Overview

IdentityCheck makes client verification simple for accountants and bookkeepers. With AUSTRAC Tranche 2 reforms in Australia, plus AML rules in the UK and globally, firms must now verify and store client identity securely. Doing this manually is time-consuming, error-prone, and risky.

Our tool automates the process end to end:

- Easy for clients – Send a branded email (and optional SMS), and your client completes their ID check in under 30 seconds.

- No manual data entry – Results flow straight into Xero Practice Manager or your workflow, with no re-keying.

- Audit-ready – Records stored securely for the required 7 years, supporting AU, UK, and global AML regulations.

- Advanced screening – Optional checks for Politically Exposed Persons (PEP), sanctions, and adverse media.

- Global coverage – Supports 230+ countries and 10,000+ document types.

- Trusted security – GDPR-ready, SOC 2 compliant infrastructure, DHA approved, with AES-128 encryption and two-factor authentication.

Why accountants use IdentityCheck:

- Stay compliant with AUSTRAC Tranche 2, UK AML rules, and other global obligations.

- Reduce time spent chasing and processing client documents.

- Improve client trust with a professional, branded experience.

- Affordable, predictable pricing that scales with your firm.

IdentityCheck is used by firms in accounting, financial services, law, real estate, leasing, and education. Whether onboarding a new client, updating records, or preparing for an audit, you can be confident the compliance box is ticked across jurisdictions.

IdentityCheck + Xero

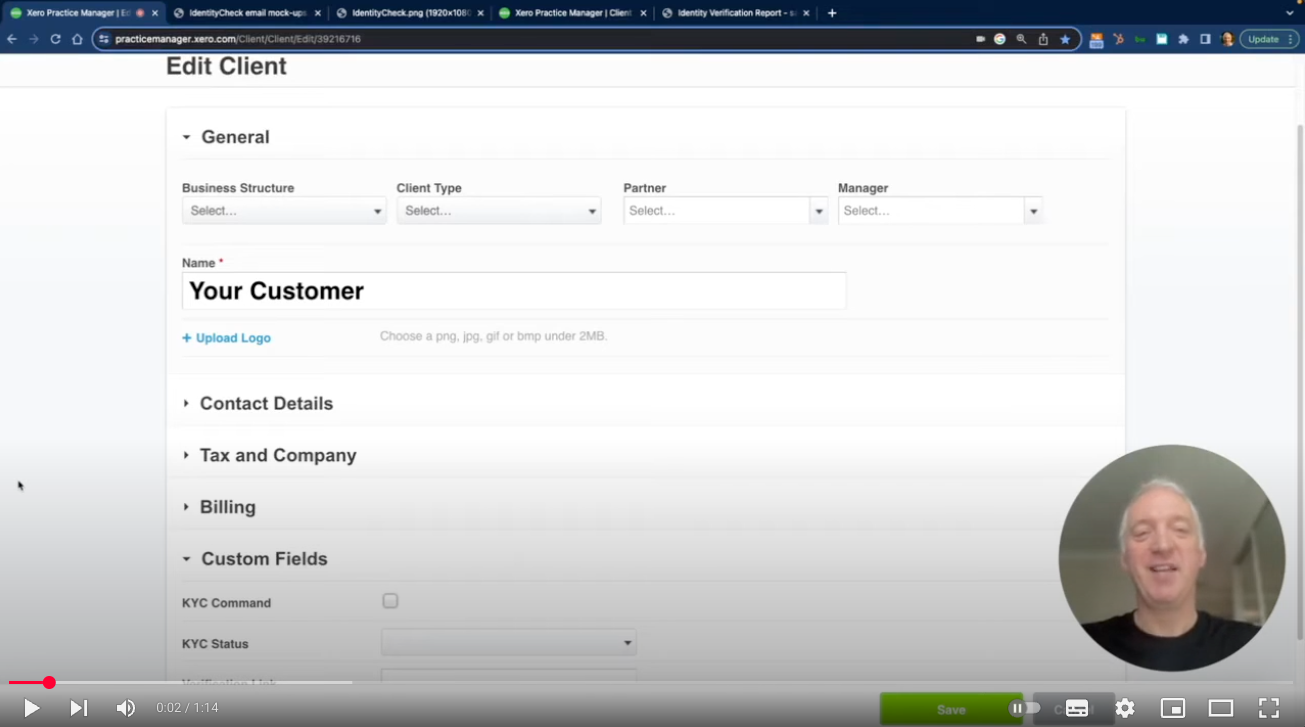

IdentityCheck integrates seamlessly with Xero Practice Manager (XPM) and other systems to remove manual steps from client onboarding.

How it works with Xero:

- Add a new client in XPM.

- Trigger an ID check with one click.

- The client receives a branded request by email or SMS.

- They complete the check in less than 30 seconds using their ID document and selfie.

- Results automatically update the XPM client record.

No more scanning, emailing, or chasing clients for paperwork. Everything is streamlined and secure.

Integration highlights:

- Bi-directional sync – Verified client data updates in Xero.

- Conditional workflows – Choose when checks are triggered (e.g. new clients, high-risk clients, corporate entities).

- Audit support – Maintain a digital trail that satisfies AU, UK, and global AML/CTF programs.

- Custom forms – Optional onboarding forms can be mapped to XPM fields.

Security and compliance:

- Supports AML compliance in Australia, the UK, and globally.

- Data encrypted in transit and at rest.

- Images deleted after 45 days; records stored securely for 7 years.

- GDPR, SOC 2, and CCPA compliant underlying infrastructure.

- 40+ point security audit passed by SaaS platforms including Xero and HubSpot.

With IdentityCheck + Xero, your firm saves time, stays compliant worldwide, and delivers a smoother client experience.

Getting started

Get Started with Xero + IdentityCheck (Free Plan)

One-time setup

- Create your free IdentityCheck account (URL below).

- Select the Free ($0/month) plan.

- Skip the intro video (optional).

- Enter your Company Name (this appears in client emails).

- Connect your Xero Practice Manager (XPM) account.

To request an ID check

- In XPM, open the Contact you want to verify.

- Click KYC Command, then Save.

- Within 1 hour, your client will receive an IdentityCheck link by email.

- Results appear in both your IdentityCheck dashboard and the XPM contact record.