Give customers more ways to pay with PayPal and Venmo - and automatically view and reconcile transactions within Xero.

Rated

3.5

out of 5Reviewed by

135

Xero usersListed for

10 years

June 2015Key functions

Payments

Overview

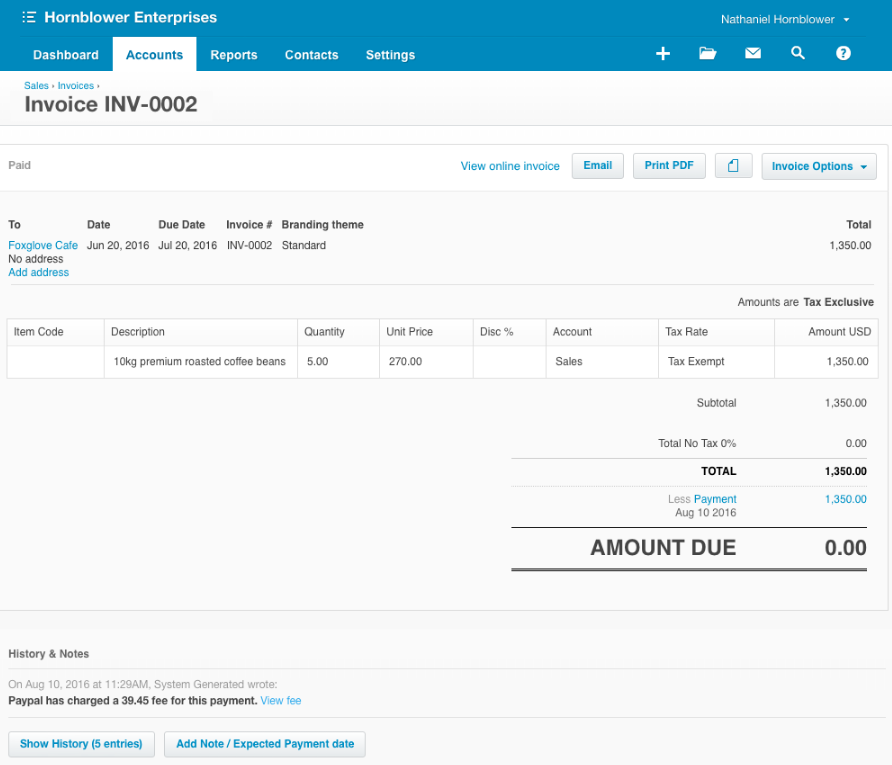

PayPal and Xero have made it easy for you to automatically offer your customers more flexible payment options on invoices, including PayPal, PayPal Credit(1), and mobile payment methods like Venmo(2). Making it easy for your customers to pay means less time chasing money, so you can spend more time on other parts of your business.

(1) PayPal Credit is subject to consumer credit approval. (2) Venmo is available for US shoppers only.

Play Video, opens in a dialog

PayPal + Xero

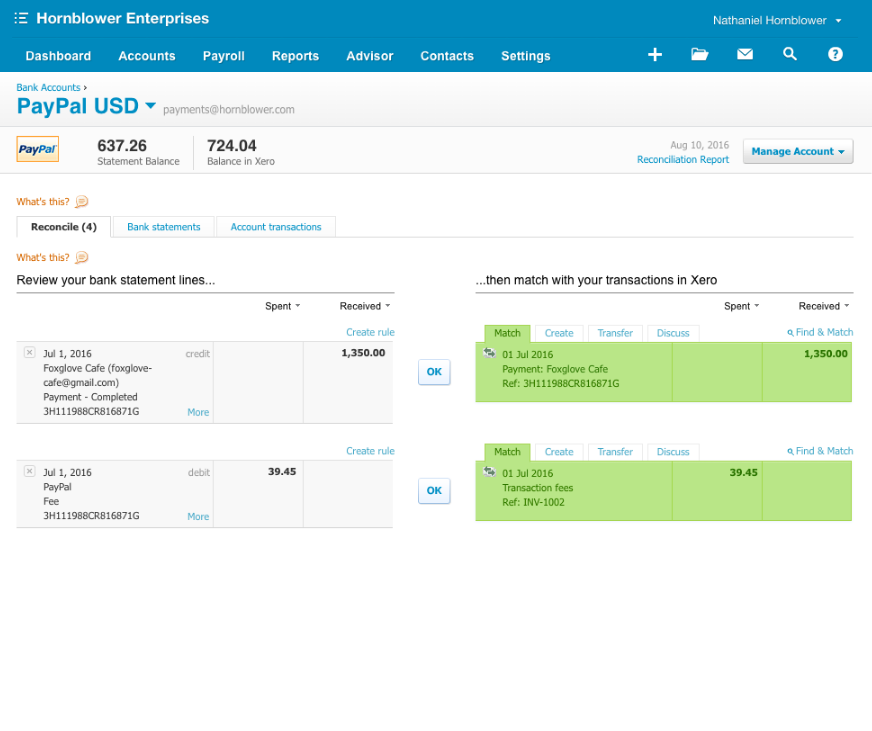

Once you’ve linked your PayPal and Xero accounts:

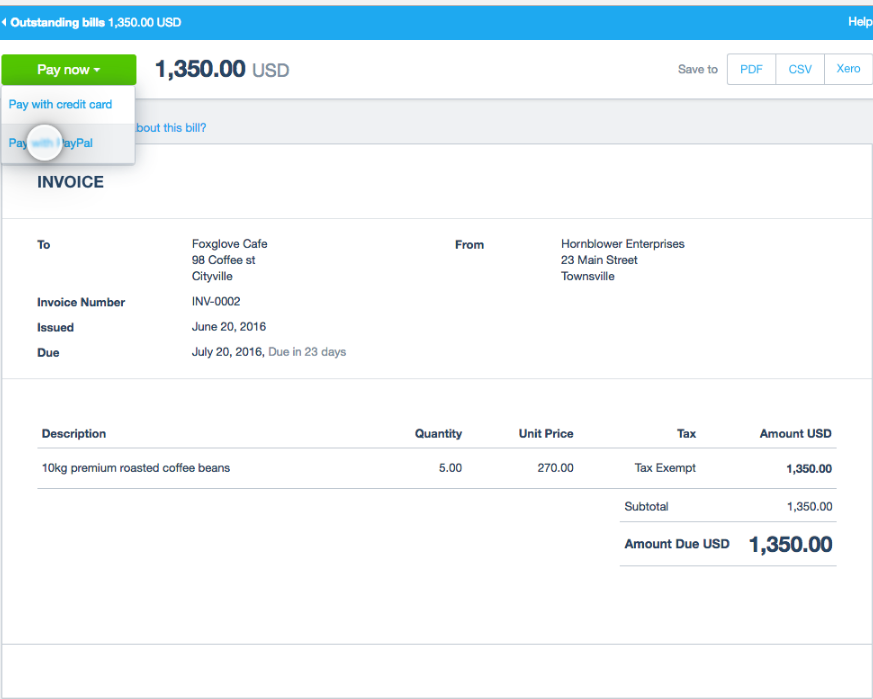

- A ‘Pay now’ button appears on your invoices.

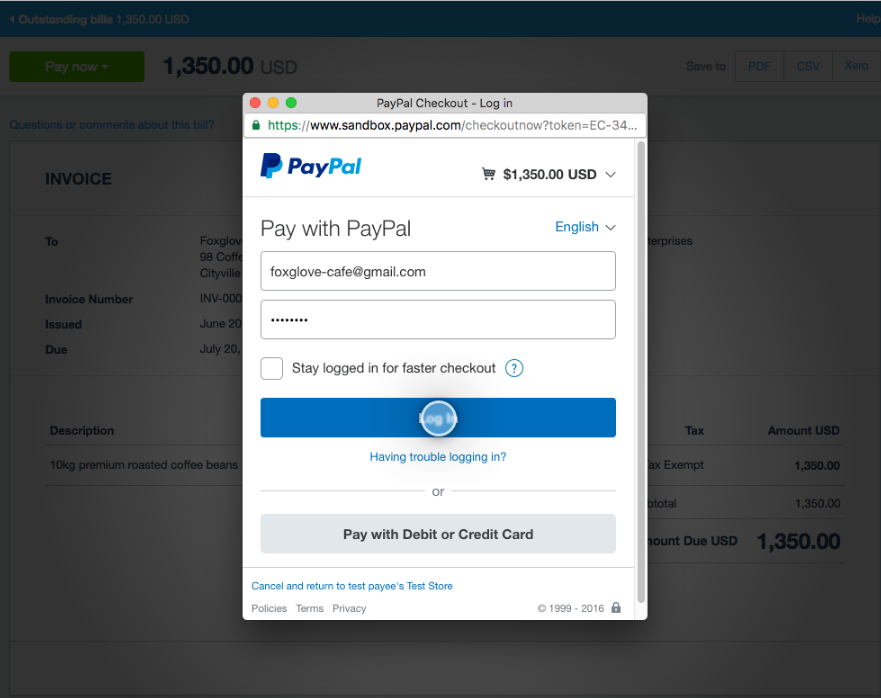

- Your customers simply click the button and either pay with their PayPal account or enter their credit or debit card details.

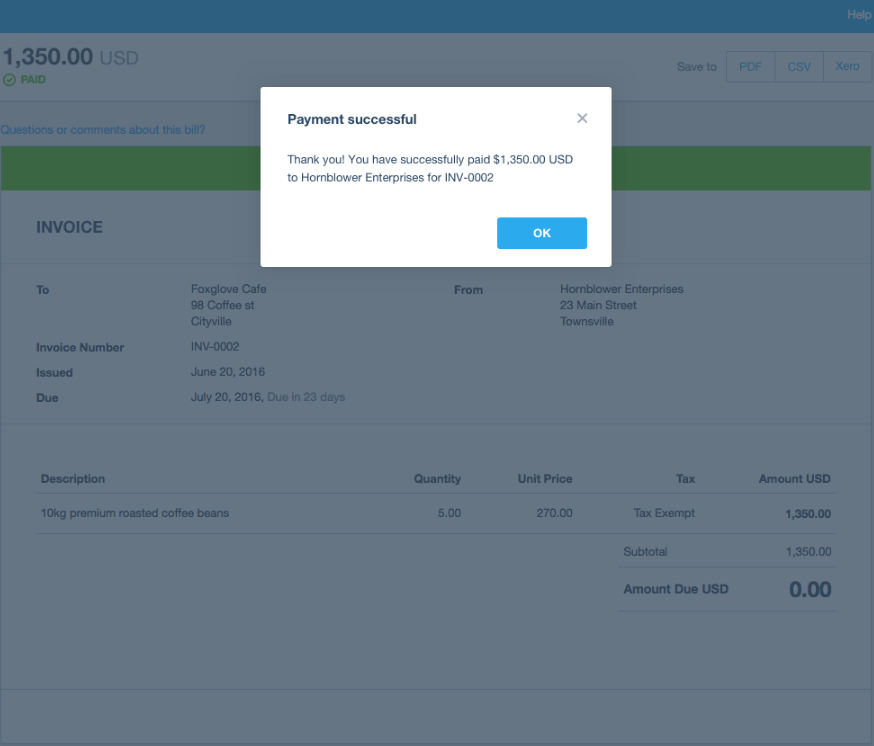

- You receive the money in your PayPal account straight away.

Getting started

You only need to link your PayPal and Xero accounts once. You can do this in your Xero settings.

In your Xero settings:

- Go to General Settings and click Payment Services.

- Click Add PayPal.

- Enter your PayPal account email address and click Save.

Reviews & ratings

135 Reviews

Sort and filter

Rating

Sort

Most recent reviews

Boris Pogoriller

Posted 11 Apr 2024

Account restrained for no reason

I am solicitor working in a one person firm. I have been using PayPal for online payments as part of Xero invoicing for about 6 years.

On 10 April 2024 I received a payment from a client that was larger than my usual payments. The client paid my invoice by credit card. Both the client and I are located in Australia.

PayPal unilaterally restrained my account and demanded proof of ID, proof of transaction, information on my business and my bank account statements.

When I contacted customer service at PayPal I was informed the transaction was deemed risky because the amount was large - circa $AUS35k and because the payer was NOT a PayPal user. The payer used his regular bank credit card in this instance. I was informed it may take 1-2 business days to reopen my account and nothing can be done sooner.

I will now cease using PayPal and would not recommend PayPal to any client or friend.

16 people found this review helpful.

Mercantil Coffee

Posted 9 Jun 2023

very bad

they took like 10% comision and block the money for 180 days

20 people found this review helpful.

AI

Andy Ingham

Posted 5 Mar 2023

Never again

Thought this would be a convenient way to receive money from overseas clients. They taxed me an my client nearly 10% of the overall transfer. This made it 10 times more than a standard bank transfer. They then had the cheek to keep 95% of all that money to 'save me from myself', 'just in case I'd not actually shipped the goods yet'. Just an excuse to keep hold of money! Never again. Avoid if you actually want to be paid!

20 people found this review helpful.

Additional info

Functions

PaymentsApp details

By PayPal

Added in 2015Countries

Australia, Canada, Global, Hong Kong, Indonesia, Ireland, Malaysia, New Zealand, Philippines, Singapore, South Africa, United Kingdom, United StatesLanguages

EnglishGet started with PayPal

Although Xero reviews each app in the Xero App Store, we can’t give any guarantees. It’s up to you to assess the performance, quality and suitability of any app before going ahead.