Overview

Lightning Payroll is trusted Australian payroll software designed for businesses that value simplicity, compliance and control. Whether you employ one worker or hundreds, Lightning Payroll takes the stress out of managing wages, PAYG, superannuation, leave entitlements and Fair Work requirements. Built and supported in Australia, it is made for local businesses that want payroll to run smoothly every pay cycle.

Lightning Payroll helps employers meet their obligations without confusion. The software calculates PAYG tax and super accurately, manages leave balances automatically, and ensures payroll records are ready for audit. It also produces ATO-compliant Single Touch Payroll (STP) submissions, making it simple to stay up to date with legislation. For businesses handling complex rosters or award requirements, Lightning Payroll offers robust features to simplify what would otherwise be difficult manual tasks.

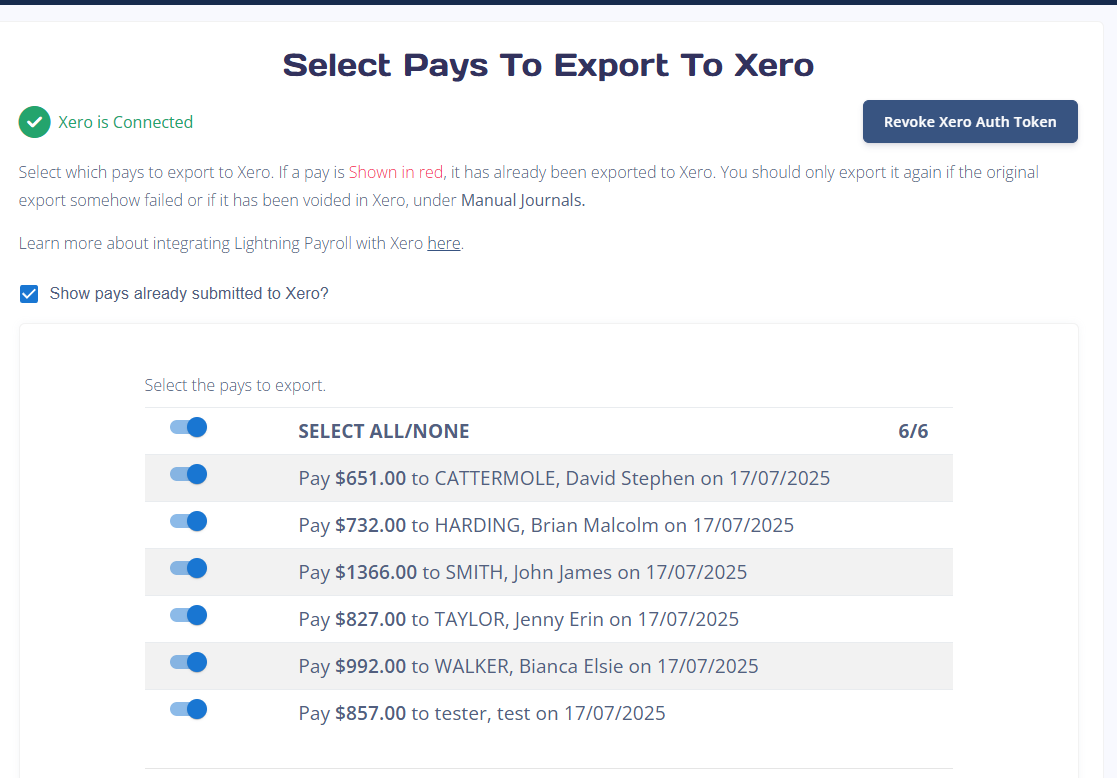

Integration with Xero makes accounting even easier. Once pay runs are complete in Lightning Payroll, you can send journal entries straight to Xero with just a few clicks. This removes the need to enter data twice, reduces mistakes, and keeps payroll and accounts perfectly aligned. You can match payroll expenses to the right chart of accounts in Xero, ensuring that wages, super and tax are reported where you want them.

Lightning Payroll is built for speed and reliability. It works offline, so you do not depend on an internet connection to process pays. Updates are delivered regularly to keep in step with ATO changes. Your data is stored securely on your own device, with optional cloud backup available for added peace of mind. With a once-per-year subscription covering two desktop installs plus a cloud account, Lightning Payroll offers excellent value.

Local support is another reason businesses choose Lightning Payroll. Our friendly team provides clear, practical help when you need it. From setup through to troubleshooting, you can trust that you will speak with someone who understands payroll and Australian business needs.

Key benefits:

- Handles PAYG, super, STP and leave automatically

- Direct integration with Xero for seamless accounting

- Runs offline for reliability and speed

- Clear annual subscription, no hidden extras

- Friendly local support team

Lightning Payroll is not just payroll software, it is a trusted tool to keep your business compliant, efficient and confident about every pay run. By combining powerful payroll features with simple Xero integration, it helps you spend less time on admin and more time running your business.

Lightning Payroll + Xero

Lightning Payroll connects directly with Xero to simplify the flow of payroll information into your accounts. The integration is designed to be straightforward, secure and flexible, allowing you to customise how payroll results are posted.

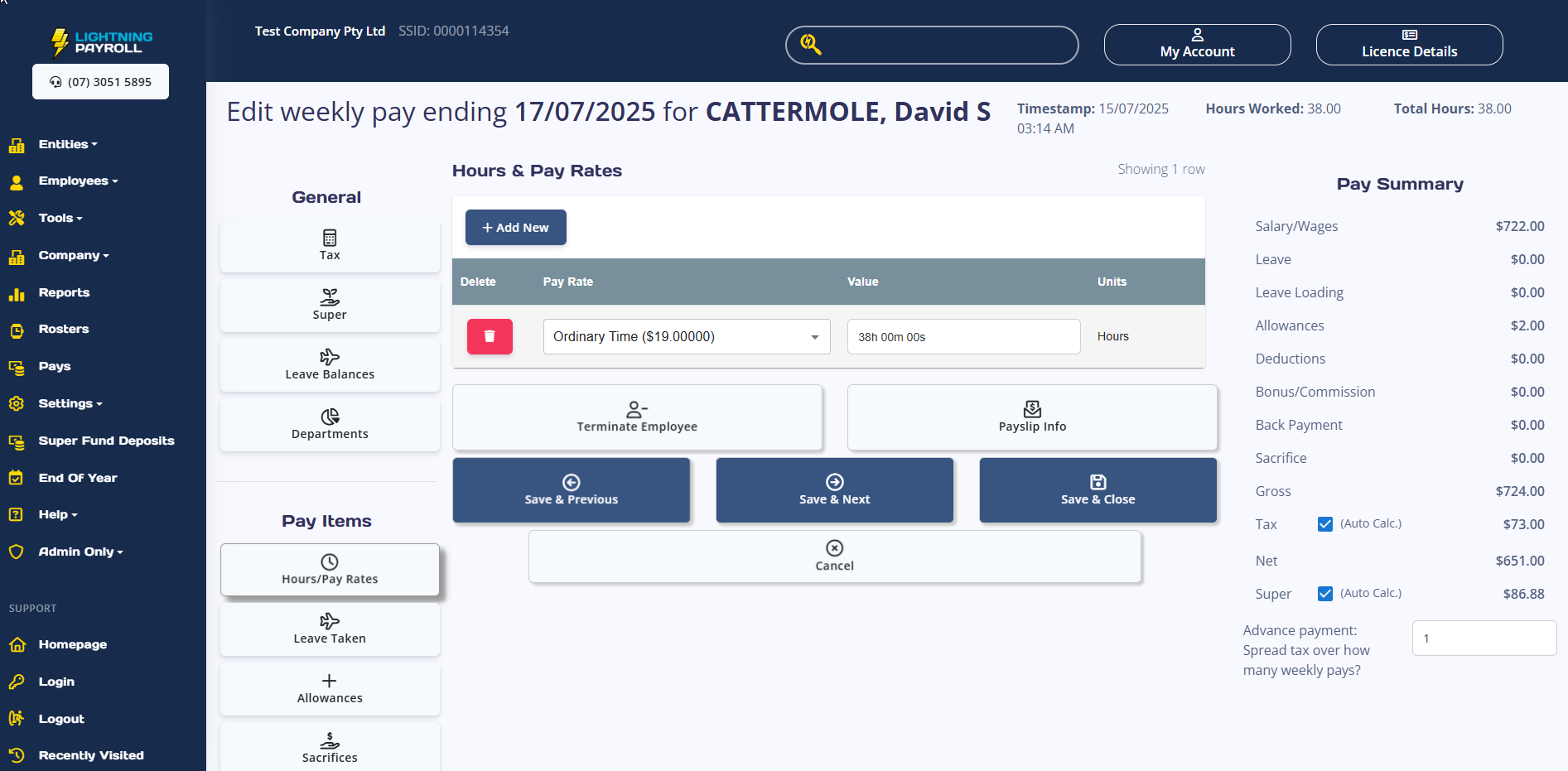

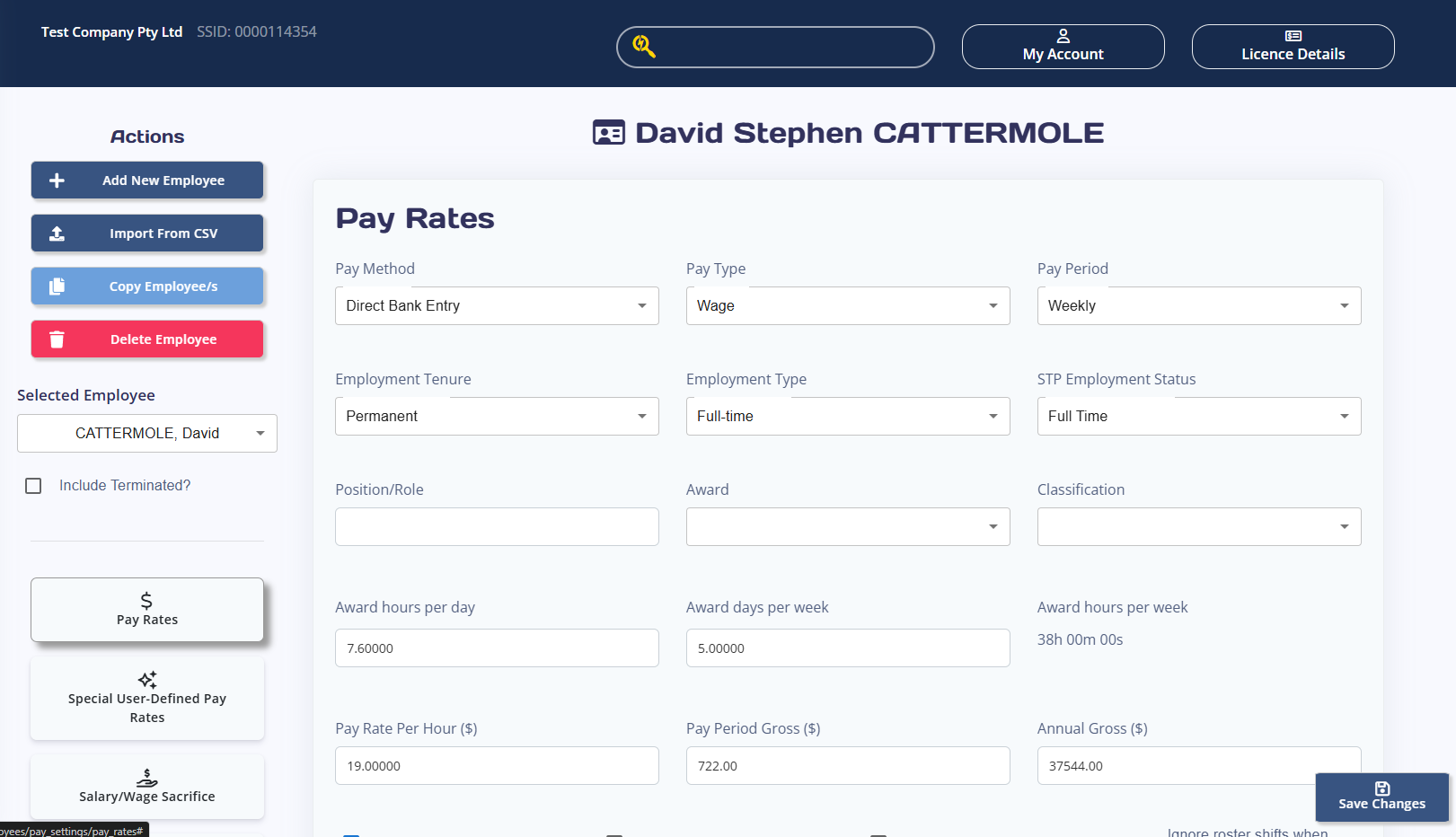

When a pay run is finalised in Lightning Payroll, you can export the results to Xero as a journal entry. This entry includes wages, allowances, deductions, PAYG, superannuation, and any other items relevant to your payroll. Each line can be mapped to the correct chart of accounts in Xero, giving you accurate and detailed financial records without the need for manual data entry.

Integration highlights:

- One-click posting: Send payroll journals from Lightning Payroll into Xero instantly after each pay run.

- Flexible account mapping: Choose which Xero accounts each payroll item should post to, ensuring wages, tax and super appear where you want them.

- Accurate records: Keep your accounting system up to date with every pay cycle, reducing reconciliation time and minimising the risk of errors.

- Audit-ready reporting: Ensure payroll data in Xero matches the figures submitted through Single Touch Payroll, making end-of-year reconciliation easier.

Lightning Payroll does not require you to upload all employee details to Xero. Instead, it focuses on the accounting side of payroll, keeping sensitive employee data securely within the payroll system. Only the journal entries that matter for your accounts are sent across. This approach keeps payroll and accounting clearly separated while still ensuring they work together seamlessly.

The integration uses secure authentication to connect your Lightning Payroll licence with your Xero account. Once connected, you simply select the company file in Xero that should receive payroll journals. The setup process is quick, and once complete you can post to Xero as often as you like.

By linking payroll results directly to your accounting system, Lightning Payroll with Xero gives you:

- Clear visibility over payroll costs

- Reduced manual workload

- Consistent, accurate financial data

- Confidence that payroll and accounts are always aligned

This integration is built to save businesses in Australia time and provide peace of mind. With Lightning Payroll handling the complexity of payroll compliance, and Xero managing your accounts, you get a powerful combination that keeps both sides of your business in sync.

Getting started

Getting started with Lightning Payroll and Xero is simple. The fastest way is to click the “Get this app” button at the top of this listing. This will begin the process of connecting Lightning Payroll with your Xero account.

Quick setup guide:

-

Install Lightning Payroll

Download and install Lightning Payroll on your computer. Your subscription includes two desktop installs plus access to a web account. -

Activate your subscription

Enter your licence details to unlock all features. Updates are included to keep your software compliant with ATO changes. -

Connect to Xero

In Lightning Payroll, open the integration settings and select Xero. You will be prompted to log into your Xero account and approve the connection. -

Map your accounts

Choose which payroll items (wages, PAYG, super, allowances, deductions) should post to which Xero chart of accounts. This ensures journal entries line up correctly. -

Run a pay cycle

Process your payroll as usual in Lightning Payroll. When finished, export the journal directly to Xero with one click. -

Review in Xero

Log into Xero to see the journal posted. It will appear against your chosen accounts, ready for reconciliation.

Tips for success:

- Review your chart of accounts in Xero before mapping, to keep your data tidy.

- Run a small test pay cycle first, to check everything posts correctly.

- Use Lightning Payroll’s built-in reports to cross-check totals before posting to Xero.

Support and reassurance:

- If you need help at any step, our support team is ready to assist.

- Clear user guides are built into the software to walk you through setup.

- Updates are automatic, so you can be confident the integration will remain compatible with Xero and ATO rules.

By following these steps, you will be up and running quickly. From then on, sending payroll data to Xero is as easy as finalising a pay run and clicking export. With the integration complete, you can trust that your payroll and accounts will stay aligned, accurate and compliant.