Overview

Powdr brings clarity to your financial future. We help you turn your strategy into a forecast that speaks to banks, investors, and finance teams.

Simple, powerful forecasting

- Translate your strategy into numbers that matter.

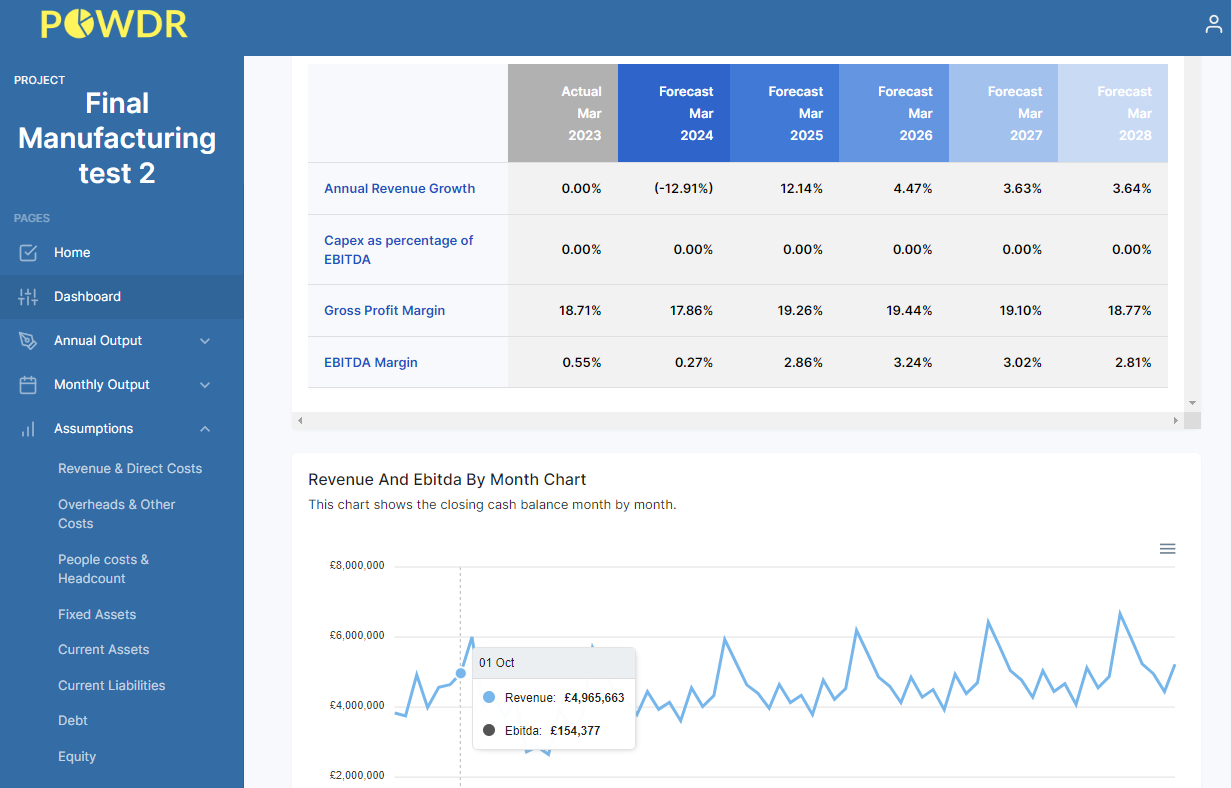

- Generate integrated P&L, balance sheet, and cash‑flow forecasts automatically.

- Use rolling forecasts that adapt as your business changes.

Designed for real people

- Build forecasts without breaking complex Excel models.

- Use KPI‑driven models that evolve with your business.

- Forecasts stay intact – no broken formulas, no time wasted.

Support at every step

- Self‑serve model building, only pay for what you need.

- Use our AI assistant when you’re stuck.

- Join live drop‑ins, onboarding sessions, and get expert guidance.

- Training and resources built for clarity and confidence.

Built for every business

- Perfect for founders, SMEs, accountants, investors, CFOs.

- Affordable tiered plans — from free starter to advanced multi‑divisional forecasting.

- Work solo or get pay‑as‑you‑go consultancy when needed.

Trusted and award‑winning

- Reached regional finals in Tech Nation Rising Stars 2024

- Short‑listed for 2024 Great British Entrepreneur Awards :

- Backed by a £1 million pre‑seed round to fast‑track our roadmap in 2025

Why Powdr?

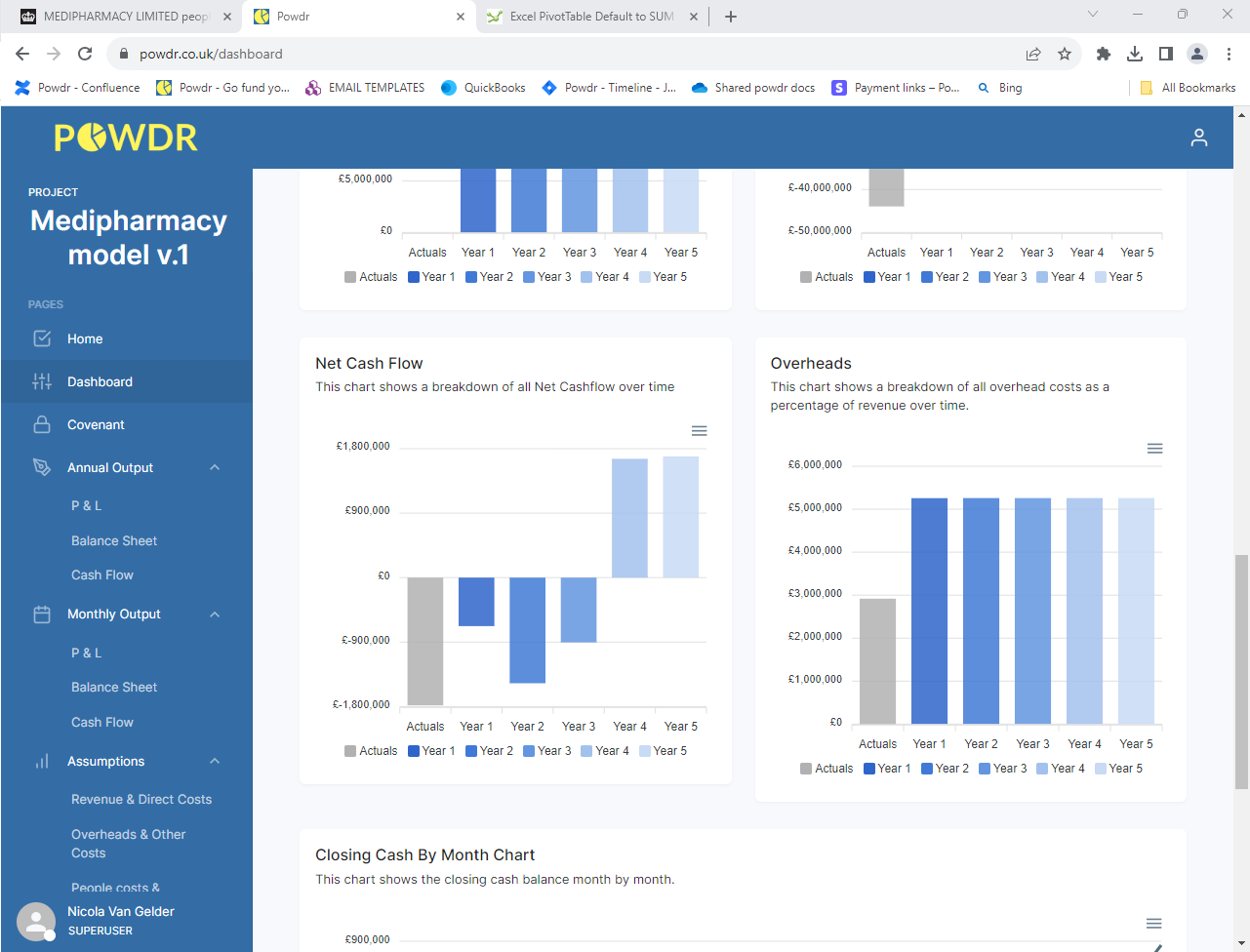

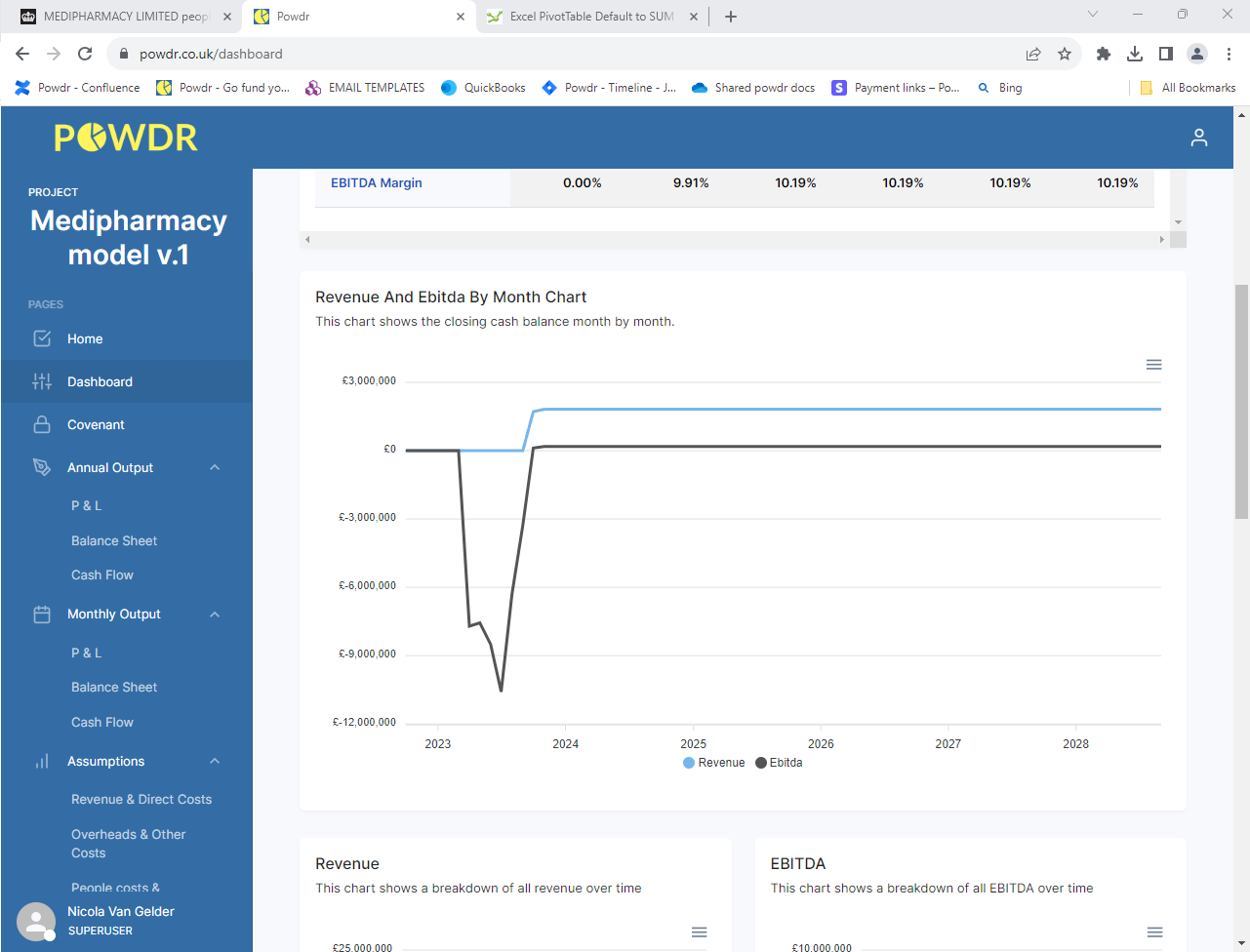

- Clarity: See the full financial picture with clear dashboards.

- Accuracy: Built by people who know banking, restructuring, and forecasting

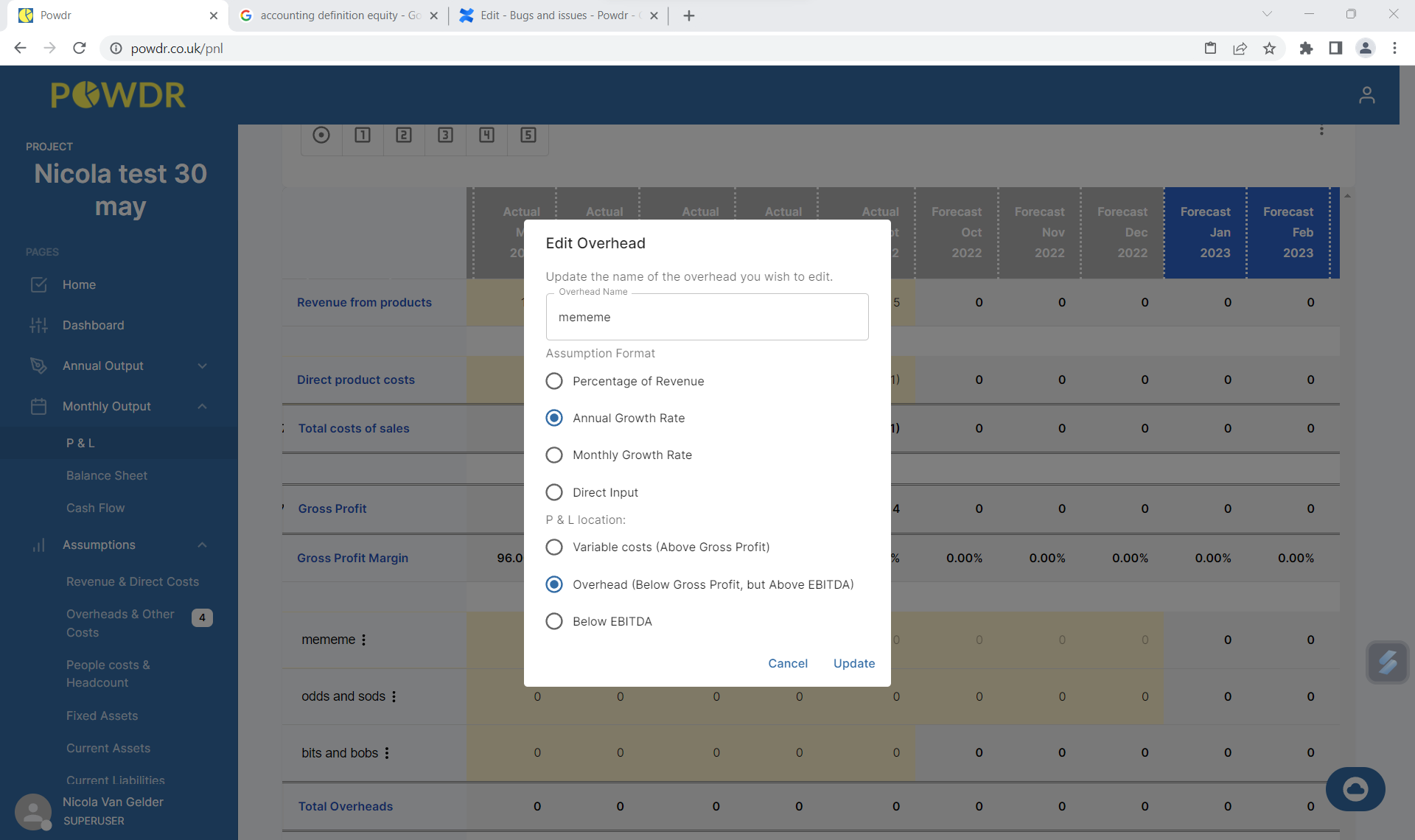

- Flexibility: Adapt assumptions, test scenarios, update actuals easily.

- Supportive: Friendly experts, live support, and evolving features.

Join the growing list of businesses gaining insight, saving time, and earning control over their financial future with Powdr.

Powdr + Xero

Seamlessly integrates with your accounting software. Powdr connects to platforms like Xero, bringing your numbers straight into your forecast.

-

Set up in minutes:

- Link your accounting platform via the integrations area.

- Map key line‑items to P&L, balance sheet, and cash‑flow categories.

- Validate mappings to ensure balance and accuracy.

-

Live data, intuitive mapping:

- Sync up-to-date actuals directly from your accounting system

- If numbers don’t balance, we help you troubleshoot mapping or source data.

-

Keep forecasts fresh:

- Import new months of actual data with a click.

- Forecasts remain intact; just “undo” any override for smooth alignment

-

AI‑powered clarity:

- Rely on our AI assistant for guidance on mapping, assumptions, and forecasting rules.

-

Expert fallback:

- Need help? Access pay‑as‑you‑go consultancy.

- If you're a partner or advisor, share models with clients and maintain access

-

Security and reliability:

- Cloud‑based on AWS in the UK. Efficient, secure, and operational 24/7/365

Powdr makes integrating finance systems and forecasting easy, accurate, and adaptable — all with expert support by your side.

Pricing plans

3 statement financial model

- Integrated P&L, balance sheet and cash flow

- Unlimited number of revenue lines modelled

- Unlimited number of overheads modelled

- Unlimited number of employees modelled

- Unlimited number of balance sheet lines modelled

- Unlimited Model saves

- Unlimited scenario testing

- Read only access available for stakeholders or third parties

- Excel exports of your model

- Monthly and annual P&L, Balance sheet and cash flow outputs

- Analysis dashboards across revenue, overheads, headcount and cashflow

- AI chatbot to support you 24/7

- Actualisation with automated updates directly from your xero account

- Covenant testing

Getting started

Getting started is easy. Hit the “Get this app” button on this listing — that’s your fastest route to clarity.

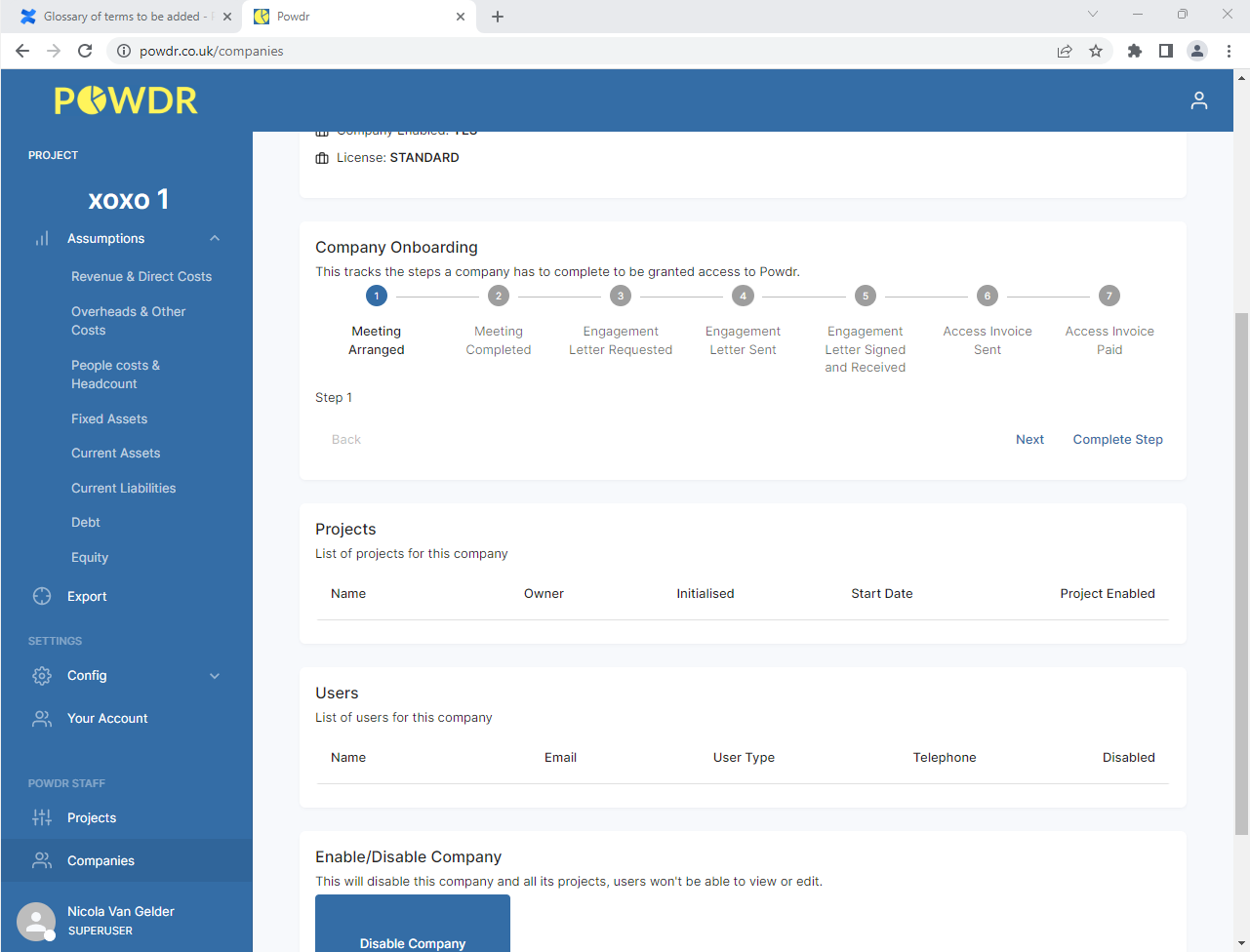

Once you click “Get this app”:

- Connect your accounting software – follow the prompts in Powdr to link your Xero account.

- Map your data – assign your Xero line items to P&L, balance sheet, and cash‑flow categories.

- Set your basline assumptions - set assumptions for the first draft of your model to be set up with and to get your first draft of a model

- Refine your model - add the strategy side of your business plans into your model - whether thats a plan to hire a new person, bring in a new product or you have additional expenses you hanve't had before, you can add these into your model to see the longer term impact to your cash flow