Overview

Payhawk helps finance leaders ensure full control and transparency over their company spend without changing their bank. With the financial system of tomorrow, our users create one place to manage the entire spending lifecycle in a digital and compliant way. Payhawk allows you to easily connect your bank account, load funds, issue physical & virtual cards with a click and reconcile to XERO in real-time.

Our NextGen cards integrate your company spend rules. Add your custom approval chain, issue team cards for those sharing a budget, pay bills and reimbursements and never chase receipts again.

Payhawk + Xero

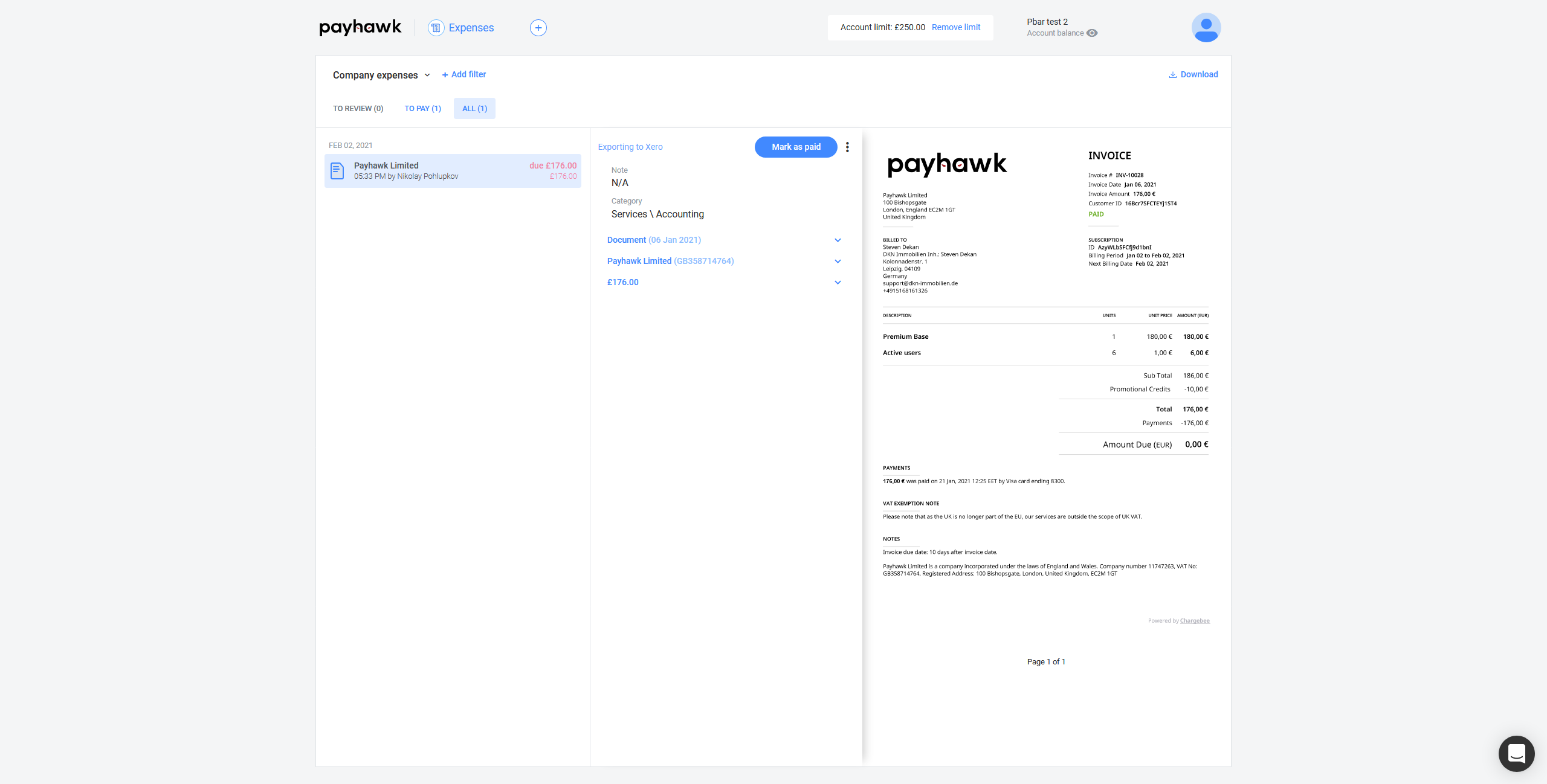

Payhawk has direct integration to Xero, allowing us the flexibility to enrich and export your expenses effortlessly.

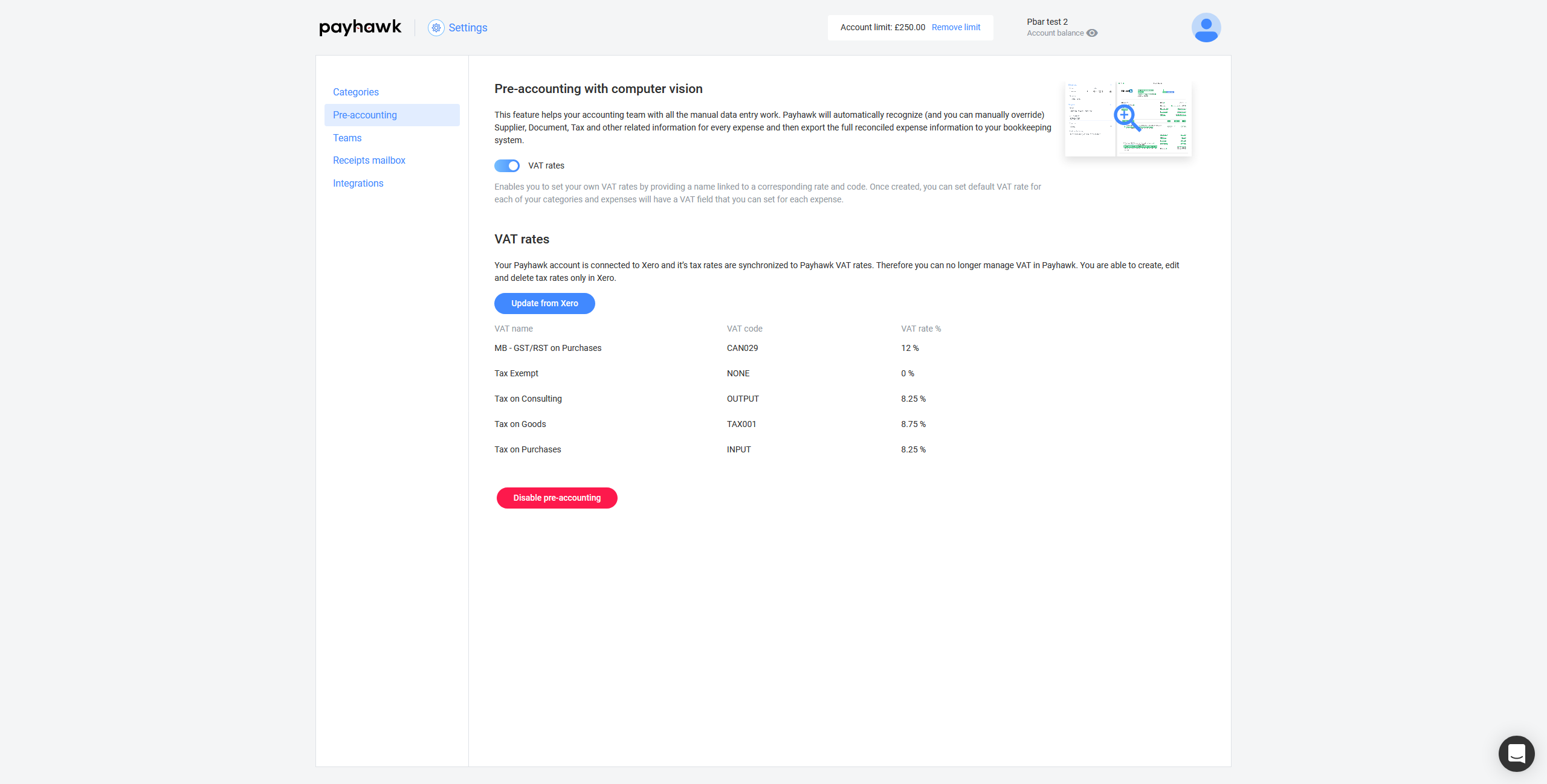

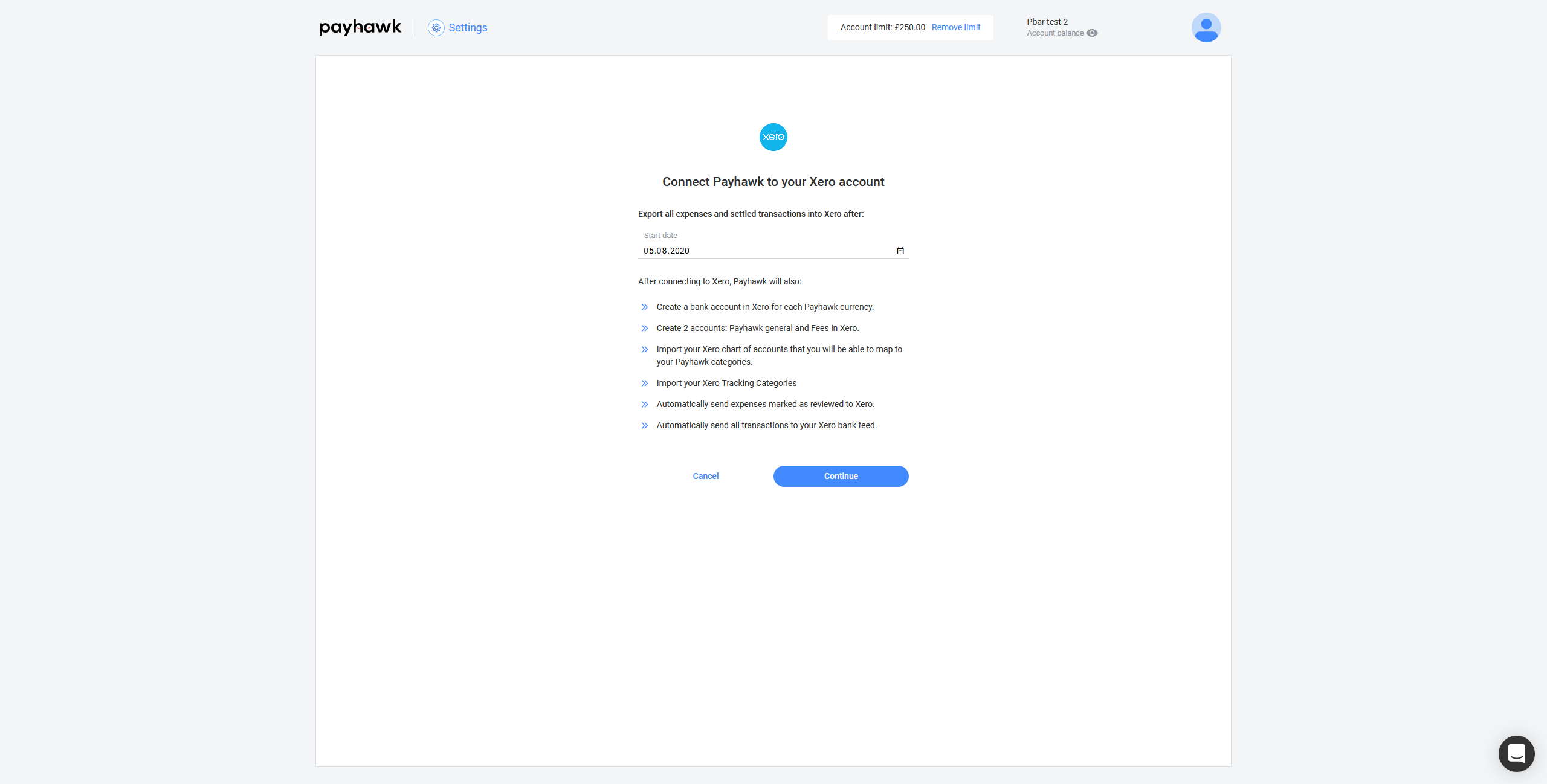

By connecting to your Xero organization, you will allow Payhawk to synchronize your chart of accounts and VAT Rates. Additionally, Payhawk imports your Xero Tracking Categories and have them as additional fields on your expenses.

Since, Payhawk offers credit cards and bank transfers, for each of your Payhawk wallets, Payhawk will automatically push the corresponding bank feed items. When a Payhawk accountant or admin, reviews an expense on Payhawk, the expense will automatically get pushed to Xero and you can effortlessly reconcile it against the bank line item.

Getting started

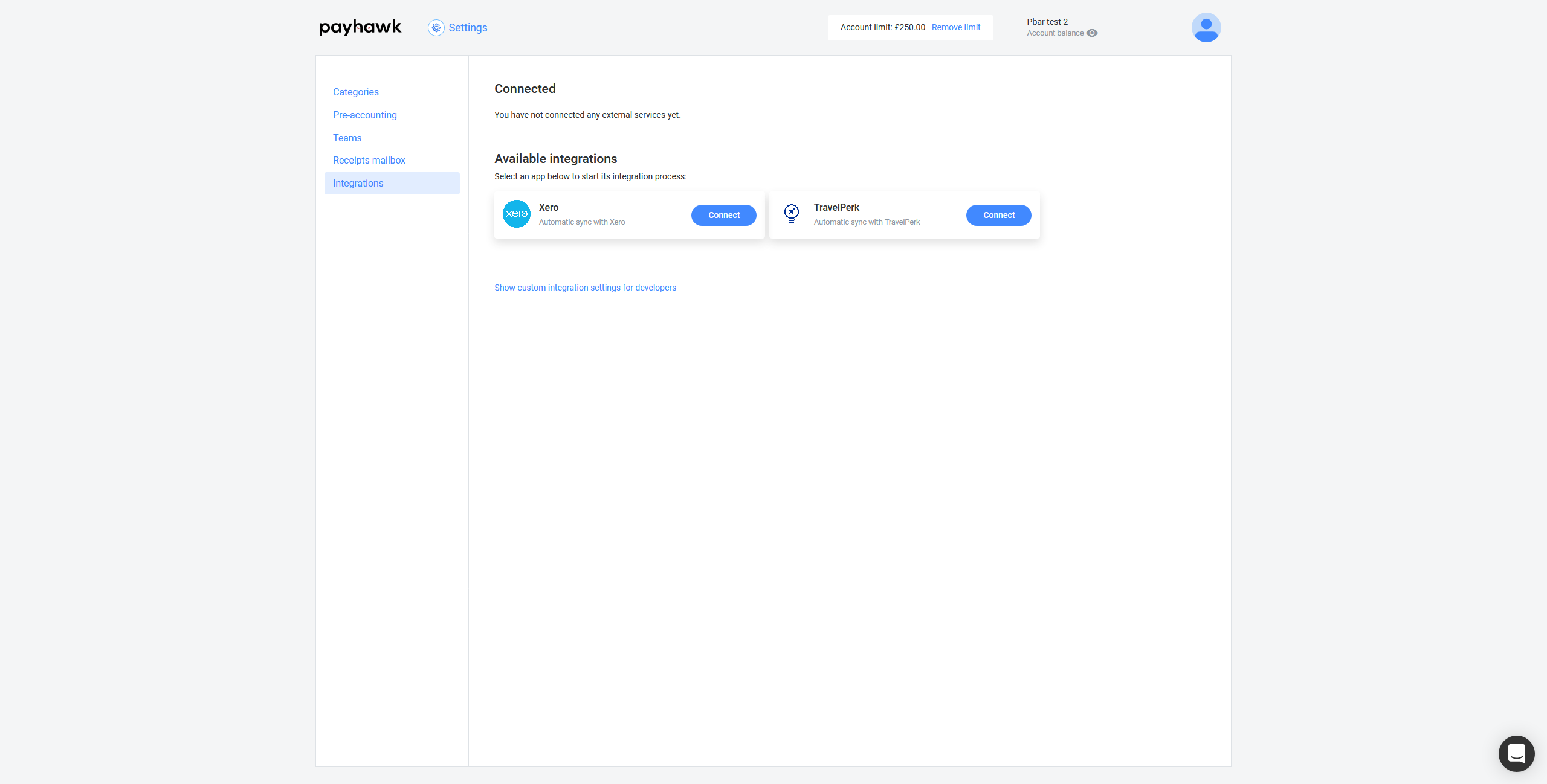

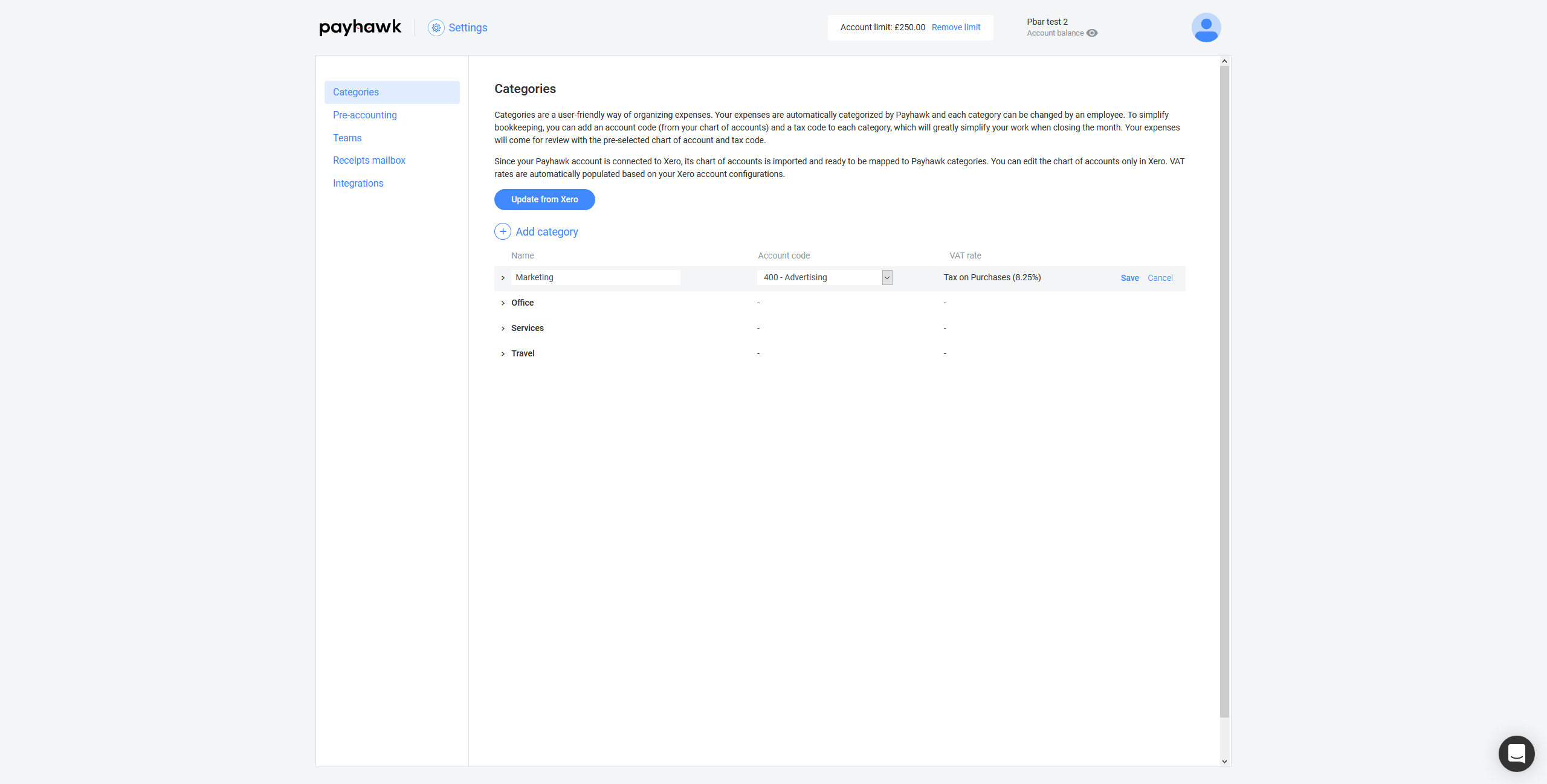

Getting started requires you to have an active Payhawk account. When you log in, you can find the Xero integration in the Settings/Integrations screen. All you have to do is to connect to Xero and map your chart of accounts to our user friendly categories.

Payhawk automatically imports your Tax Rates, Tracking categories and establishes an automatic bank feed as soon as you connect.