Overview

A2X is for ecommerce businesses, accountants, and bookkeepers. If you sell on Shopify, Amazon, Walmart, eBay, PayPal, or Etsy, A2X has you covered.

Save hundreds of hours… & headaches Since 2014, A2X users saved between 2-20 hours/month on their ecommerce accounting. Accurate books keep the tax-(wo)man happy and are crucial if you ever wish to sell your business.

Automagic accounting sync Never waste another minute manually matching bookkeeping entries. A2X automatically posts settlement summaries to Xero, with all income/expenses automatically corresponding with your payouts - reconciling perfectly. A2X splits out settlements, even if they span over 2 months.

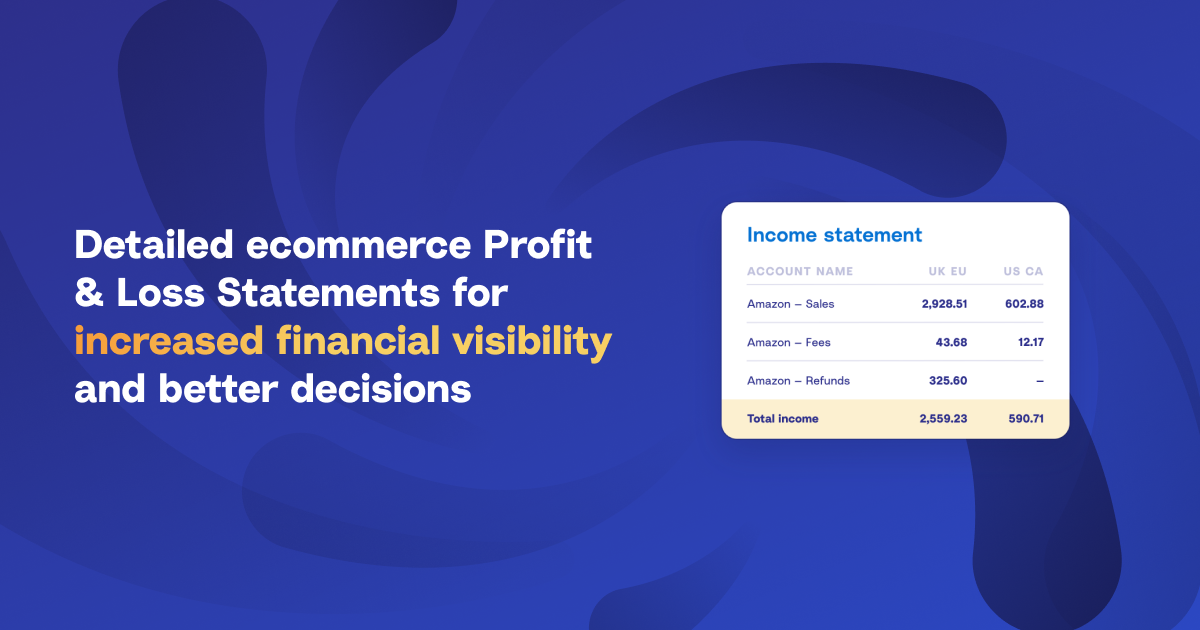

Gold Standard accounting accuracy for better business decisions 1000s of accountants and bookkeepers refer to A2X as the ‘Gold Standard’ for ecommerce accounting: A2X organizes your books in a few clicks – using accrual accounting – giving you a clear picture of how value is flowing through your business.

With A2X, it's easier to make sense of your Amazon, Shopify, Walmart, eBay, PayPal, and Etsy financials. It's free to try and you can get set up in minutes.

A2X for Shopify posts Shopify sales automatically to Xero and reconciles your payouts, so you know everything has been accounted for correctly.

A2X for Amazon posts Amazon sales and fees to Xero and reconciles to settlement deposits. Supports Amazon marketplaces worldwide. A2X saves you hours of reconciling Amazon settlements each month. Eliminate Amazon spreadsheet accounting, which is error-prone and time-consuming.

A2X for eBay posts your eBay sales automatically to Xero, and reconciles eBay Managed Payments payouts so that you know everything has been accounted for correctly.

A2X for Etsy posts Etsy sales automatically to Xero and reconciles payouts so that you know everything has been accounted for correctly.

A2X for Walmart posts Walmart marketplace sales and fees to Xero simply, reconciling to settlement deposits. A2X saves you hours, by eliminating Walmart spreadsheet accounting (error-prone and time-consuming).

__A2X for PayPal__reconciles your PayPal payouts to the originating sales transactions across your Shopify store or any online store that supports PayPal — scaling to handle thousands of transactions and supporting multi-currency wallets for multi-channel sellers.

A2X supports Amazon Pay reconciles your Amazon Pay payouts to the originating sales transactions across your Shopify, WooCommerce, BigCommerce or any online store platform that supports Amazon Pay.

Sell on multiple channels? A2X Multi is for ecommerce businesses selling in multiple regions, countries, or channels (e.g. Amazon + Shopify). Pick and choose from the A2X ecosystem and manage your sales and fees accounting from within the same A2X dashboard.

A2X + Xero

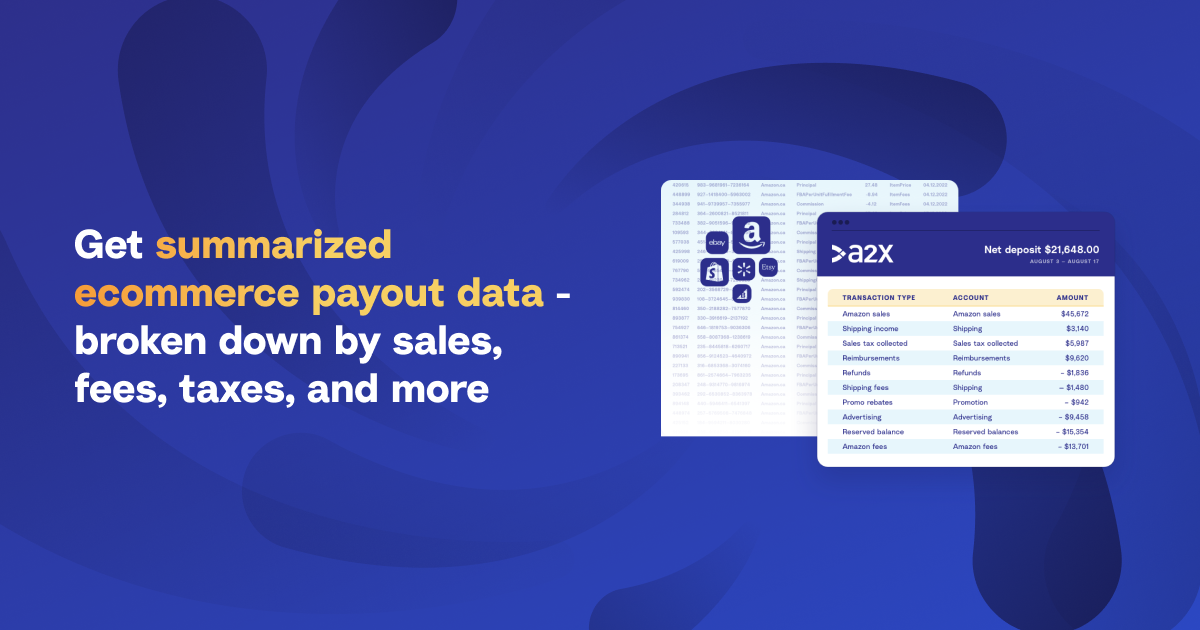

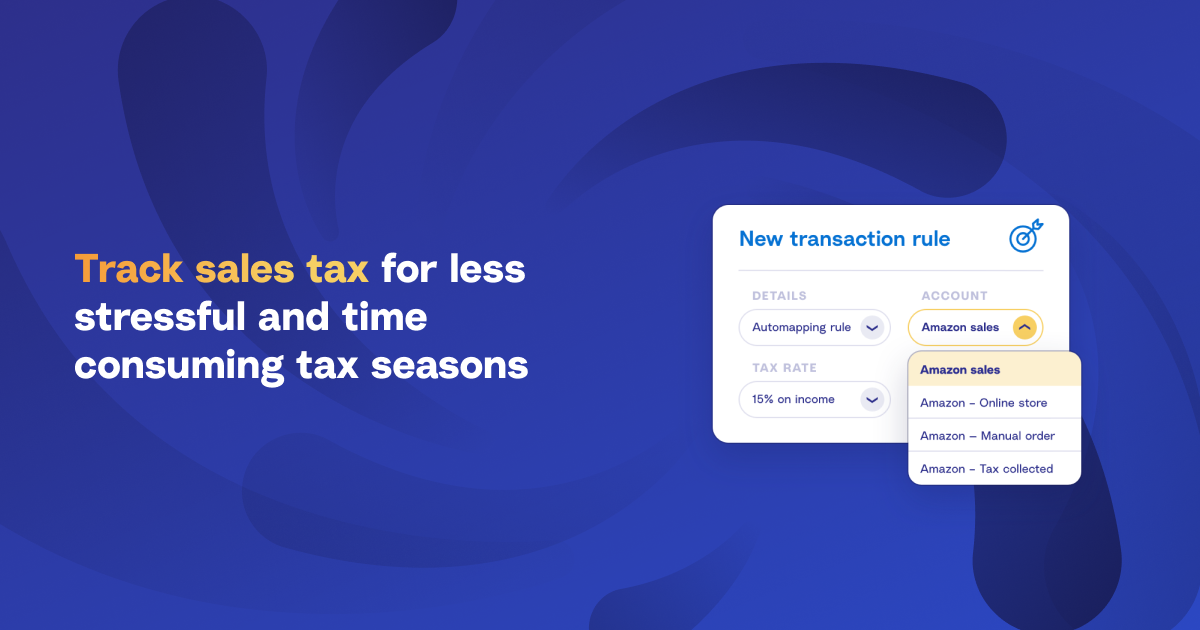

Ecommerce accounting is challenging, with A2X it doesn’t have to be. A2X references the Xero chart of accounts to facilitate mapping of Shopify, Amazon, Etsy, Walmart, PayPal, and eBay marketplace transaction types to the appropriate ledger accounts. Optionally A2X can create a set of ledger accounts in Xero suitable for a Shopify store, Amazon seller, Etsy seller, Walmart seller, and/or eBay store. It also works for those using PayPal as a payment gateway. A2X posts summarized journals to the Xero ledger using the invoice API; this shows up in Xero as ‘invoices’, summarizing the transactions in your Shopify, Amazon, Etsy, Walmart, PayPal, and eBay settlements and payouts.

A2X posts as invoices to enable Xero’s auto-reconciliation capability, so that when the Shopify, Amazon, Etsy, Walmart, PayPal, or eBay settlement or payout amount appears in the bank feed, the amounts posted by A2X reconcile precisely to the bank statement.

Always reconcile. Rigorous reconciliation is core to A2X, meeting exacting standards of professional accountants and bookkeepers. Accuracy is paramount.

A2X for Shopify, A2X for Amazon, A2X for Etsy, A2X for Walmart, A2X for PayPal, and A2X for eBay can load past Shopify, Amazon, Etsy, Walmart, PayPal, eBay payouts and settlements, generating up to a year’s financial history. This enables A2X clients to go back to the start of their financial year and roll forward all their Shopify, Amazon, Etsy, Walmart, PayPal and eBay transactions from that point using A2X for ‘clean’ books that reconcile.

A2X posts the cost of goods sold corresponding to the sales posted in each settlement for Shopify, Amazon, Etsy, Walmart, PayPal, and eBay merchants, which gives accurate product margins in Xero.

Getting started

Select the A2X product for your business, A2X for Shopify, A2X for Amazon, A2X for Etsy, A2X for Walmart or A2X for eBay or all of them; then;

A2X for Shopify, connect to your Shopify store using your Shopify store URL, connect to Xero, and either use a standard e-commerce chart of accounts provided by A2X or set up your preferred mapping of Shopify and payment gateway transactions to your chart of accounts. A2X will monitor your Shopify store, detect payouts, and post sales and fees automatically to your Xero ledger.

A2X for Amazon, connect to your Amazon merchant account, connect to Xero, and either use a standard e-commerce chart of accounts provided by A2X or set your preferred mapping of Amazon transactions to your chart of accounts. A2X will monitor your Amazon merchant account, detect settlements, and post automatically to your Xero ledger.

A2X for Etsy, connect to your Etsy store account, connect to Xero, and either use a standard e-commerce chart of accounts provided by A2X or set up your preferred mapping of Etsy transactions to your chart of accounts. A2X will monitor your Etsy store, detect payouts, and post sales and fees automatically to your Xero ledger.

A2X for Walmart, connect to your Walmart account, connect to Xero, and either use a standard e-commerce chart of accounts provided by A2X or set your preferred mapping of Walmart transactions to your chart of accounts. A2X will monitor your Walmart seller centre account, detect settlements, and post automatically to your Xero ledger.

A2X for eBay, connect to your eBay store connected to your eBay Managed Payments account, connect to Xero, and either use a standard e-commerce chart of accounts provided by A2X or set up your preferred mapping of eBay and payment gateway transactions to your chart of accounts. A2X will monitor your eBay store, detect payouts, and post sales and fees automatically to your Xero ledger.

A2X for PayPal, connect your PayPal account to A2X, link to Xero, and either use a standard ecommerce chart of accounts provided by A2X or set up your own mappings for PayPal transactions. A2X will import your PayPal statements, summarize thousands of transactions into reconciled entries, and post deposits, fees, refunds, and withdrawals automatically to your ledger — scaling with your business, supporting multi-currency wallets, and ensuring perfect reconciliation every time.