Overview

With high interest rates, Cash is now once again a valuable resource that business leaders must manage accordingly. No wonder we hear every day that managing cash is a burning challenge.

Agicap delivers value at every level of the company, turning cash into a lever for growth and profit:

- CEOs: Secure financing for business strategy, mitigate risk of cash shortage, gain visibility and control over cash inflows & outflows, improve external financial communication

- CFOs: Increase financial income from investments, reduce financing costs, facilitate negotiations with banks, iImprove internal financial communication

- Finance teams: Improve cash forecasts, increase available cash, increase efficiency, make life easier for teams

Agicap all-in-one modular treasury management platform meets most cash challenges. It relies on several complementary and interconnected solutions:

- Banking & ERP connectivity: Manage data connections between your banks and Xero.

- Daily Cash Management: Manage and monitor company-wide cash in one place to establish a solid foundation for short-term financial decision-making.

- Liquidity Planning: Plan long-term liquidity by consolidating data from multiple sources and enhancing forecast modelisation and actuals comparison.

- Cash Collection: Enhance late payment collection capabilities, automate processes and resolve disputes.

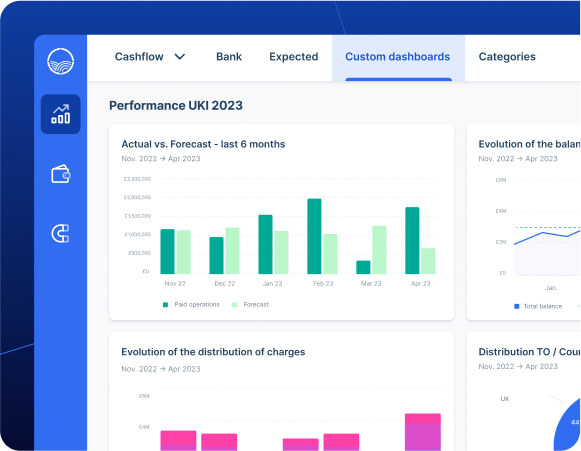

- Reporting & Analytics: Streamline financial reporting internally and externally by building custom reports, accessing them from the mobile app, and sharing them easily.

- Business Spend Management: Streamline company-wide spending processes from procurement to pre-accounting with advanced payment capabilities.

Agicap + Xero

Agicap & Xero :

First step, Agicap leverages multiple connectivity protocols to retrieve banking information from all your banks. Second step, Agicap automatically connects with Xero to retrieve all relevant information to feed cash flow forecast. Then, Agicap and Xero synergies empower you on this topics:

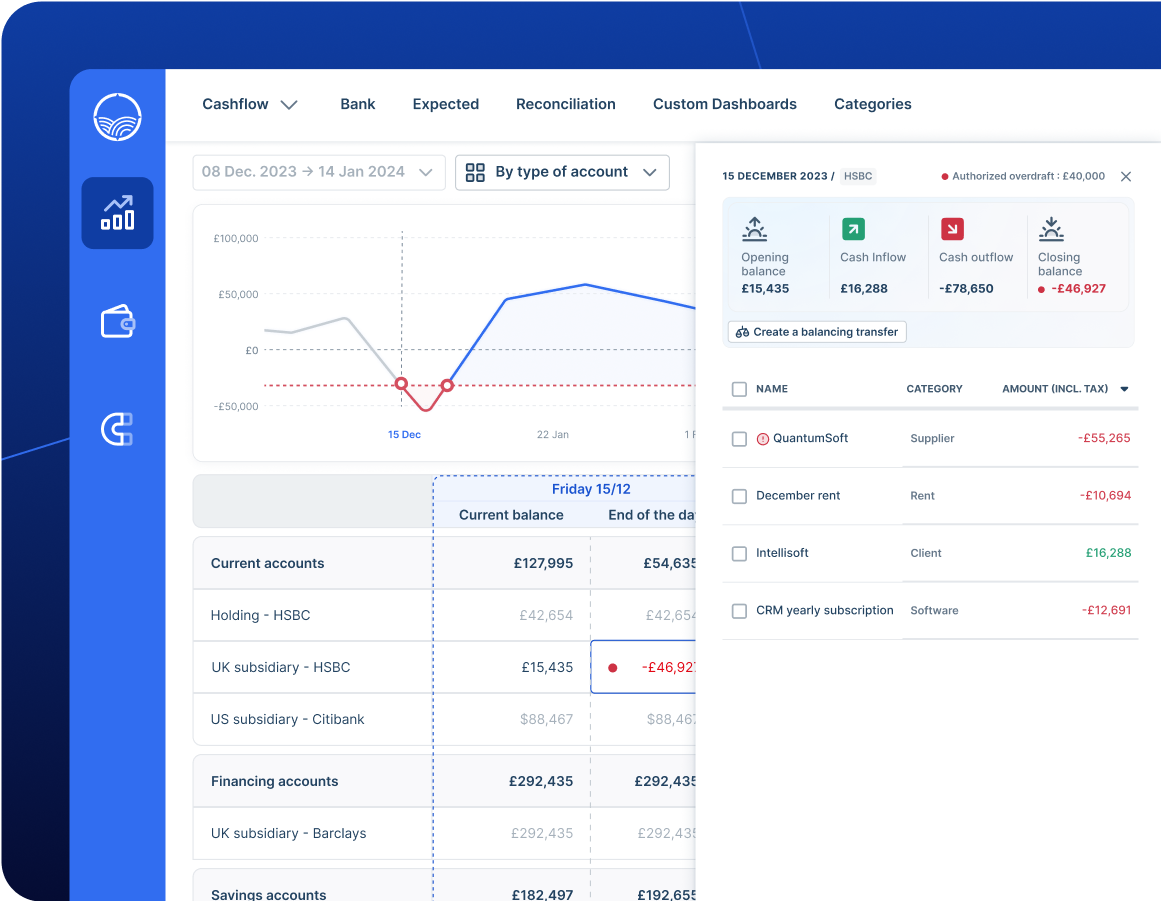

- Cash positioning: Unlock a global perspective of your cash position after integrating data into one single source and highly automating data processing 13-week forecast: Effectively anticipate daily cash to mitigate risk of shortfalls while leveraging surpluses to earn some yield on excess cash

- Accounts balancing: Leverage balances evolution overview and anticipation to perform optimization operations (payment rescheduling, balancing transfers…)

- Multi-source forecast: Automatically retrieve and combine all relevant data sources (Xero, P&L, spreadsheets, debt...) for a comprehensive forecast at all levels (group, divisions, subsidiary…)

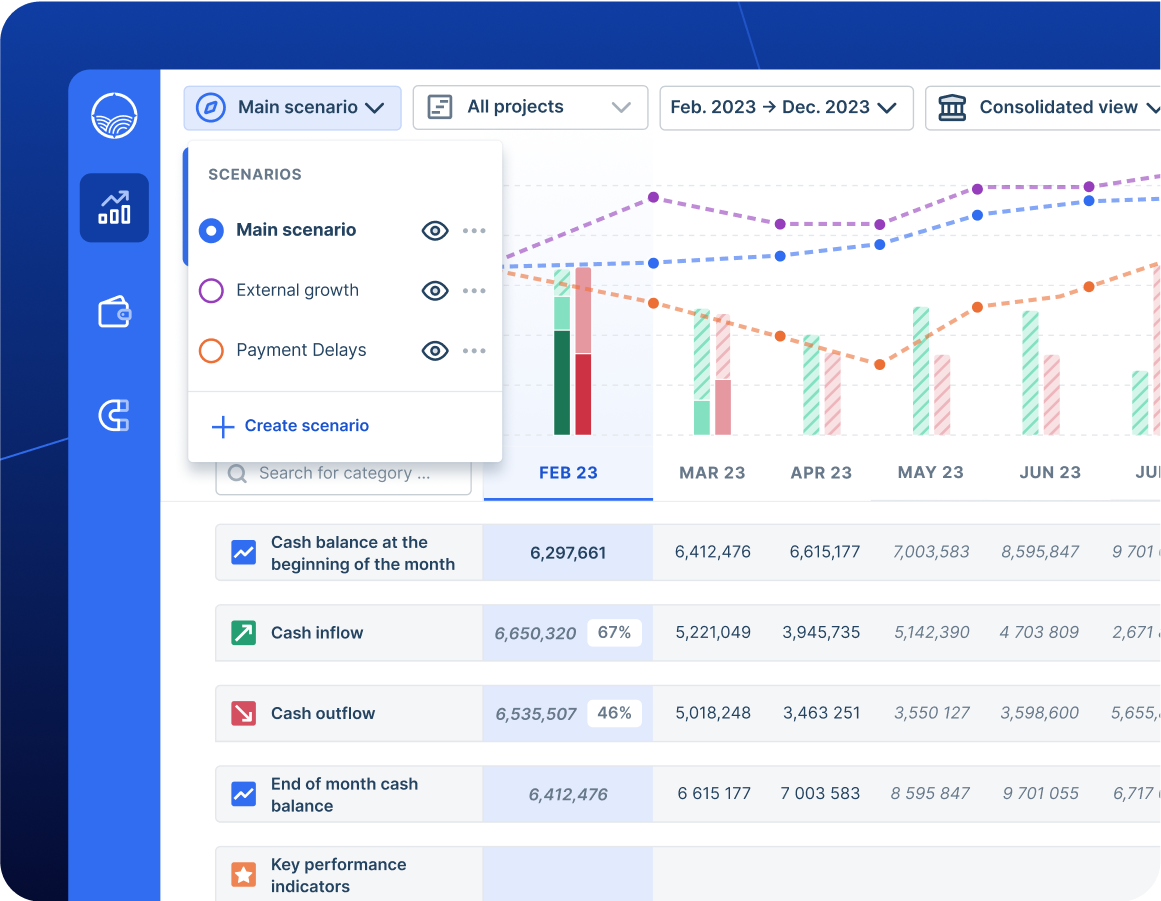

- Forecasting & scenario: Perfect cash forecasting and model development opportunities across multiple scenarii more efficiently than with spreadsheets and manual processes

- Actuals comparison & reforecast: Forecasting is a permanent process, it remains accurate and actionable only if is frequently re-evaluated and adapted

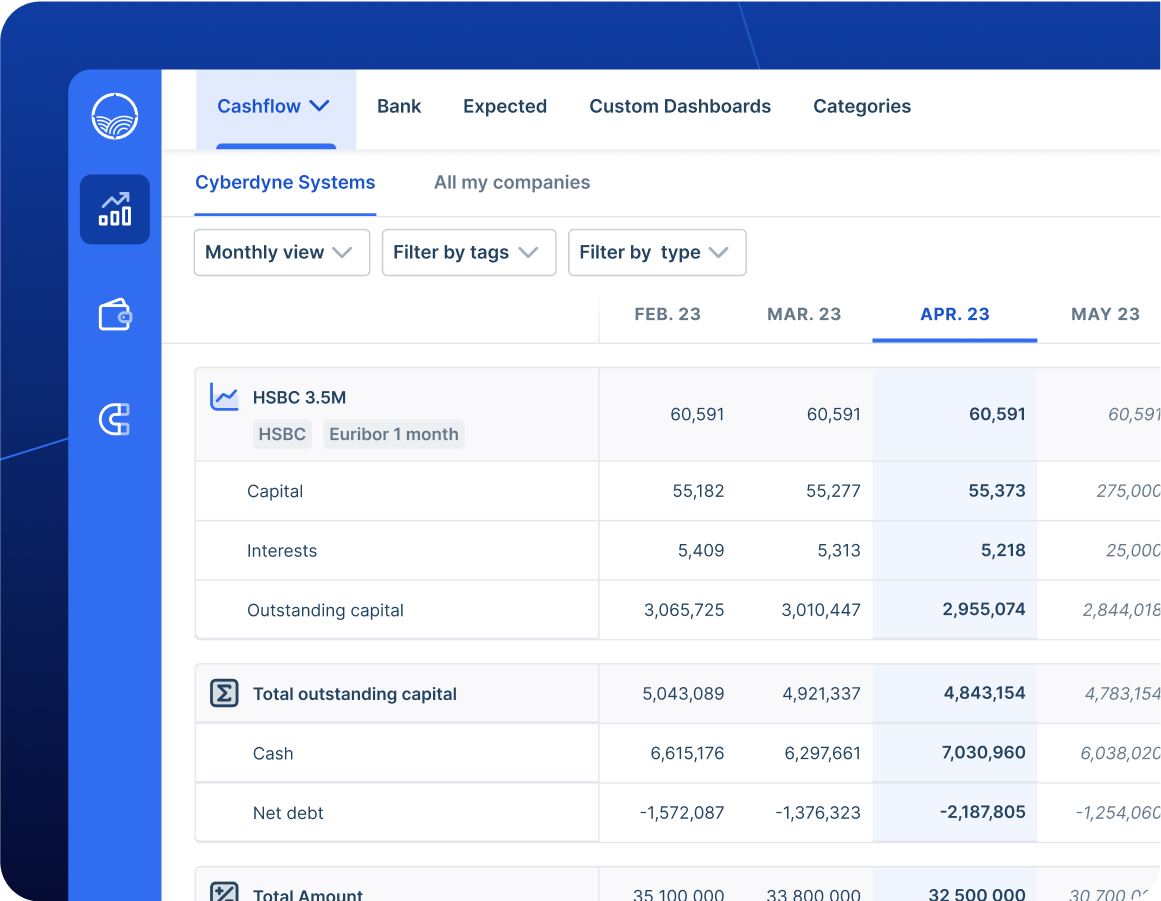

- Debt Management: Centralise fixed and variable-rate bank loans, anticipate forecasted interest repayments, and monitor the level of exposure by bank

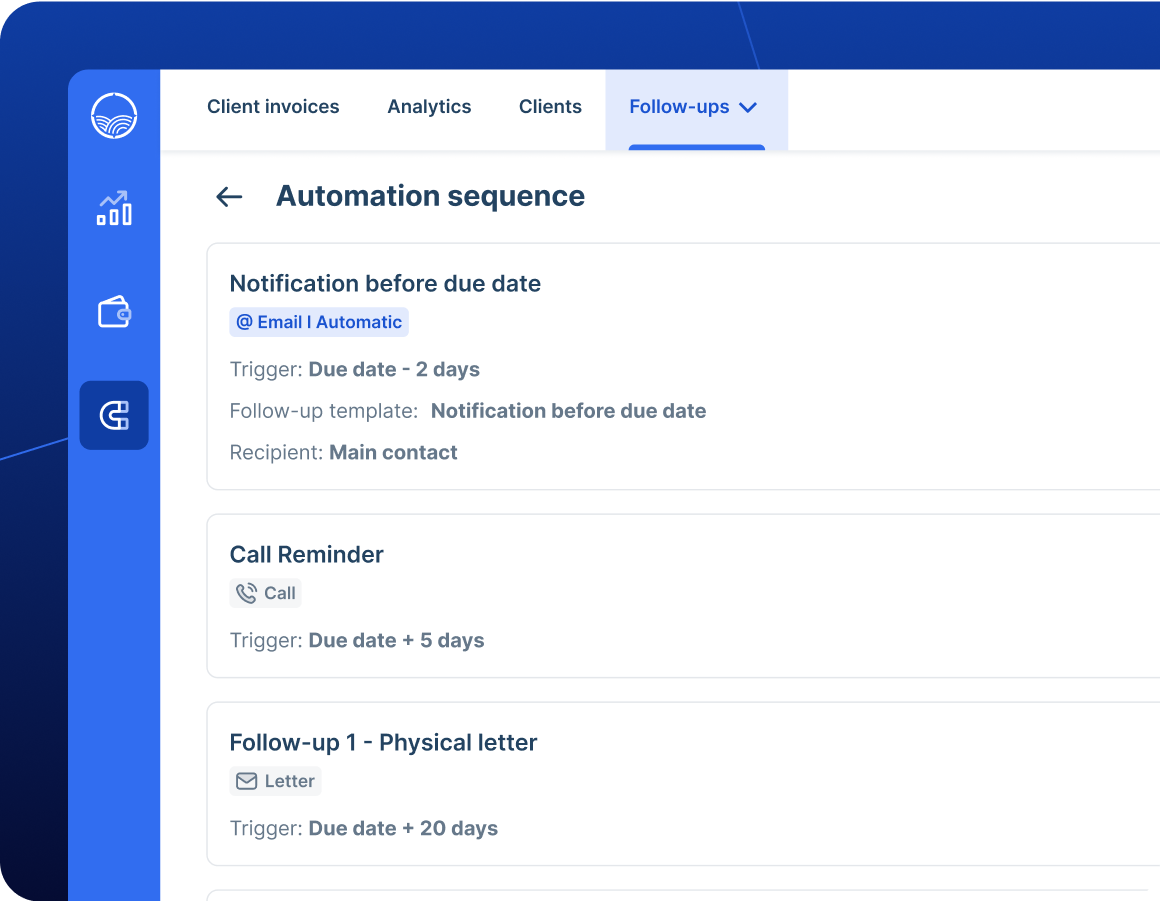

- Late Payment collection: Turn your revenue into cash and reduce your DSO with an advanced late payment collection system

- Dispute Management: Identify disputed invoices during your collection process, and route them accordingly to resolve the issue promptly

Pricing plans

Company

- Treasury Management

- Cash Management

- Cash Forecasting

- Debt Management

- Investment Management

- Accounts Payable automation

- Accounts Receivable automation

- Factoring Management

- Payments

- Accounting automation

Getting started

- Connect to your Agicap account

- Go to your banks and integrations tabs on the top right corner

- Click on the button "Connect" > "New integration"

- Type "Xero" in the search bar

- Allow access to connect the two tools

Next step you can connect your bank feeds directly into Agicap. For this we recommend that you get in touch with our experts via our live demonstration.