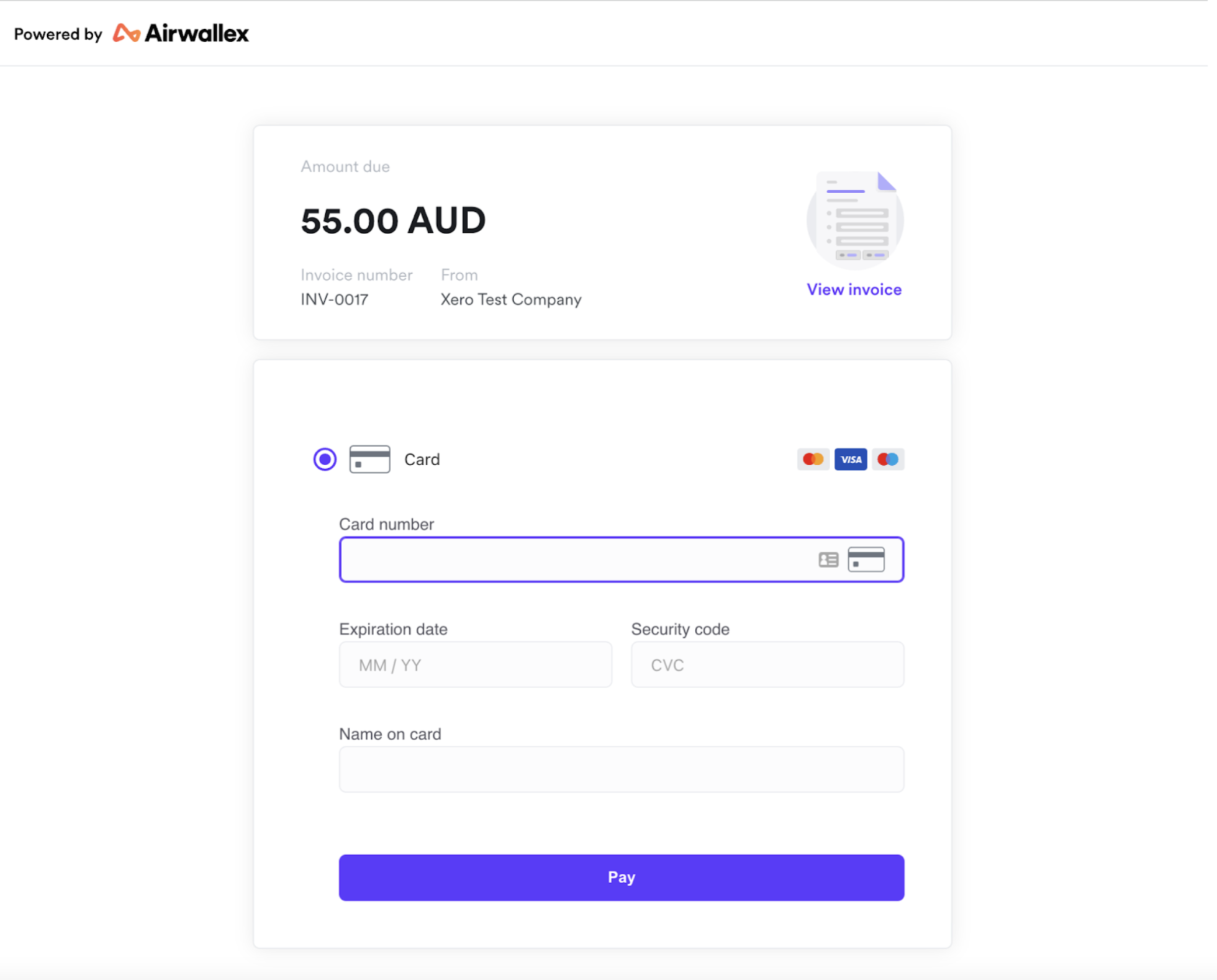

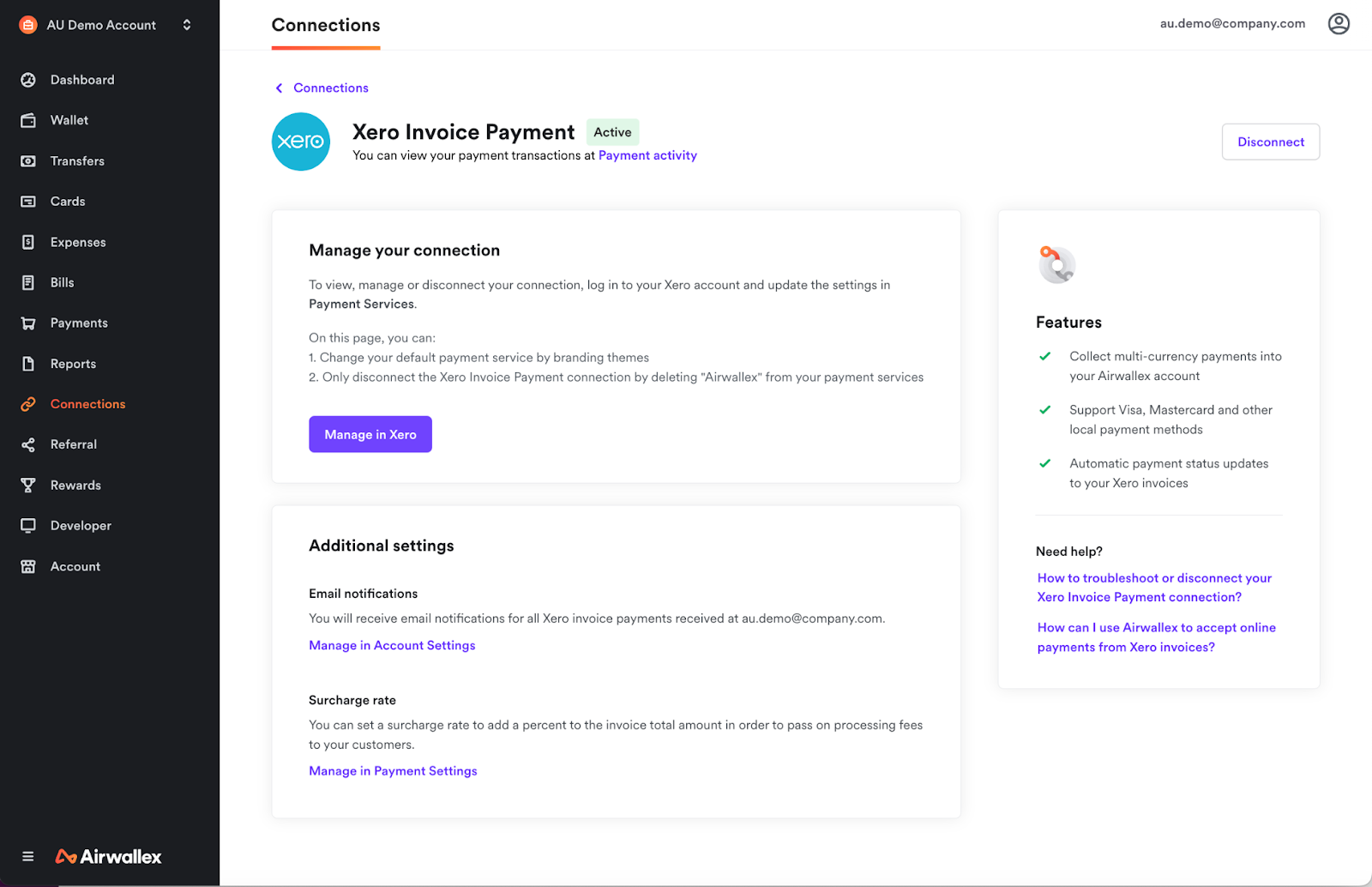

Invoice Payment:

- Collect payments with Airwallex for your Xero invoices without navigating out of your Xero account.

- Collect funds directly into your Airwallex account via cards, ApplePay, Google Pay, and 30+ local payment methods.

- Pass on your payment processing fees to your customers by setting a surcharge rate for your invoices.

- Automatically reconcile payments received in your Airwallex account directly to an invoice in Xero.

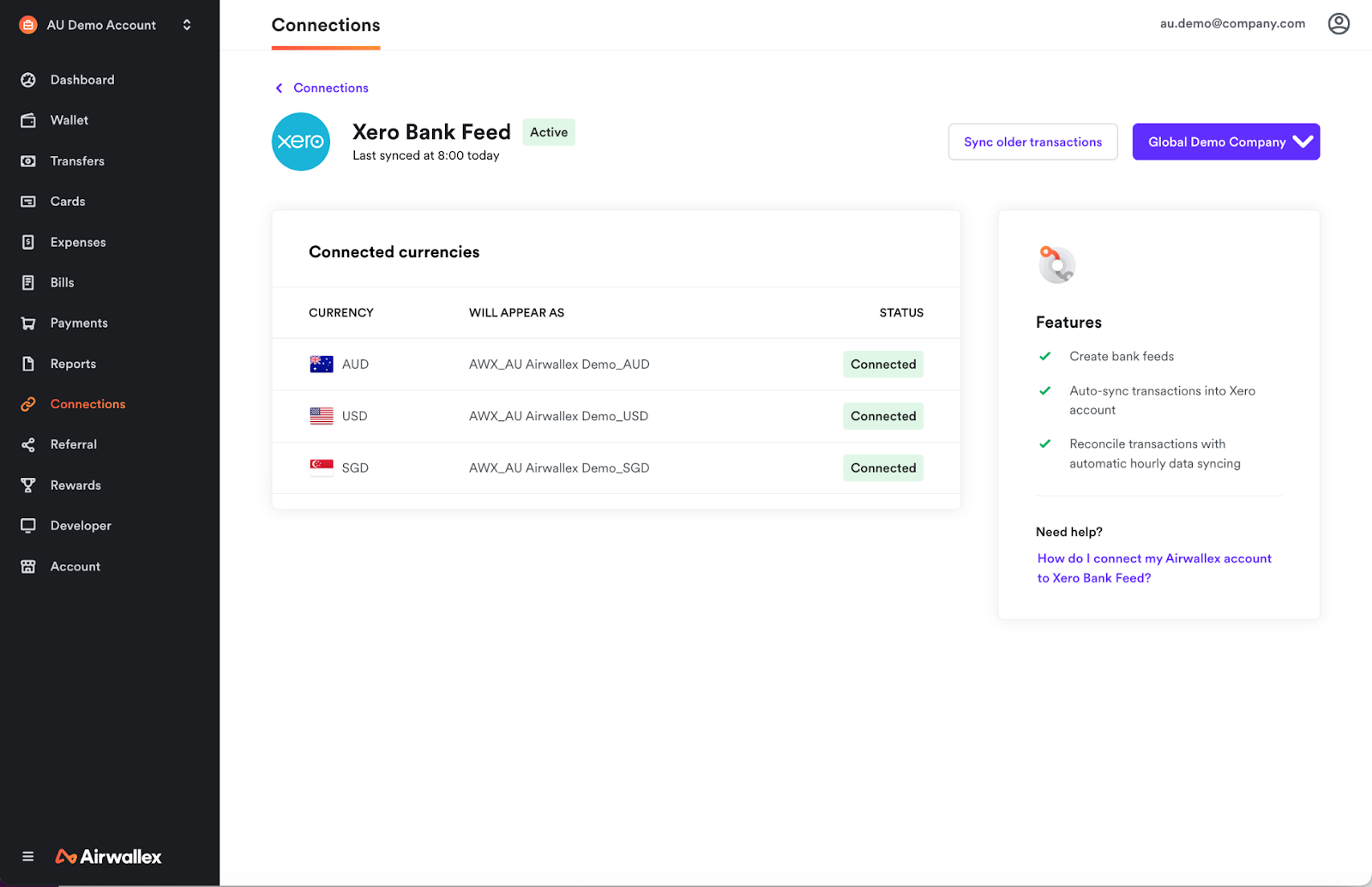

Bank Feed:

- Create bank feeds for each currency balance that automatically reconcile your deposits, conversions, payouts, card transactions, and adjustments from Airwallex into Xero.

- Categorise each transaction with clear descriptions and accounting codes.

Online Payments Feed:

- Reconcile your online payments activity with itemised breakdown of sales, refunds, and fees in Xero.

- Works with Airwallex’s payment links, eCommerce plugins, Airwallex for Xero invoices integration, and online payment processing products.

Getting started

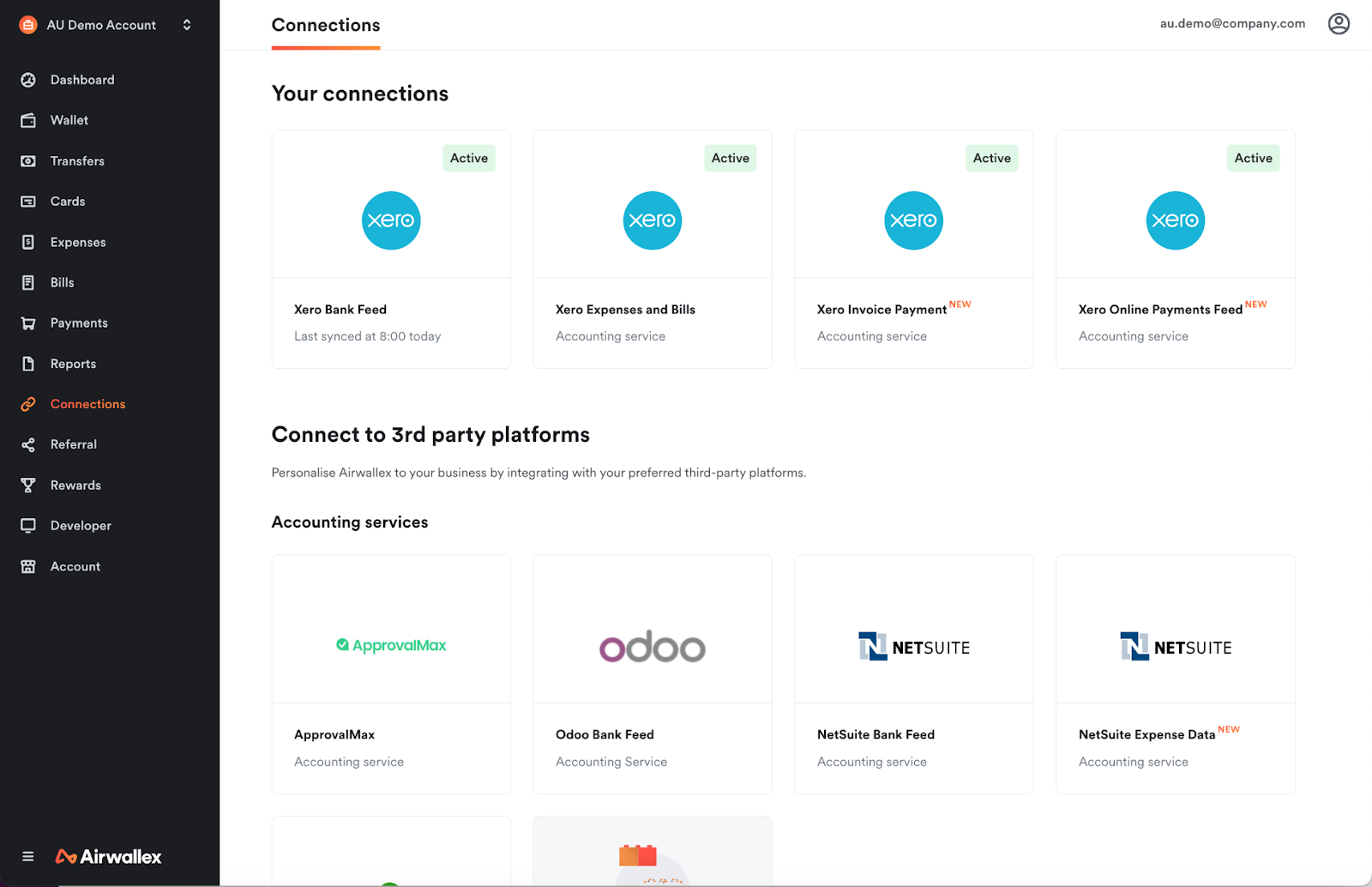

If you already have a Xero account and an Airwallex account:

- Log in to your Airwallex account and navigate to “Connections” under the “Account” tab.

- Find the Xero Invoice Payment, Expenses & Bills, Bank Feed, and Online Payment Feed connection tiles, and select “Connect”

- Follow the instructions to finish the connection.

If you are new to Airwallex:

- Sign up for free.

- Sign in with your Airwallex account and navigate to “Connections” under the “Account” tab.

- Follow instructions to complete the setup of your integration to Xero Invoice Payment, Expenses & Bills, Bank Feed, and Online Payment Feed