Overview

ezyCollect by Sidetrade is trusted by businesses worldwide to manage over $18 Billion in receivables annually, saving businesses 1000s of hours each year through automation of manual tasks and enhancing cashflow. On average, businesses with ezyCollect by Sidetrade improve their cash flow by 43% in the first six months.

ezyCollect by Sidetrade is a full-stack AR management platform with integrated payments, credit scores, digital credit applications & integrated digital payments with direct debit and collect now functionality.

It's easy to integrate, intuitive to use, and offers a no-fuss solution that untangles the complex and oftentimes manual accounts receivable function.

Businesses with ezyCollect by Sidetrade get paid faster - we looked at 208 businesses over the last two years, and on average their overdue receivables reduced by 43% in 6 months after getting started with ezyCollect by Sidetrade.

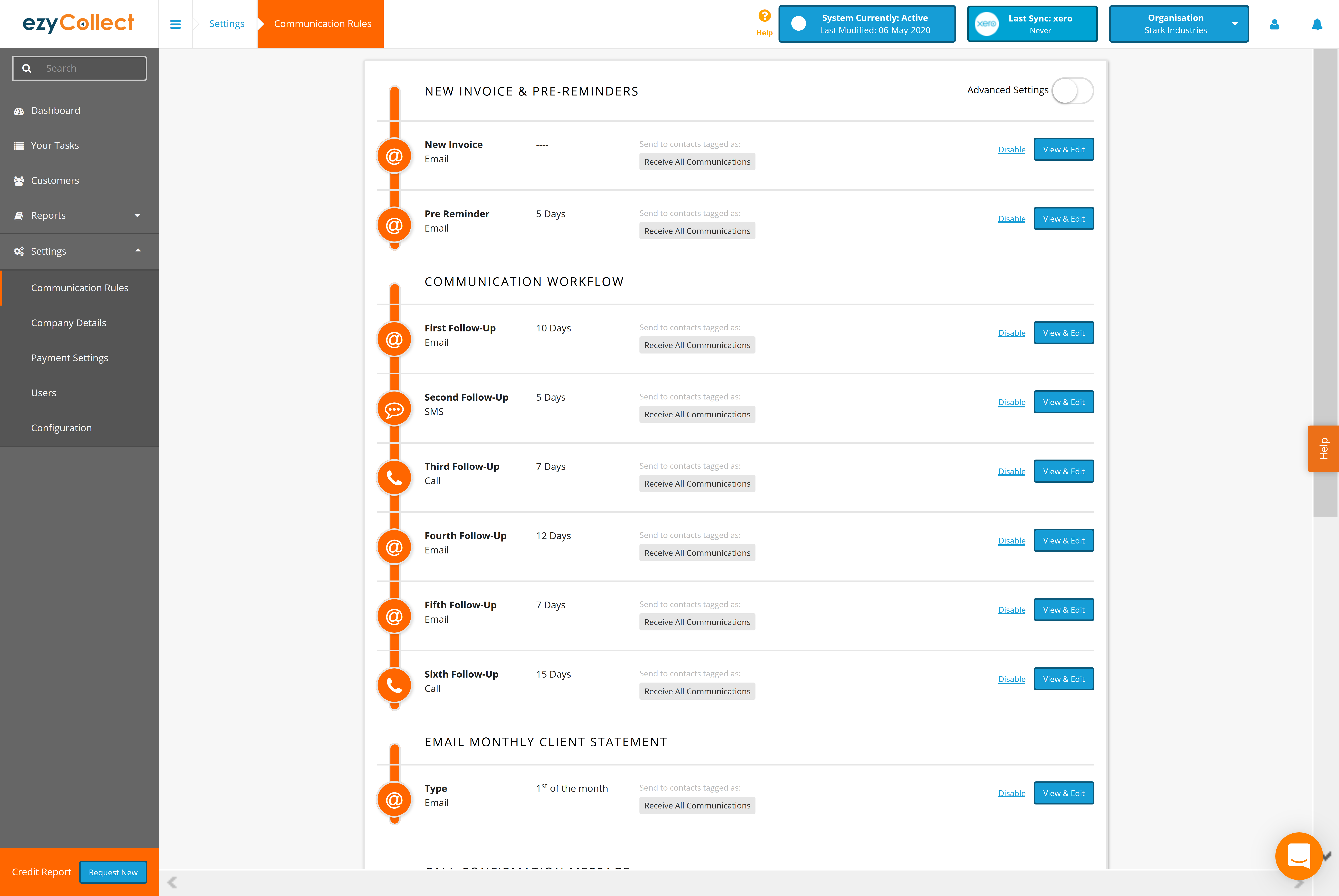

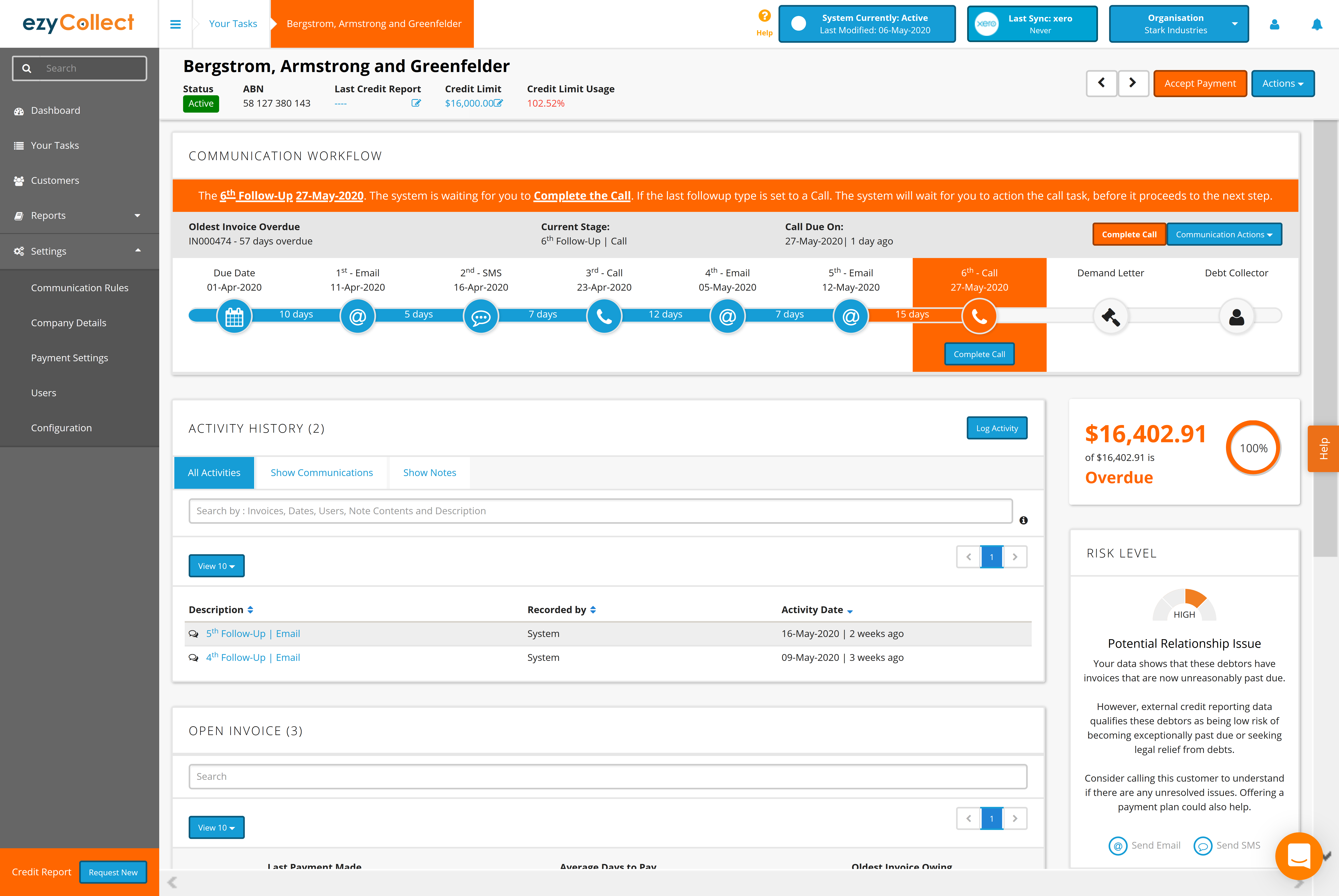

- Saves time with automated communications and reminders

- Automates reconciliations with payment write-back

- Give your clients a checkout experience with integrated 'Pay Now' buttons and multiple payment options including settle now pay later.

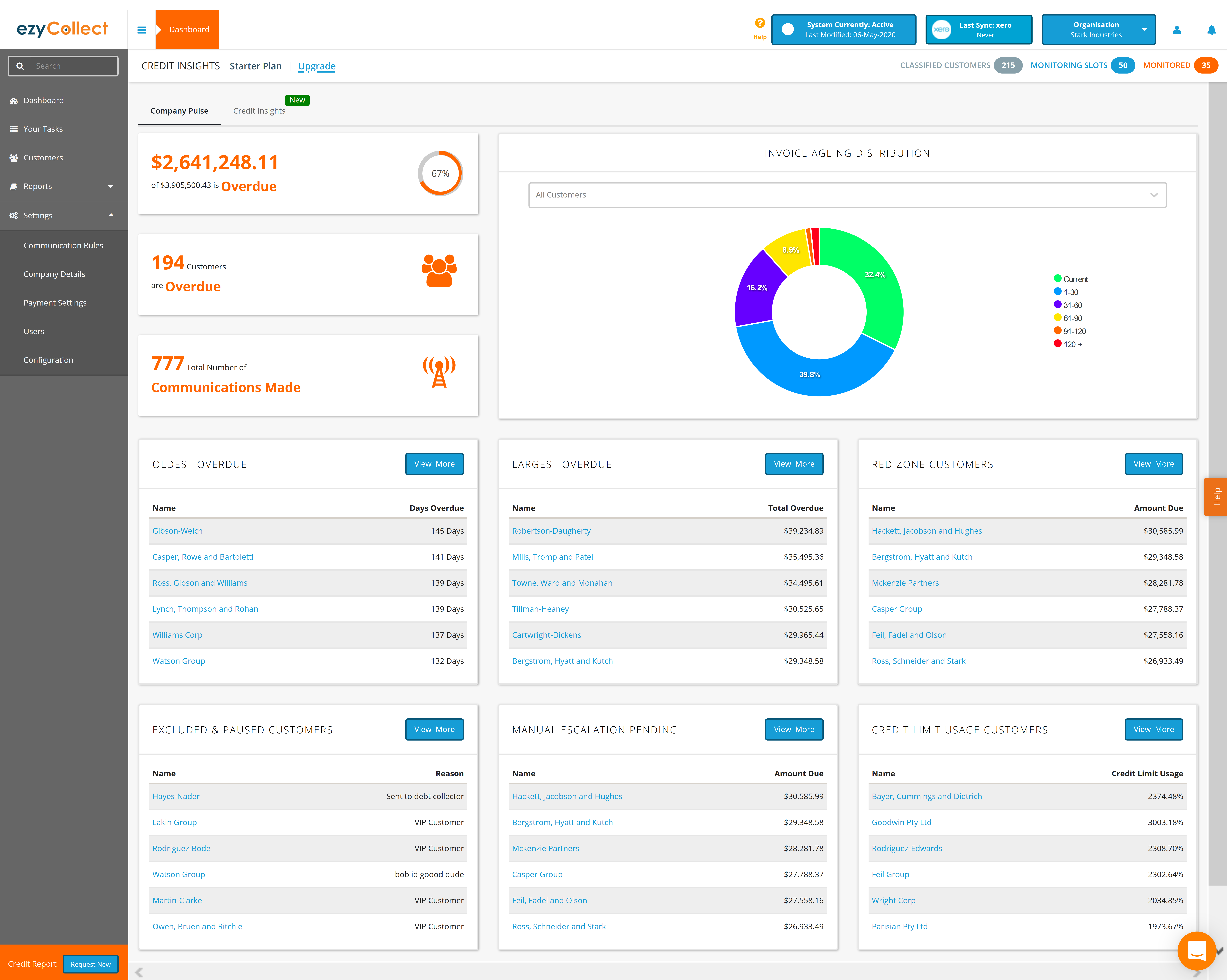

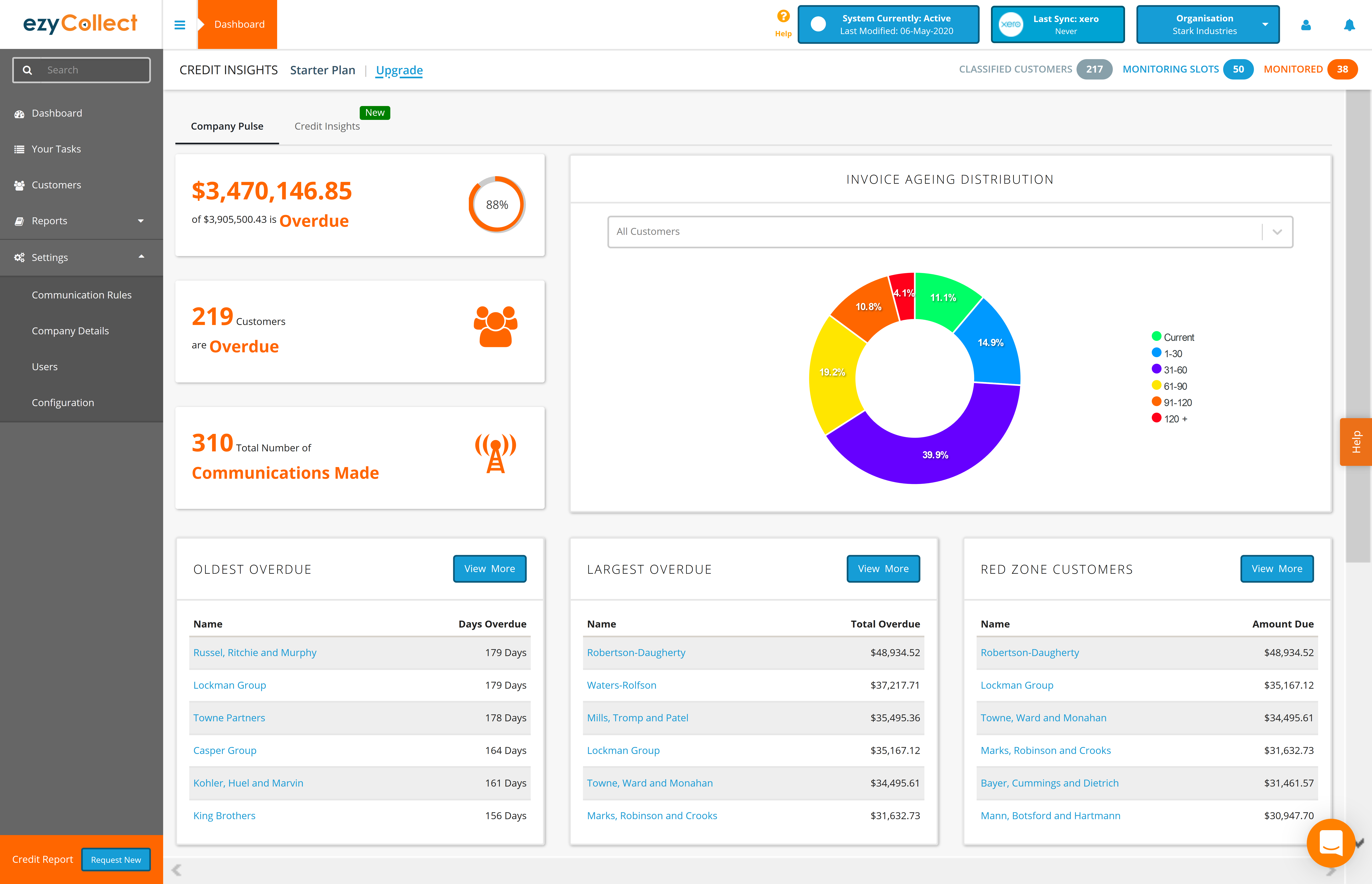

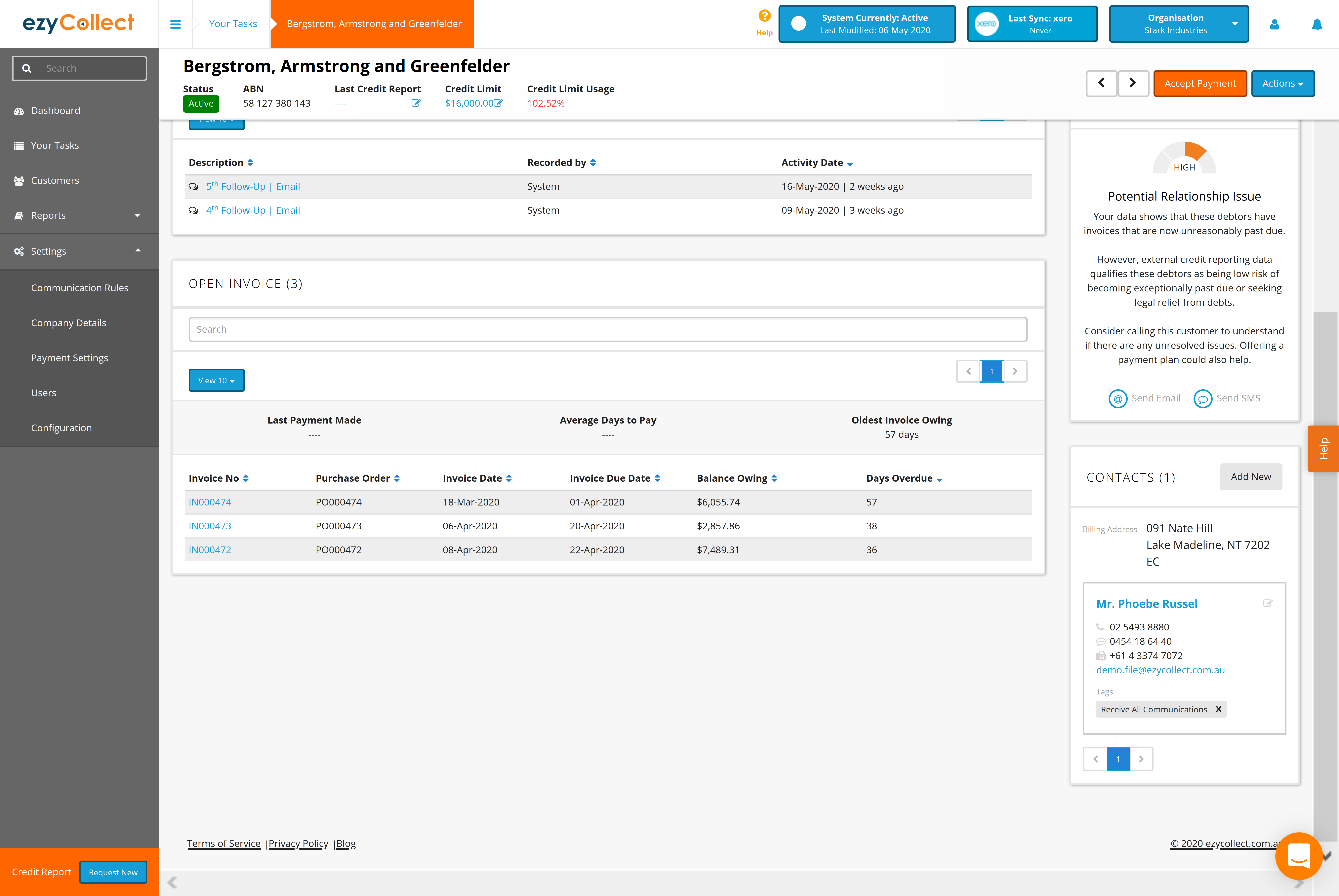

- A dashboard that helps you pinpoint accounts receivable risks and priorities and act decisively.

- Perform credit checks on new customers, receive alerts as customers get into financial difficulty.

- Onboard new customers seamlessly with a digital credit application

- Automated communications: Email and SMS reminders, groups all overdue, says thank you.

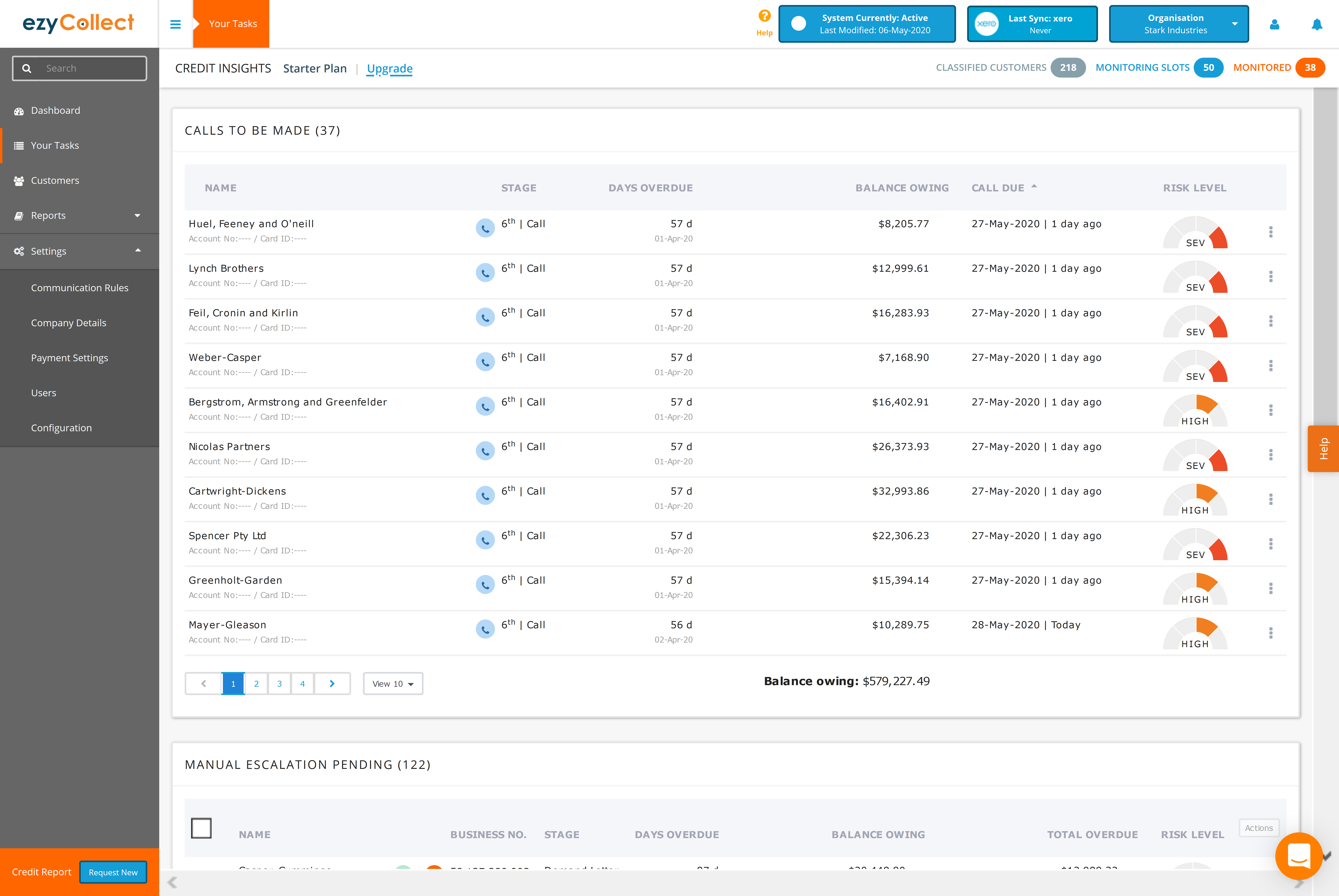

- Phone calls: Include a phone call in your reminder sequence and get a daily email of calls to be made.

- Online payments: Pay multiple invoices at once, credit card checkout, allocate payments to Xero.

- Credit risk insights: Debtor late payment and failure risk ratings, daily credit risk analysis, and reporting, credit monitoring alerts.

- Debt escalation: Send a demand letter, refer debts to a debt recovery agency.

ezyCollect by Sidetrade would rather lose sleep than keep you waiting. We offer phone support, setup training, an online helpdesk, and a library of articles and resources.

ezyCollect + Xero

ezyCollect instantly elevates your existing debtor data into an insightful AR hub:

- Every debtor is rated daily for their low-to-severe credit risk to your business.

- Optimise 7 reminder templates to include your language, branding, email address, Pay Now button, customer account information.

- Exceed expectations and send a ‘thank you for payment’ message.

- Preview and approve daily automated communications.

- Prioritise who to phone with a daily call list sent to you.

- Add a PAY NOW button to invoices and emails so customers can pay immediately online.

- Add a Pay Later option so customers pay in installments while you get paid straight away.

- Go further with a single click to order a demand letter, debt collection service, or detailed credit report.

Close more payments. Collect more money. Create more time.

Getting started

Simply choose to integrate with Xero, and follow the simple instructions to start a free trial, no credit card is required.