Overview

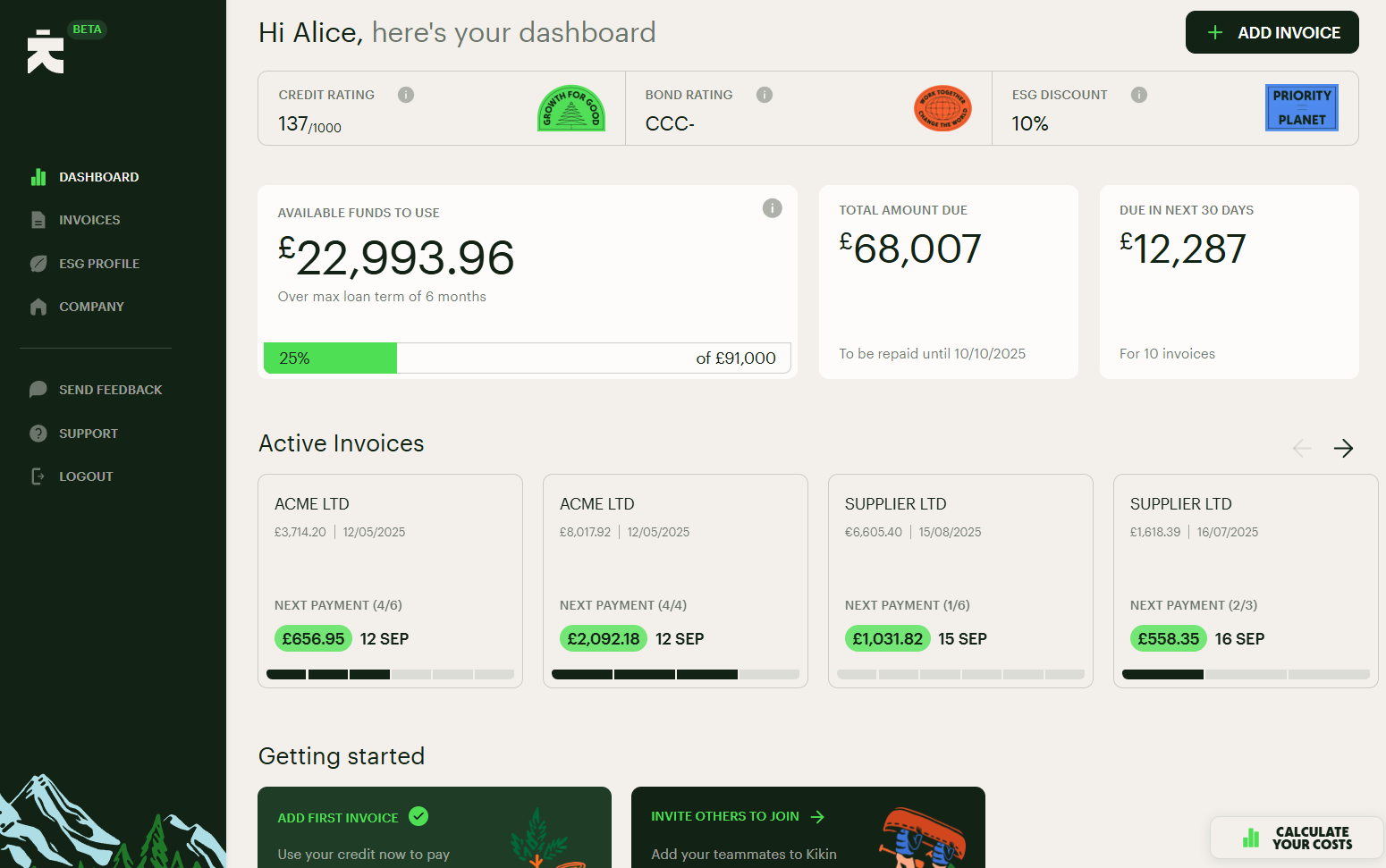

We know how hard it can be for mission-driven businesses to access financing options so we make it our mission to help! Invoice financing smooths out your cash cycle, giving you headroom for extra spend on things that make a real difference, like marketing. Simply connect your Xero and open-banking and our AI will give you a credit allowance within minutes. Import an invoice from your Xero account and the money will be in your supplier's account within hours!

The Problem: Cash Flow Kills Growth

Outstanding invoices in Xero. Suppliers need paying. Cash tied up waiting 30-60 days for customer payments. 73% of UK SMEs struggle with late payments.

Traditional financing falls short: banks take weeks, factoring damages supplier relationships, most lenders don't understand your mission.

The Solution: Pay Suppliers Today, Repay Later

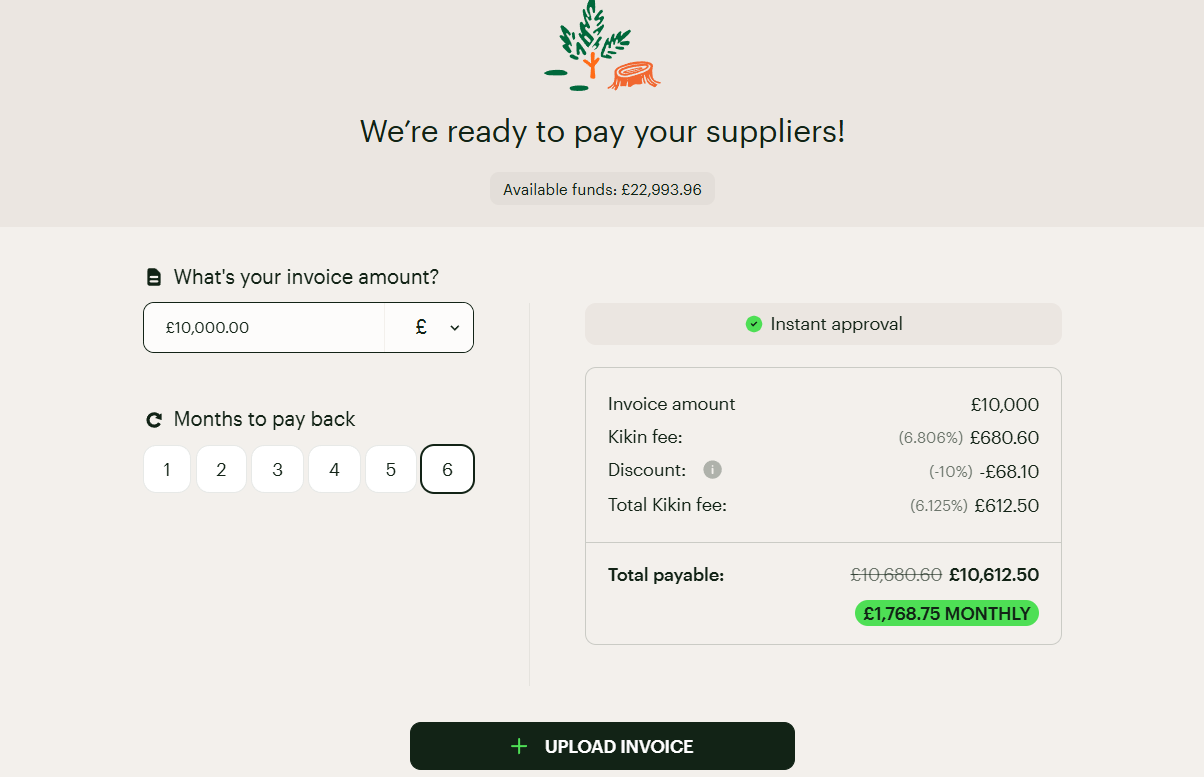

Kikin is the first invoice financing platform built for purpose-driven businesses. We pay your suppliers immediately while you repay us over 1-6 months.

Lightning-Fast Process

- Connect Xero and open banking (2 minutes)

- Instant assessment - AI provides credit decision within minutes

- Select invoice from Xero (up to £1,000,000)

- Supplier gets paid within hours

Key Benefits

- Seamless Xero integration - one-click invoice import

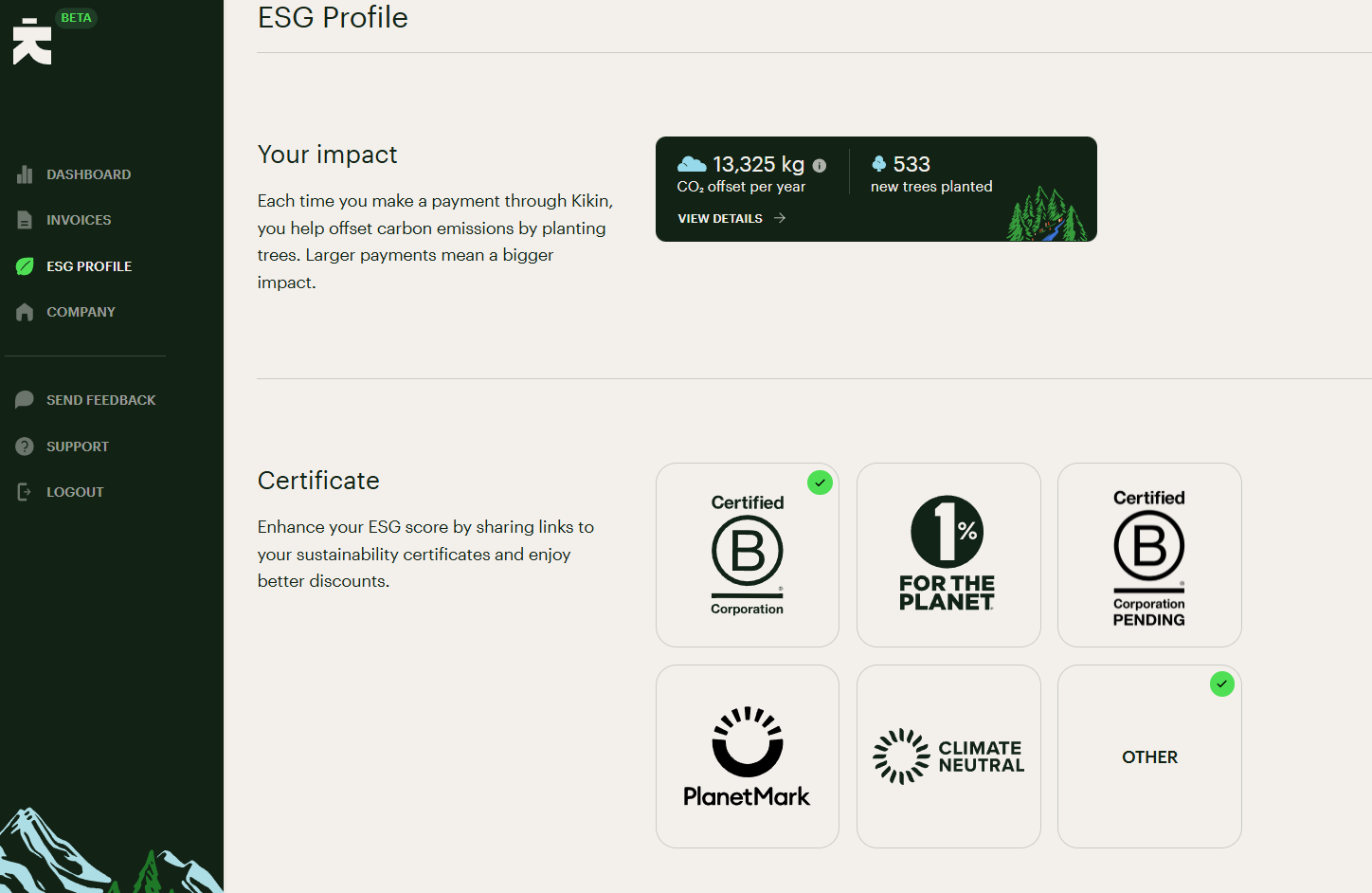

- ESG discounts up to 15% for B-Corps and impact businesses

- 25+ currencies for global suppliers

- No personal guarantees required

- Flexible 1-6 month repayment terms

Who We Serve

Purpose-driven UK businesses with £10k+ monthly revenue: B-Corps, environmental innovators, social enterprises, growth-stage companies.

Customer Impact

"Kikin helped us navigate cashflow challenges with their quick and easy application process and rapid turn around time." - Jojo Regan, Manors Golf

"We get discounted fees for being a B Corp. Great to work with a partner that shares our values." - Sue Aksaz, The Nue Co

Real Business Benefits

- Strengthen supplier relationships with immediate payments

- Take on larger projects with confidence in cash flow

- Negotiate better supplier terms when paying promptly

- Focus on growth instead of chasing payments

- Maintain working capital for marketing and expansion

- Access global suppliers with multi-currency payments

Pricing

- Variable APR from 15% based on credit assessment

- No setup fees or monthly charges

- ESG discounts for purpose-driven credentials

- International transfers: 1% fee

Get Started

- Install Kikin app from Xero App Store

- Connect accounts (under 2 minutes)

- Receive instant credit decision

- Finance first invoice within hours

Ready to unlock your cash flow potential? Install Kikin today.

Kikin + Xero

How Kikin Integrates with Xero

Integration Architecture

Kikin connects to Xero using the standard REST API with OAuth 2.0 authentication, ensuring secure, authorised access to your accounting data. Our integration operates bidirectionally - pulling essential financial data from Xero whilst writing back loan-related transactions to maintain accurate accounting records.

Data Synchronisation

What We Pull From Xero

- Bills (Supplier Invoices): Outstanding payables that customers can select for financing

- Chart of Accounts: Account structure for proper transaction categorisation

- Financial Statements: P&L and balance sheet data for credit assessment

What We Write Back to Xero

- Bill Payment Records: When we pay a supplier, the corresponding bill in Xero is marked as paid

- Bank Feed Integration: Creates a dedicated bank account showing outstanding loan obligations

- Loan Transaction Records: Maintains complete audit trail of financing activities

Sync Frequency

Daily automated synchronisation ensures your Xero data stays current with financing activities whilst maintaining system performance.

Key Workflow Integration

Invoice Selection Process

- Real-time Bill Import: Users browse and select unpaid bills directly from their Xero account within our platform

- Instant Verification: Cross-reference bill details with supplier information for accuracy

- One-click Financing: Selected bills automatically populate loan applications with correct amounts and supplier details

Payment Processing Workflow

- Supplier Payment: When we pay the supplier, the transaction flows back to Xero

- Bill Status Update: The financed bill is automatically marked as "paid" in Xero

- Accounting Entries: Proper journal entries maintain accounting accuracy

Bank Feed Functionality

Kikin creates a dedicated bank account in your Xero chart of accounts that functions as a live bank feed, showing:

- Outstanding Loan Balance: Real-time view of what you owe Kikin

- Repayment Transactions: Automated recording of loan payments

- Interest Charges: Transparent fee tracking

- Complete Audit Trail: Full transaction history for compliance and reporting

Getting started

Getting Started with Kikin - Setup Process

Overview: 5-Minute Setup

The setup process has five straightforward steps that take about 5 minutes total.

Step 1: Basic Details (30 seconds)

- Enter your company number

- Provide your name

Step 2: ESG Credentials (1 minute)

Tell us about your purpose-driven initiatives:

- Are you a certified B-Corporation?

- Member of "1% for the Planet"?

- Environmental practices (renewable energy, sustainable packaging, etc.)

- Social impact or community initiatives

- Any other relevant certifications

This helps us determine if you qualify for ESG discounts up to 15%. This step is optional.

Step 3: Connect Xero (1 minute)

- Authorise connection to your Xero account using OAuth 2.0

- We access your bills (supplier invoices), chart of accounts, and financial statements

- We create a dedicated loan account in your Xero

- Daily sync is set up automatically

We don't access customer invoices or other sensitive data.

Step 4: Connect Bank Account (1 minute)

- Connect via FCA-regulated open banking

- We access 6 months of transaction history (read-only)

- Used for cash flow analysis and credit assessment

- Your bank credentials aren't shared with us

Step 5: Credit Assessment (1 minute)

Our AI analyses your data and provides:

- Credit decision, usually within 2 minutes

- Credit limit up to £1,000,000

- APR from 15% (before any ESG discounts)

- Repayment term options (1-6 months)

You'll see how we calculated your limit and pricing.

After Setup: Finance Your First Invoice

- Select unpaid bills from your Xero account

- Choose repayment terms

- Confirm supplier payment details

- Sign loan agreement electronically

- Supplier gets paid within hours

- Bill marked as paid in Xero automatically

Key Points

- No setup fees or monthly charges

- No minimum usage requirements

- No paperwork - everything is digital

- Finance invoices only when you need to

- Real-time sync with your Xero account

Common Questions

What if I don't have formal ESG certifications?

You can still describe your initiatives. Formal certification isn't required for all discounts.

How secure is my data?

We use bank-grade security and FCA-regulated providers. Your bank credentials stay with your bank.

Can I change my credit limit later?

Credit limits can increase as we build a relationship with your business.

What if something goes wrong with the Xero connection?

Our support team monitors all integrations and can resolve technical issues quickly.