Overview

Payments Technology by Real People

Australia's most trusted payments technology company. The top rated and reviewed payments platform that integrates with Xero.

For Service Based Businesses

Secure "card on file" for manual and automatic charging.

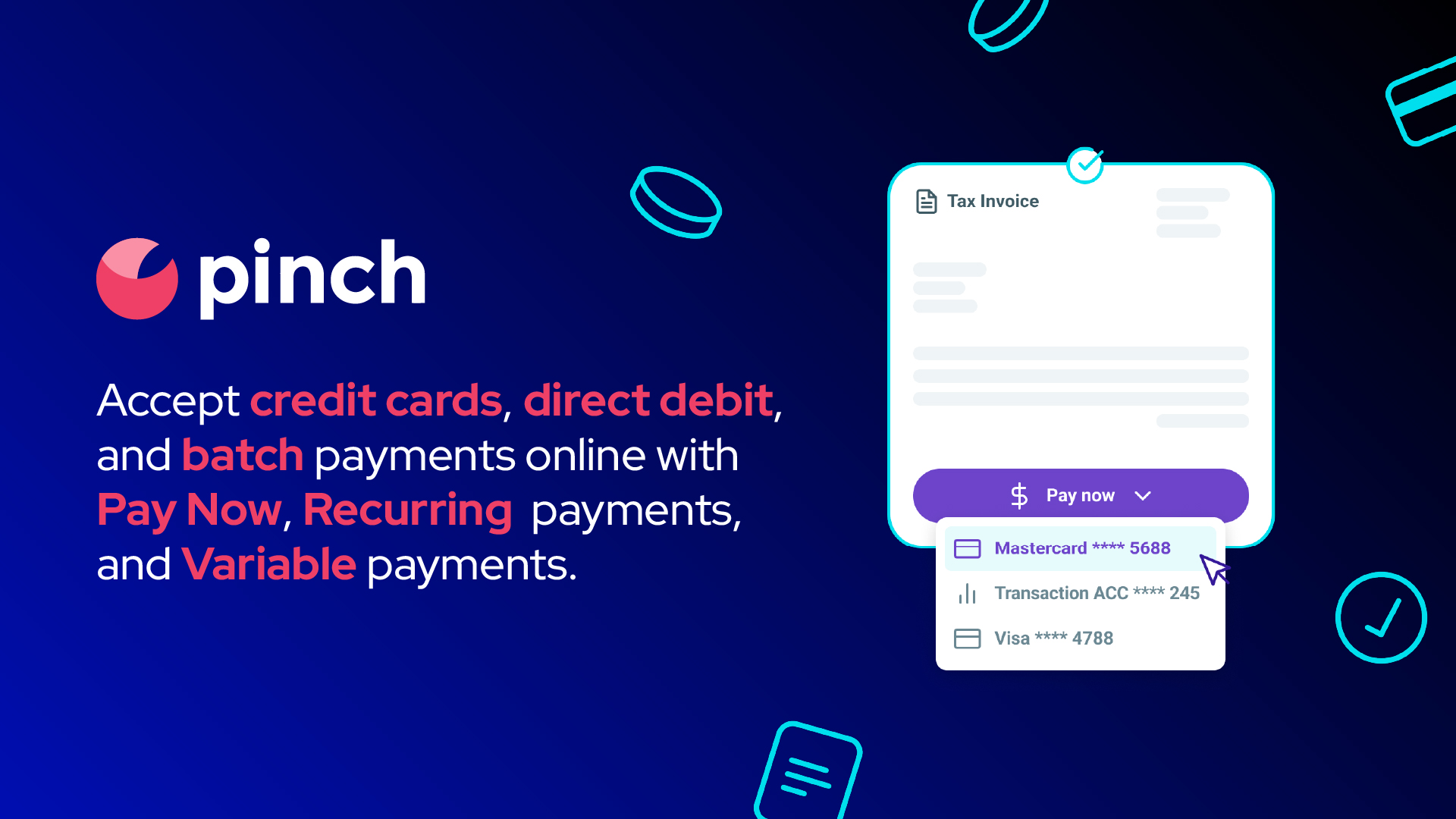

Take payments with credit cards, debit card, online wallets, direct debit from bank account. More services are being added all the time.

Offer flexible payment plans configured to the needs of your customers with automatic recurring auto-debits and automatic reconciliation.

Offer your customers their own secure portal for managing payments to you.

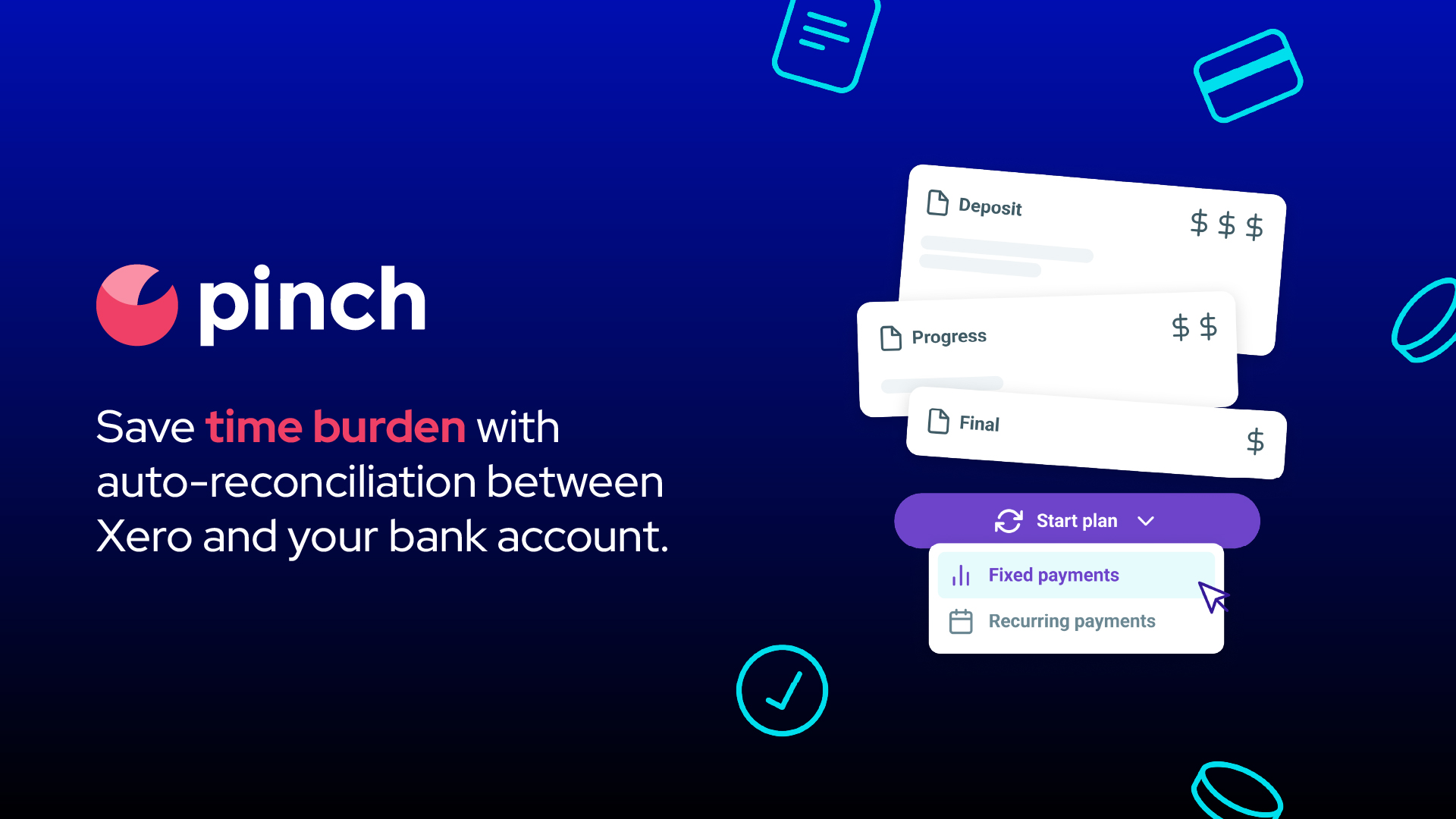

Two way invoice and reconciliation sync with Xero. Automate payments from any system that syncs invoices into Xero.

Award winning customer service team that understand that payments is the lifeblood of your business. We work with you every step of the way and truly care about making sure you get paid for the service you deliver.

Speedy account approval. Don't be left waiting weeks to get your account approved. We can get your account approved in under a business day!

Book a demo to chat with a consultant and ask any questions you need, or set up an account and allow our tutorials to guide you.

Pinch Payments + Xero

Set up Pinch as your default payment service for Xero in as little as five minutes.

What Pinch can do with Xero?

Accept one time credit card payments on invoices, and easily set up direct debits agreements.

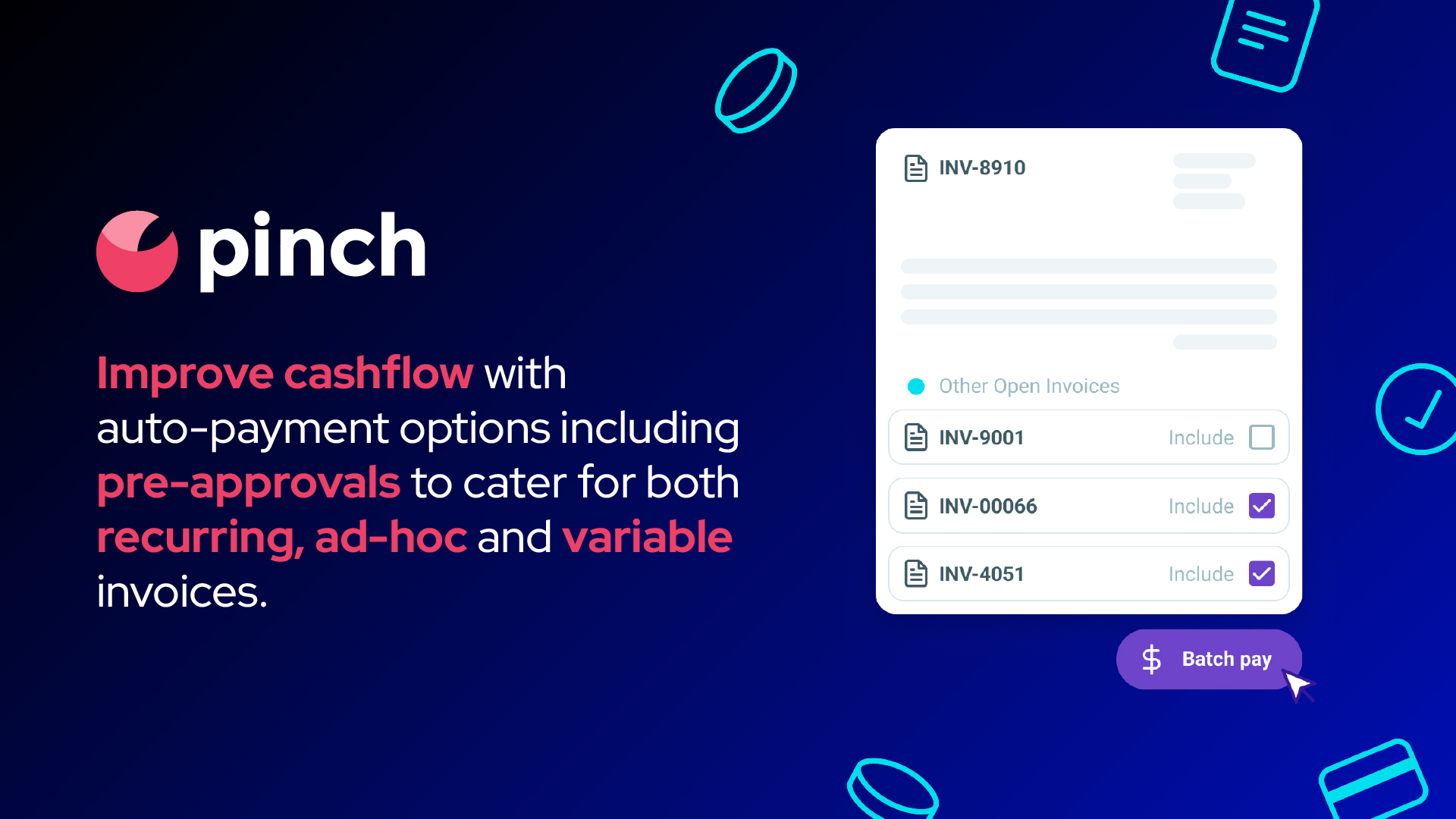

Collect payments automatically on any invoice in Xero with our Pre-Approvals feature. Your customer can nominate their bank account, or use their credit card. Hundreds of businesses have made the switch to Pre-Approvals and get 100% of their invoices paid on time.

Offer your customers payment plans - breakdown larger invoices into smaller payments and easily turn consistent late payers into good ones.

Offer your customers their own secure payer portal to make payments to you, and any other suppliers they have that use Pinch.

Reduce overheads in your business with flexible surcharging options.

Everything automatically reconciles back in Xero with precision accuracy.

Enable the Pinch Plus browser extension to use Pinch without leaving Xero.

Our helpful Australian based support team will work tirelessly to take care of you and your payments. We work seamlessly with your accountant or bookkeeper to set up Pinch the way that works best for you. Don't have one? We can work with you directly, or find one for you.

Are you more technical? Use our Payments API to enable our features in your own software platform. Our tech team has worked for some of the world's largest payment companies, and our approach to tech partnership is full collaboration. If you need a more integrated and technical solution we’ve got you covered.

Getting started

Start for free and keep it that way. Pinch has no subscriptions. There are only transaction fees, which you can choose to pass on to your payers (details on our website).

To get started you’ll need:

1 - Admin access to your Xero account

2 - Business verification documents – A standard requirement for any payment provider. Our merchant application process will guide you through exactly what’s needed (such as ID for the business owner or director, a recent bank statement, and an ASIC summary) and how to upload it.

When you register, you’ll be asked to connect your Xero account. You can skip this step and do it later, but connecting early means Pinch can sync your customers and invoices straight away, giving you the full benefits of automated payments and reconciliation.

Once your application is submitted, we’ll review it and let you know the outcome within 2 business days.

Want a closer look? Book a fortnightly group demo or a one-on-one session through our website.