Overview

Turn compliance into paid advisory

TaxFitness helps accounting firms expand services, grow advisory revenue, and deliver more value to clients without adding complexity or unpaid work.

It provides a complete advisory system that integrates tax planning, Top 20% business benchmarking, and business advisory into everyday practice.

⭐ 5.0 out of 5 rating Reviewed by Xero users Listed since September 2022 🆓 14-day free trial

What TaxFitness Does

Most firms have the insight. What they lack is a simple, repeatable way to turn it into paid advisory.

TaxFitness gives you the systems, reports, and frameworks to deliver advisory on purpose, not as an afterthought.

Key benefits

- Generate new advisory revenue from existing clients

- Produce professional advisory reports in minutes

- Move beyond compliance to proactive advice

- Strengthen client relationships and retention

- Deliver measurable outcomes clients understand and value

Core features

Advisory reports: Tax planning, benchmarking, and business advisory, client-ready in minutes

Tax planning engine: Identify relevant Australian tax strategies quickly and confidently

Strategy libraries:

- 250+ Australian tax strategies

- 350+ business advisory strategies

- 400+ Top 20% industry benchmarks

Customisable reports: Fully branded and tailored per client

Training & support

- 5 hours of structured onboarding training via Zoom

- Access to webinars, guides, and practical resources

Pricing

- Annual subscription: $1,320 (incl. GST)

- Unlimited users, clients, and reports included.

Who it's for

Accounting practices ready to turn compliance work into structured, profitable advisory.

Tax Fitness + Xero

- Seamless integration with Xero, MYOB, and QuickBooks

- Import client groups and financial data

- Eliminate manual data entry and double handling

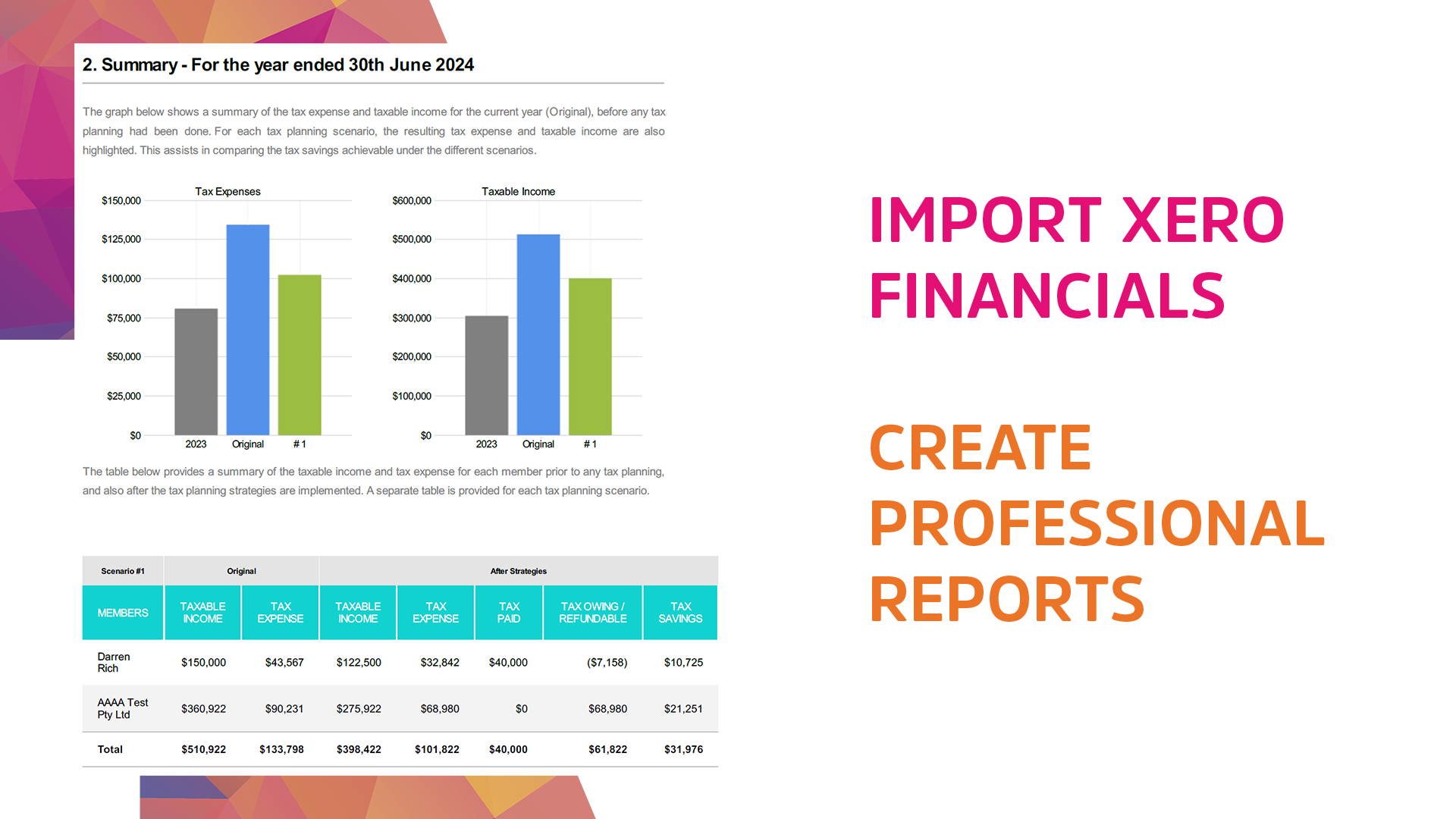

TaxFitness integrates directly with Xero to streamline tax planning by importing live client financial data, profit & loss, balance sheets, and entity structures directly from Xero.

This integration eliminates manual data entry, allowing accountants to generate professional tax planning, top 20% business benchmarking and business advisory reports.

Seamless Data Import:

Users can securely link client files from Xero and import data, removing the need for manual exporting and reformatting.

Practice Management Integration:

The connection allows for syncing client lists from Xero Practice Manager (XPM), TaxFitness User Manual notes. Usage for Advisory: The imported data is immediately used for tax planning strategies, benchmarking (top 20% business), and business valuations.

Setup Process:

Users can connect Xero to TaxFitness by signing up, navigating to "My Clients," and selecting the "Sync Xero Clients" button, Tax Fitness Xero Integration Reviews & Features notes.

Multi-Entity Handling:

The system supports importing data for complex structures.

Access Control:

Strategies added are only visible to the user's specific practice.

This integration enables accountants to proactively offer tax planning and advisory services rather than just focusing on compliance.

Pricing plans

This app includes a free 14 day trial

TaxFitness Plan Pricing

- Client import from Xero

- Unlimited users

- Unlimted clients

- Unlimited reports

- Access to over 200 tax strategies

Getting started

3 easy steps

- Sign up for a 14-day free trial

- From the left-hand menu, select My clients and click the pink Sync Xero clients button.

- Select a client member and click the pink Import your financials from Xero button.

Reviews & ratings

Sort and filter

Most recent reviews

Makes tax planning so much easier and applicable to any business

Response from Tax Fitness

Tax Planning Software

Response from Tax Fitness