Overview

Wagepoint’s payroll software was built just for Canadian small businesses and the accounting and bookkeeping partners who support them. We make payroll simple, compliant, and worry-free for businesses with 1-100 employees. By automating tax calculations, filings, and remittances, Wagepoint ensures payroll is accurate and stress-free, while Xero streamlines your accounting. Together, these platforms create a unified experience that reduces administrative burden and gives you more time to focus on literally anything else. More than 30,000 happy customers trust Wagepoint for their payroll. Here are the features they love:

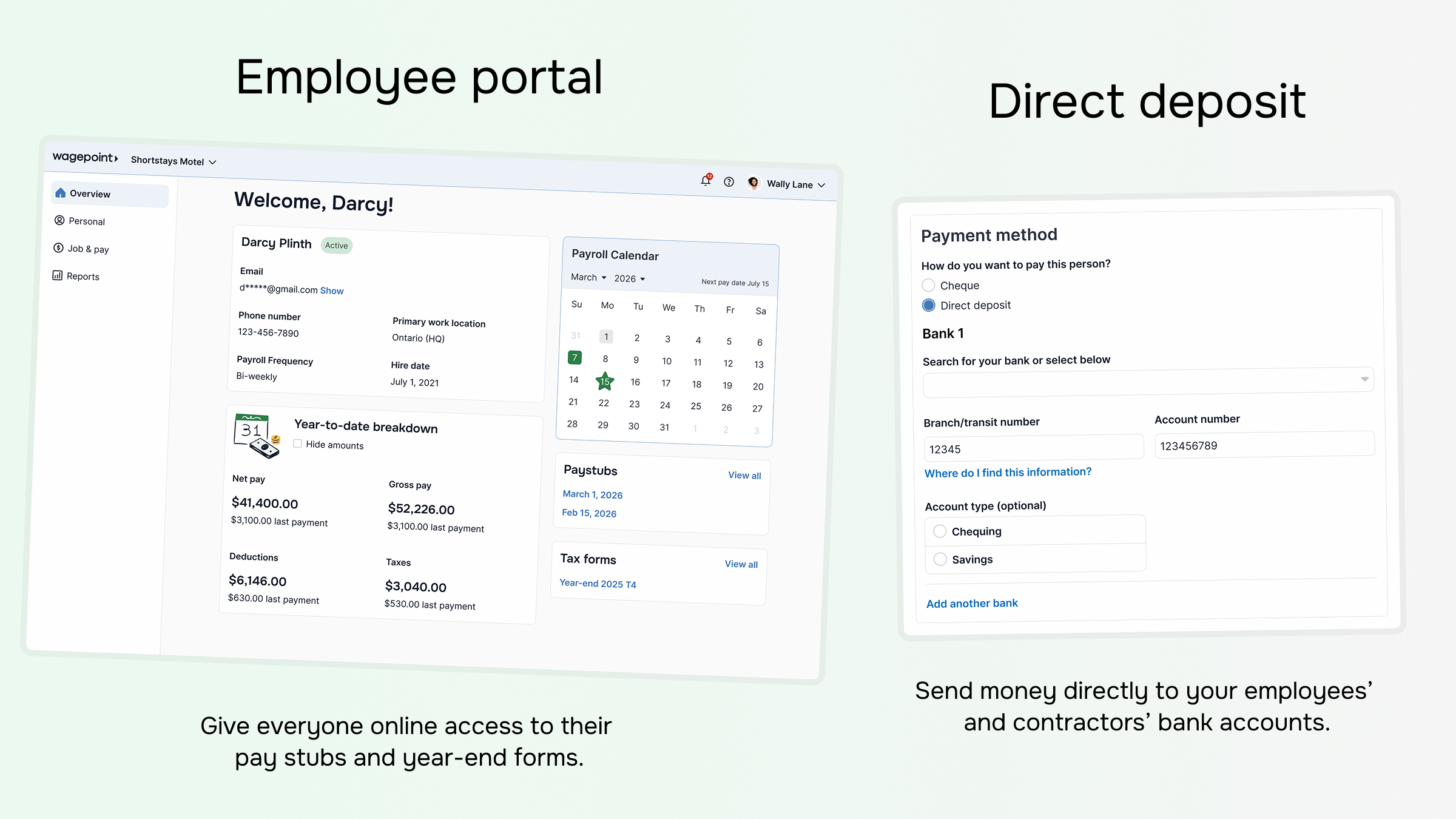

Direct deposit. Send money directly to your employees’ and contractors’ bank accounts.

Employee portal. Give everyone online access to their pay stubs and year-end forms.

Automated payroll taxes. Wagepoint handles all payroll tax calculations, filings, and remittances, so you stay compliant.

T4s and T4As. Generate and distribute tax forms electronically to keep year-end stress to a minimum.

Automated Records of Employment (ROEs). Create and submit ROEs directly from Wagepoint (seeing folks go is hard enough). Payroll schedule. See all your processing deadlines, so you never miss one.

Employee self-onboarding. Save hours when adding new hires.

Effective dating. Schedule your payroll changes in advance.

Intuitive workflows. Get instant feedback during your workflows, so you can feel good knowing you're on the right track.

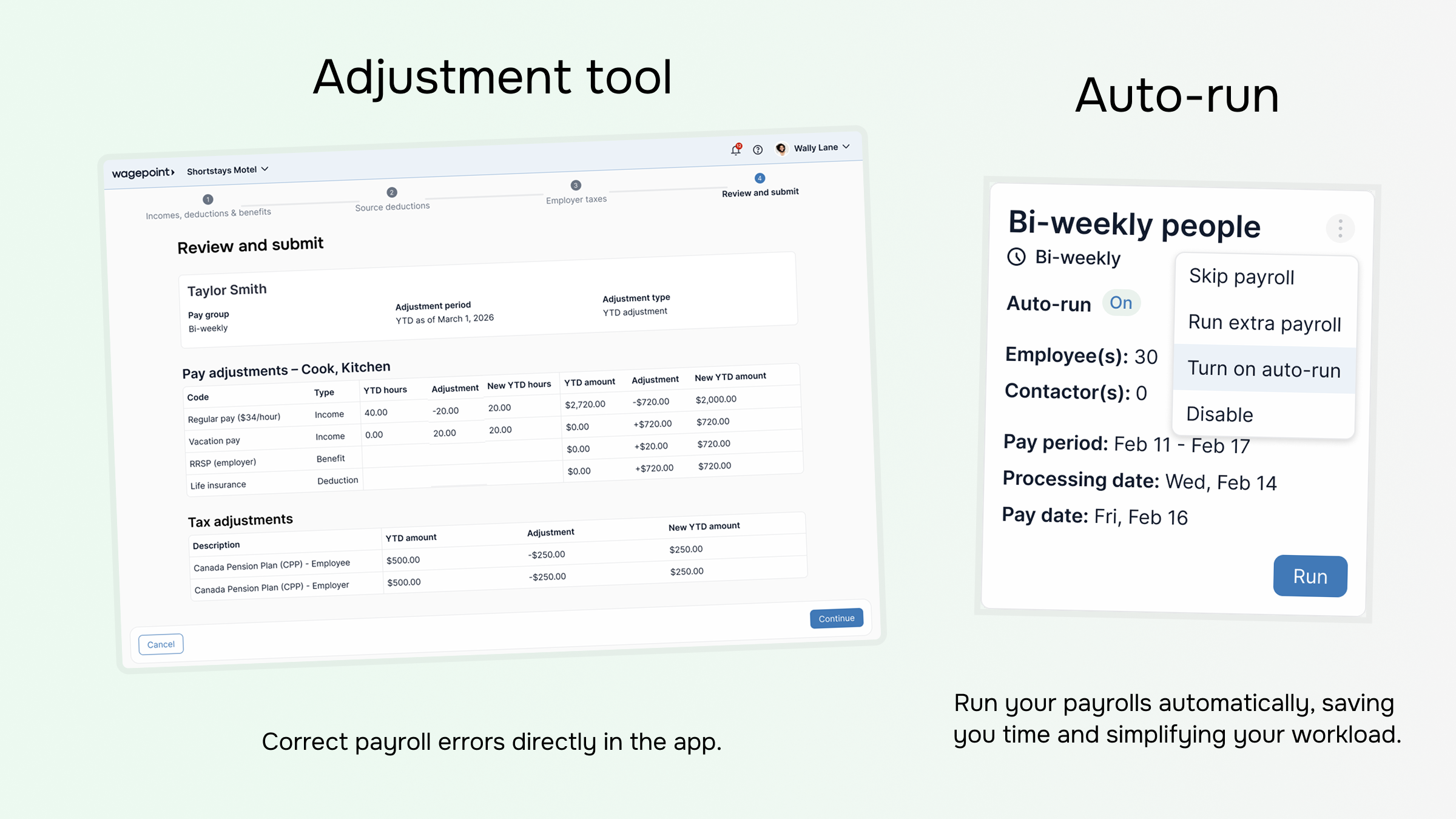

Adjustment tool. Correct payroll errors directly in the app.

Tailored reports. Filter your payroll data into custom reports so you can make the best decisions for your business.

Live messaging support. Chat with a friendly agent via the app.

We love our customers and have a 4.6/5 Capterra rating! “I have been using Wagepoint for nearly two years and the system has been reliable, straightforward and any time I've needed support it has been a great experience. It seems Wagepoint knows how to give their staff members the training and tools they need to be successful. Keep up the good work, Wagepoint!” - Denise, Capterra review

Wagepoint Payroll + Xero

Wagepoint + Xero

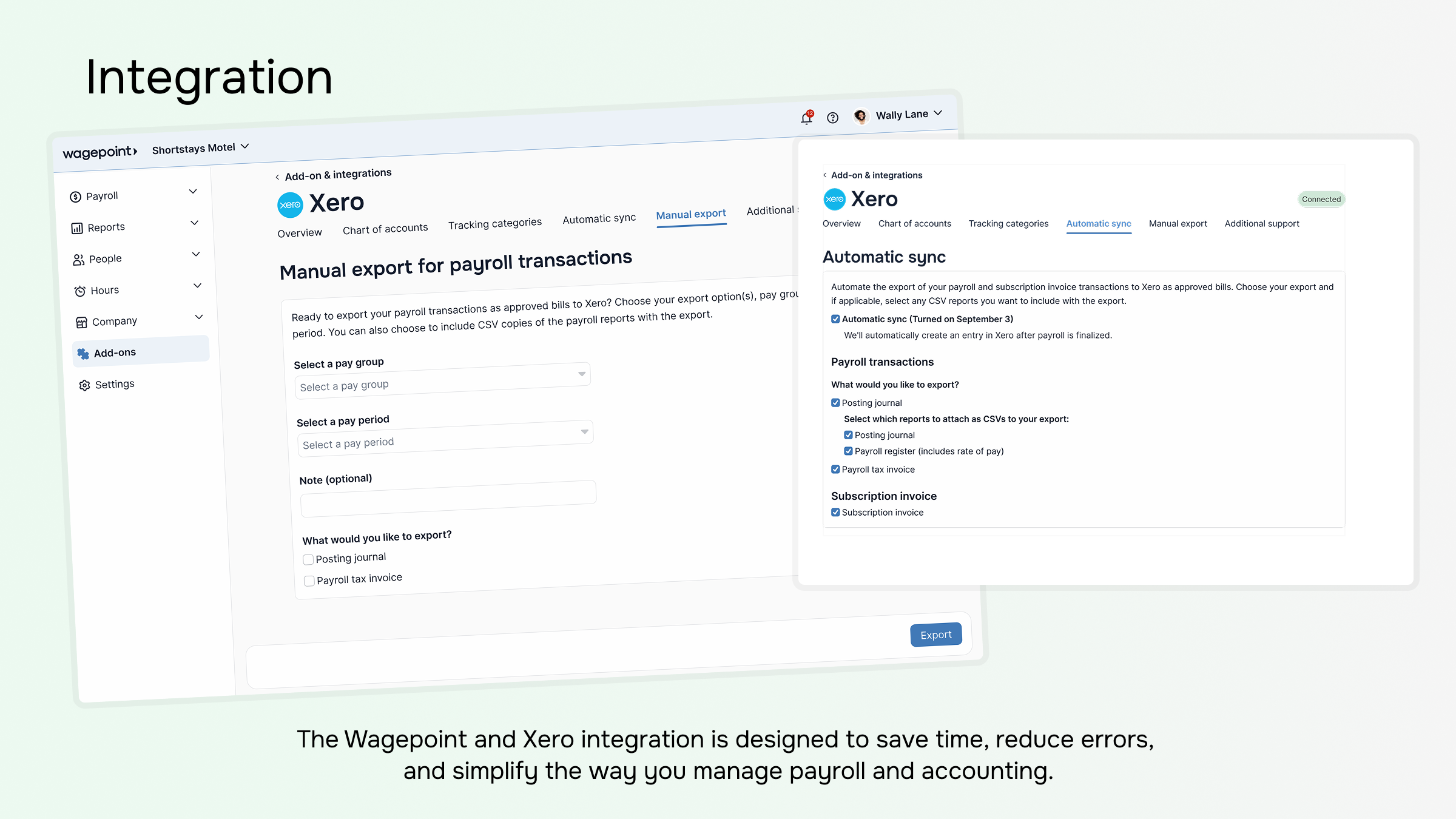

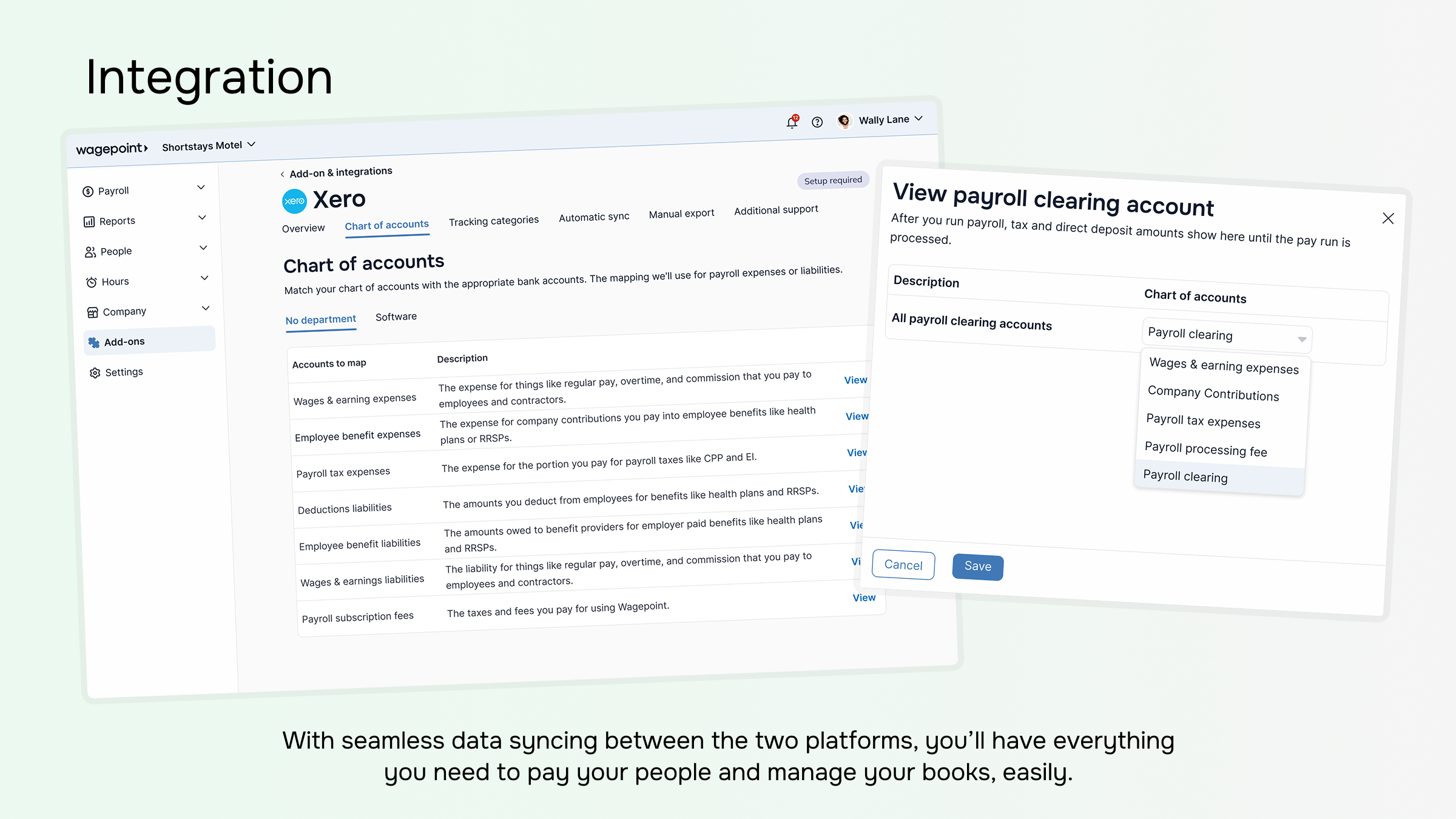

The Wagepoint + Xero integration is designed to save time, reduce errors, and simplify the way you manage payroll and accounting. With seamless data syncing between the two platforms, you’ll have everything you need to pay your people and manage your books, easily.

Here’s what you can expect from the integration: Automatic Data Syncing: Wagepoint automatically exports payroll transactions, including wages, taxes, deductions, and benefits, directly into Xero. This creates journal entries that eliminate manual data entry and reduce the risk of errors. Subscription invoices for Wagepoint are also sent to Xero, so your billing records are always up to date.

Automatic Chart of Accounts Mapping: Save time during setup with automatic chart of accounts mapping. You can still make tweaks manually afterwards! This feature streamlines the integration process and gets you up and running quickly.

Department-Level Expense Mapping & Tracking Categories: Wagepoint offers flexible mapping options, allowing you to assign payroll expenses and liabilities to specific accounts. You can even map transactions to categories like Wages & Earning Expenses, Wages & Earnings Liabilities, and Employee Benefit Expenses for more detailed tracking. Custom mapping for all remaining expense and liability categories is coming in early 2025.

Real-Time Cash Flow Visibility: By connecting Wagepoint to Xero, you gain a real-time view of your cash flow. This ensures you’re always prepared for payroll runs and helps streamline bank reconciliations.

Scalability: Whether you’re managing payroll for a handful of employees or a growing team, the integration scales with your needs. Features like department-level mapping and automated workflows make it easy to stay organized as your business grows. In Wagepoint, you’ll save time as you grow with features like employee self-onboarding, bulk updates and grid view to enter payroll data.

Built-In Compliance: The integration is built specifically for Canadian small businesses, helping you meet federal and provincial payroll regulations with ease.

Caring Customer Support: Both Xero and Wagepoint are customer-obsessed, and offer support from friendly CS teams that truly care about helping businesses succeed.

Note: Manual journal exports aren’t supported, making this integration unsuitable for users on the Xero Partner Edition.

Getting started

Setting up the Wagepoint + Xero integration is straightforward: Step 1: Create a Wagepoint Account

Step 2: Connect Your Xero + Wagepoint Accounts

Step 3: Map Your Chart of Accounts

Step 4: Automate Syncing

For a detailed walkthrough, visit our integration guide. Friendly support is always available if you need assistance during setup.