Overview

Brex is reimagining financial systems so every growing company can realize their full potential. New customers can get up and running in minutes with high-limit corporate credit cards and cash management in a single, strategic account. Plus, companies save hours every month with built-in tools and integrations, like our integration with Xero, to track spend and manage expenses. Sign up online in minutes and start using virtual cards right away, all with no personal guarantee and live support available in seconds.

Brex + Xero

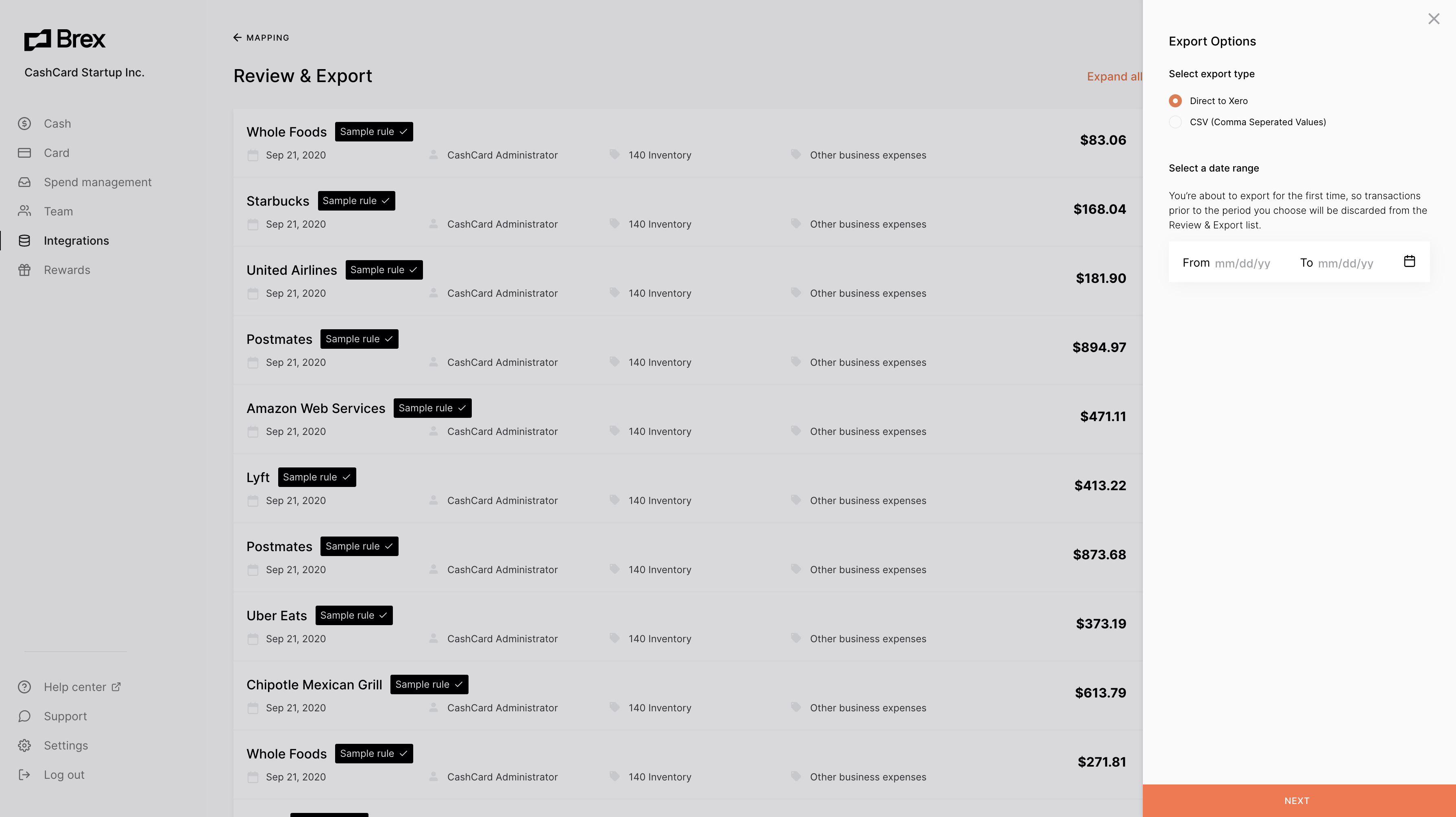

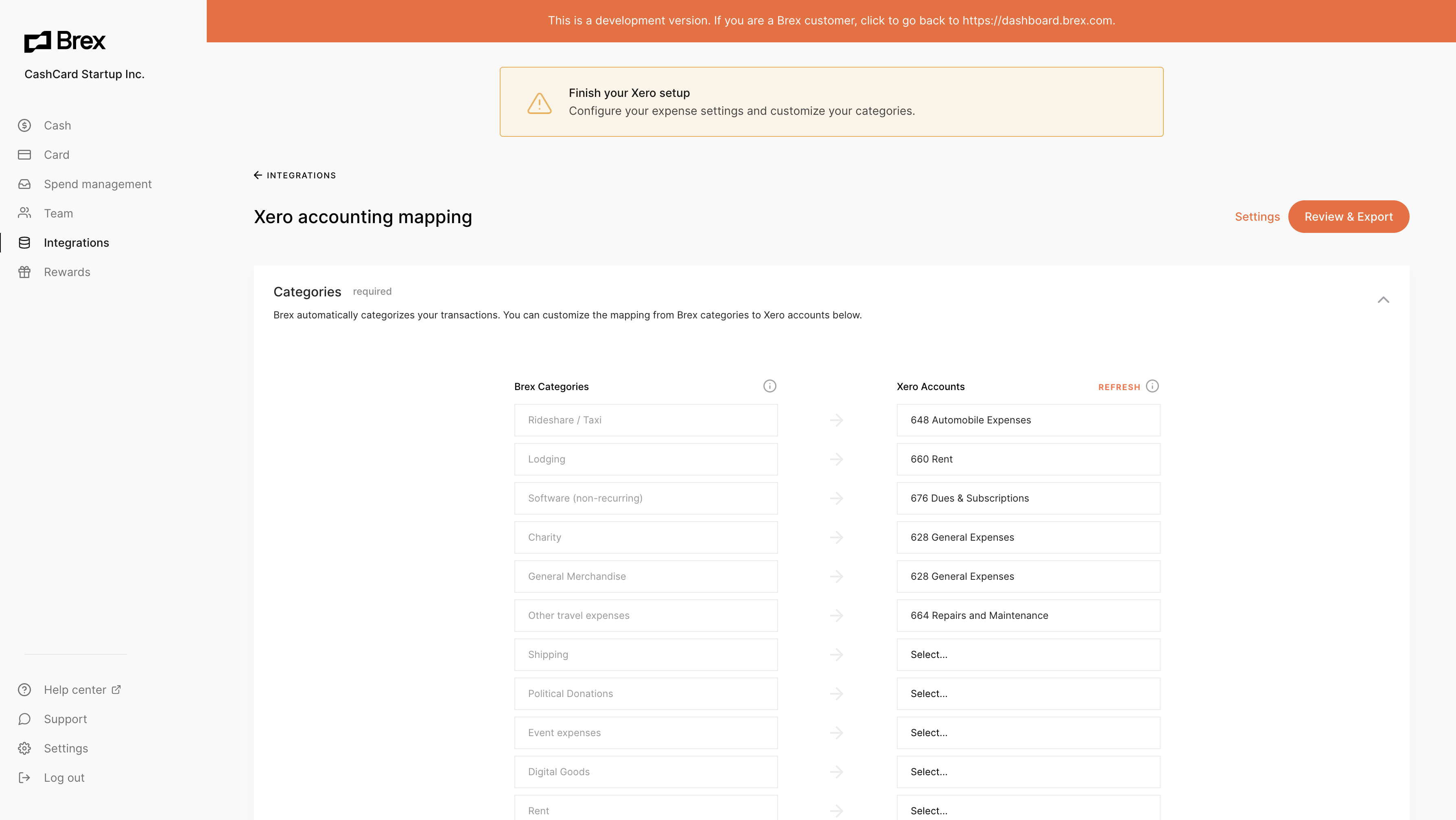

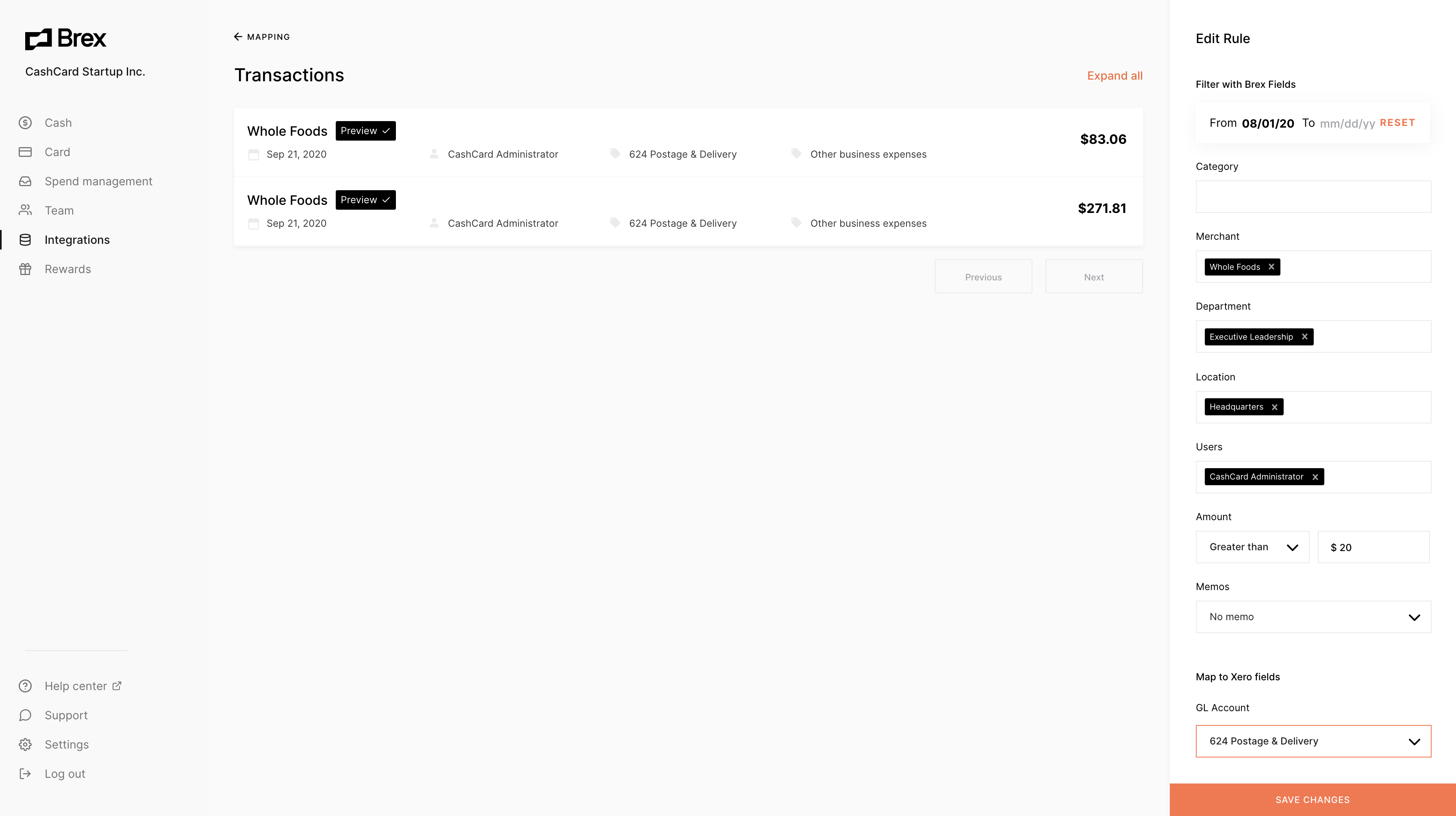

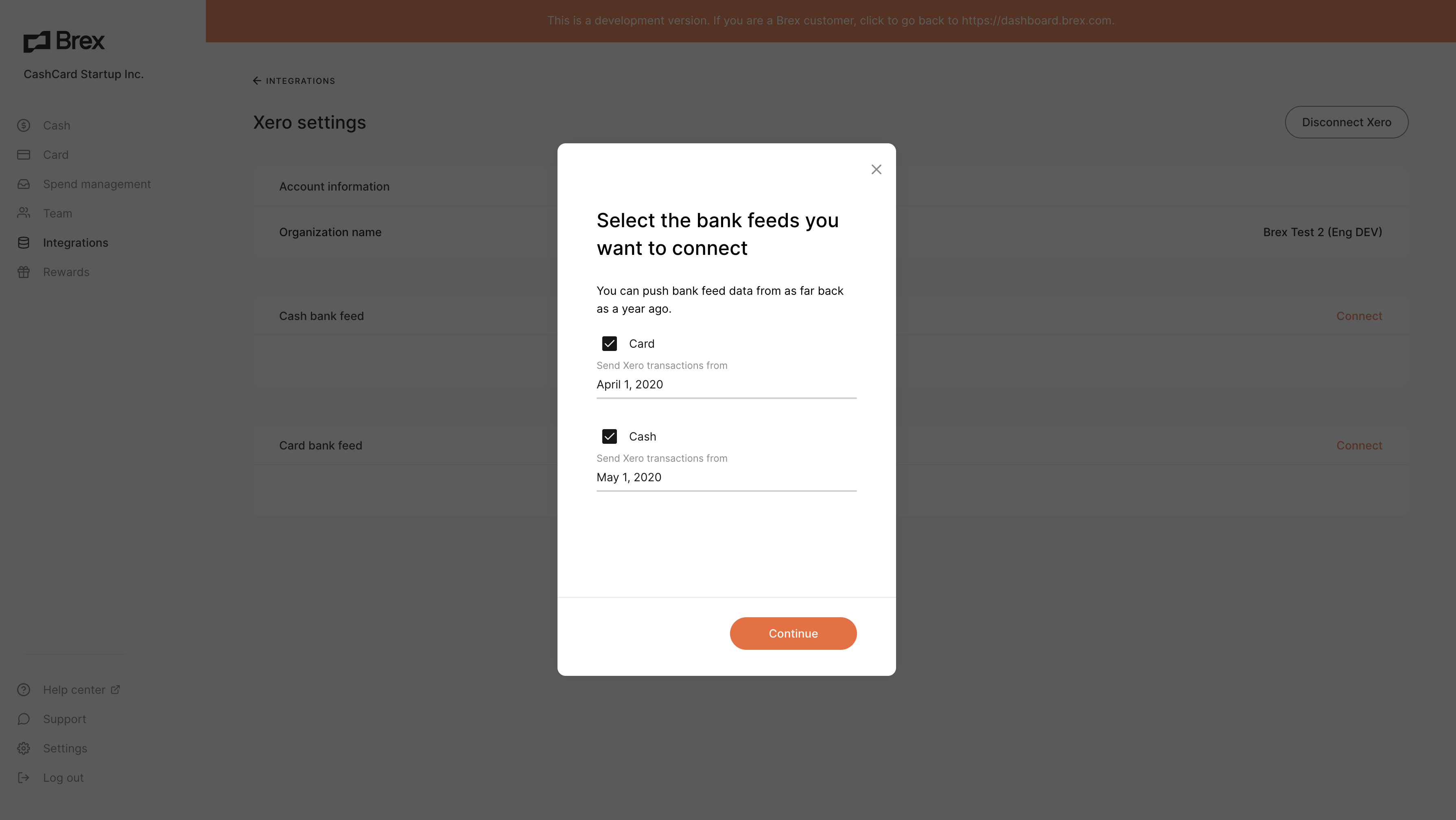

The newly improved Xero integration works with Brex Card and Cash to help customers close their books faster, with standard bank feed automation and real-time data flows. This integration also allows custom configurations to help finance and accounting teams control how their transaction information shows up in Xero’s general ledger, using custom rules and category-mapping. This makes Brex one of the most advanced Xero integrations in the US. Key features and capabilities include: bank feed, expense matching and category mapping, custom rules, automated receipt-matching and memo-matching, mobile app, and more.

Getting started

Brex customers can connect their accounts by navigating to the Integrations tab in the Brex dashboard. Once the bank feed setup is complete, transactions will begin exporting automatically within a few minutes. Customers also have the option to sync expense data for automatic category mapping. Matching the expense records to the bank feed will automatically reconcile your spending to your balance sheet, giving you better data visibility and saving hours on your month-end close.