Overview

Fast Capital is revolutionising the business borrowing process with an easy online application and real-time decisions. This is helping you to grow, expand, or provide a buffer for your business.

Fast Capital allows Kiwi businesses to apply for borrowing from $5,000 to $1 million and get a decision within minutes. We'll use your summarised financial information in Xero or MYOB Business (Pro, Lite and AccountRight), along with your credit history, to assess your application.

If approved, we’ll contact you to discuss the best borrowing solutions for your business needs - whether that’s a loan, overdraft, credit card, asset finance, or a mix of these.

Kiwibank Fast Capital + Xero

Kiwibank Fast Capital + Xero

FAQs

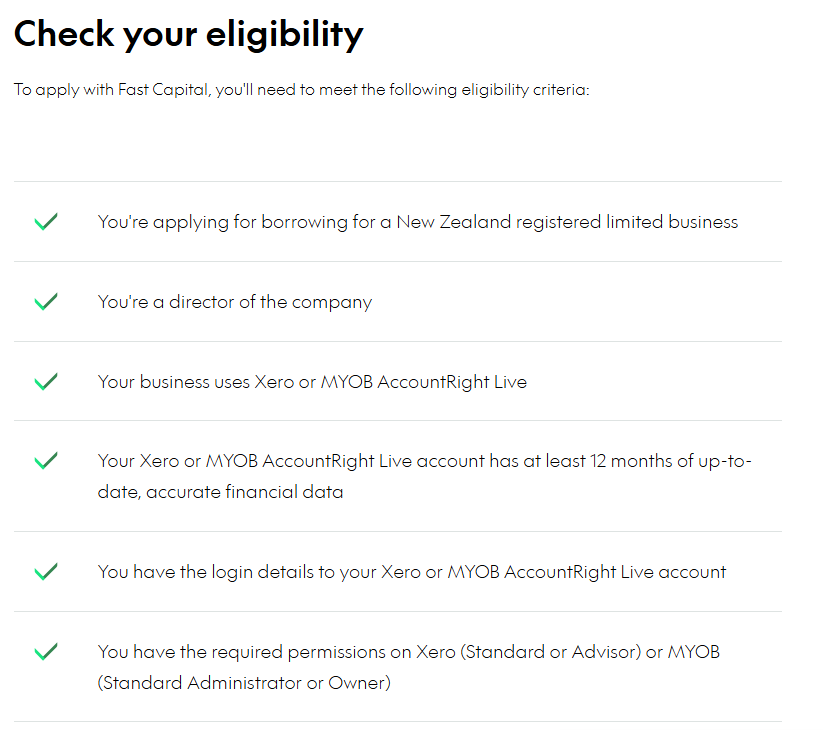

Who can apply with Fast Capital? Directors of New Zealand registered limited businesses can apply with Fast Capital. Sole traders, partnerships and trusts aren't eligible. Your business doesn't need to bank with Kiwibank to apply. If your application is approved, we'll help you to join quickly so you can access your approved funds. For other business borrowing enquiries, contact our Business Banking Specialists.

I just applied, what happens next? After you apply, our system performs detailed calculations using your Xero or MYOB AccountRight Live data and makes a borrowing decision. You'll receive an email with the decision within five minutes of applying. If your application is successful or we need more information, we'll be in touch to discuss next steps.

How will you store my data, and how long will you keep it for? During the application process you'll be required to log in to your Xero or MYOB AccountRight Live account, where you'll authorise us to see your summarised financial data. It's important this information is accurate and current. We'll also assess your credit history to make our decision about your application.

Your financial information will be used and stored in accordance with our privacy policy.

After you’ve completed the application, you can manually revoke our access to your accounting software within your MYOB settings or Xero settings.

What product am I applying for? We'll chat to you about what product or product mix will best suit your business needs. This could be a business loan, business overdraft, business credit card or asset finance. We'll then aim to give you access to your borrowing within a few business days, however it may be longer if you're new to Kiwibank.

Getting started

It takes less than 10 minutes to apply. Simply complete a short form and log in to your Xero or MYOB Business (Pro, Lite and AccountRight) account. Your business' financial data will be used to assess your application.