Overview

Collecting regular payments like invoices and subscriptions can be painful - but it doesn’t need to be. GoCardless is made for recurring payments and puts you in control of when you get paid. Join over 60,000 businesses worldwide and say goodbye to chasing late payments, hidden costs and manual admin.

GoCardless + Xero

Get paid faster with GoCardless for Xero

-

End late payments Take control when you get paid and cut out the stress of chasing unpaid bills.

-

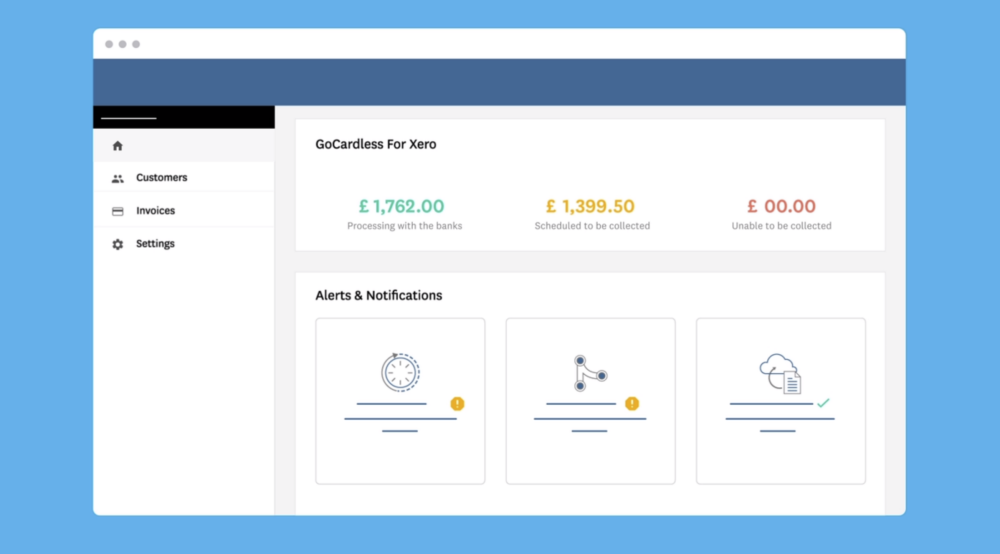

Predictable cash flow Payments are collected automatically as soon as your invoices are due.

-

Less bookkeeping Payments are automatically reconciled against your Xero invoices, saving you hours on admin.

-

Transparent fees Low, pay-per-transaction fee. Avoid the markups and hidden fees of card networks. Low cost cap on domestic payment fees.

-

International payments Collect payments in international currency, receive payout in your home currency with no mark-up on foreign exchange. See the pricing page for details.

Who is it for?

GoCardless is made for businesses that bill their customers on a recurring basis. It’s ideal for collecting payment for both intermittent and repeating invoices as well as subscriptions, retainers and instalments.

How does GoCardless work?

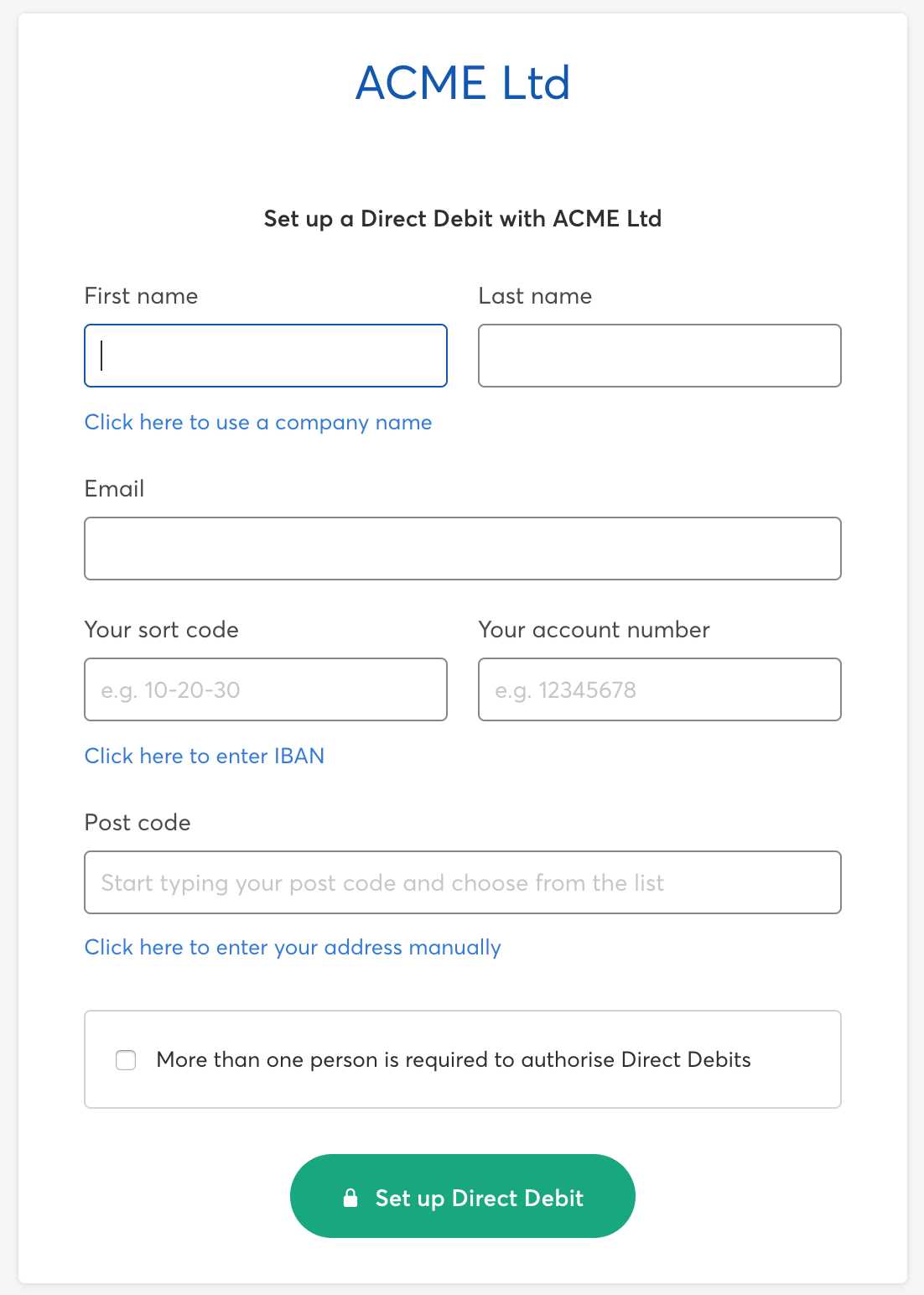

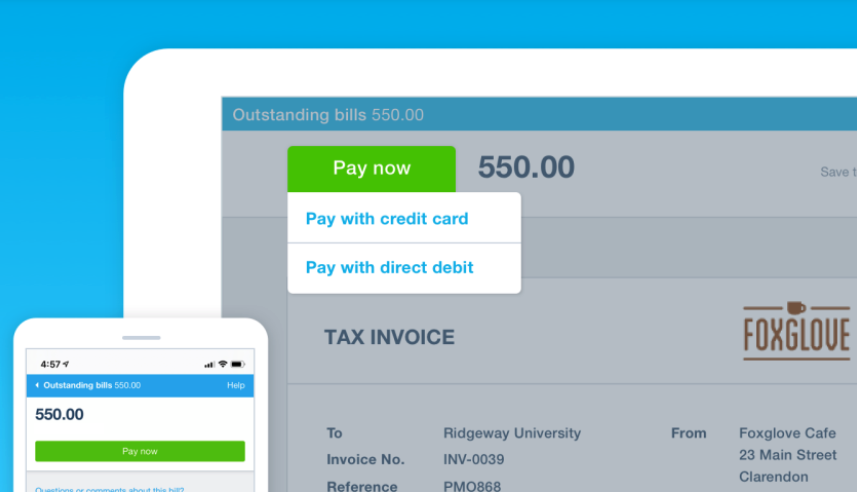

GoCardless is a bank-to-bank payment method. It uses Direct Debit, ACH and PAD to automatically collect payments directly from your customer’s bank account.

Your customers only need to enter their payments details once, and that’s it. You’re authorised to collect all future payments without further action from your customer.

The amount you charge and when you charge can be fixed or flexible. In fact, it’s linked to the amount and due date on the Xero invoice you’ve sent your customer. Payments happen frictionlessly in the background.

How does it work with Xero?

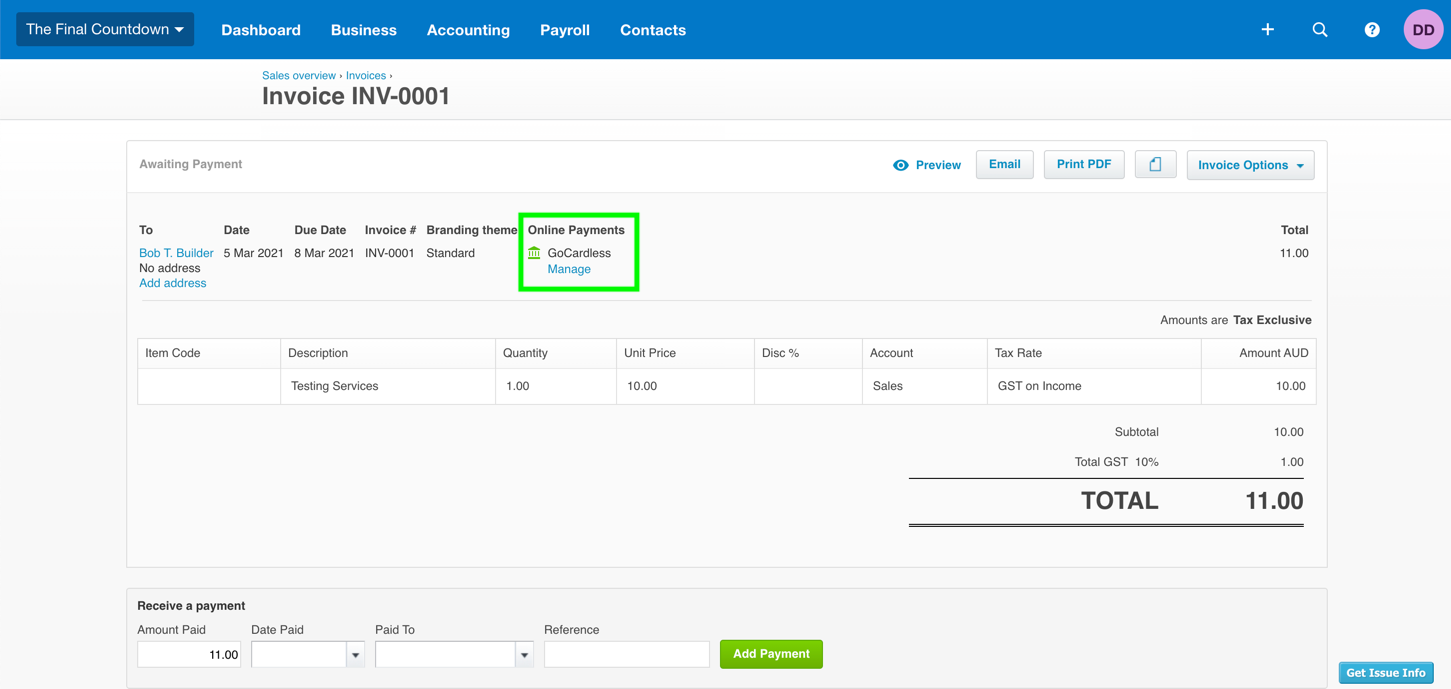

Simple setup You can create an account from this page or directly within Xero. Once connected to Xero, it’s simple and secure to set your customers up to pay via GoCardless. Then, just send out your invoices and GoCardless can automatically collect payment when they are due.

One-click reconciliation Once invoice payment has been collected via GoCardless, the invoice is marked as ‘paid’ and an expense transaction is added for the GoCardless fee. Reconciling your payment can then be done with a single click!

Getting started

Create a GoCardless account online and connect it to Xero. You will need an active bank account to use GoCardless.

Reviews & ratings

Sort and filter

Most recent reviews

No verification

Been using for 6 years faultlessly

Response from GoCardless