Overview

Businesses of all sizes can use easy to use, full service 1099 filing solutions to save time and stay compliant with 1099 reporting requirements. We support vendor TIN verification, full state filing, corrections, mailing address verification, email delivery.

We have tiered pricing for high volume filers. For small businesses, forms beyond 30 are FREE for eFiling. For bookkeepers and accountants, tiering works across all clients and forms beyond 1000 are FREE for eFiling.

1099SmartFile + Xero

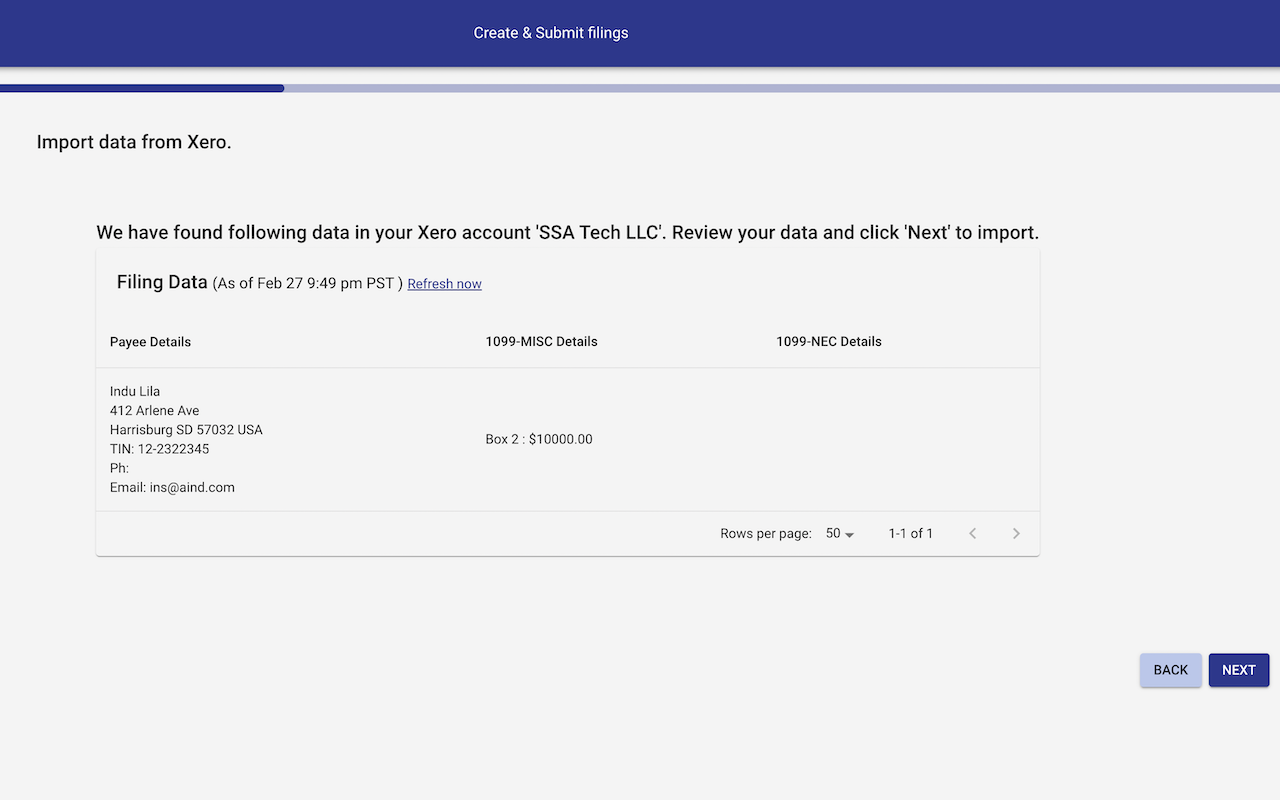

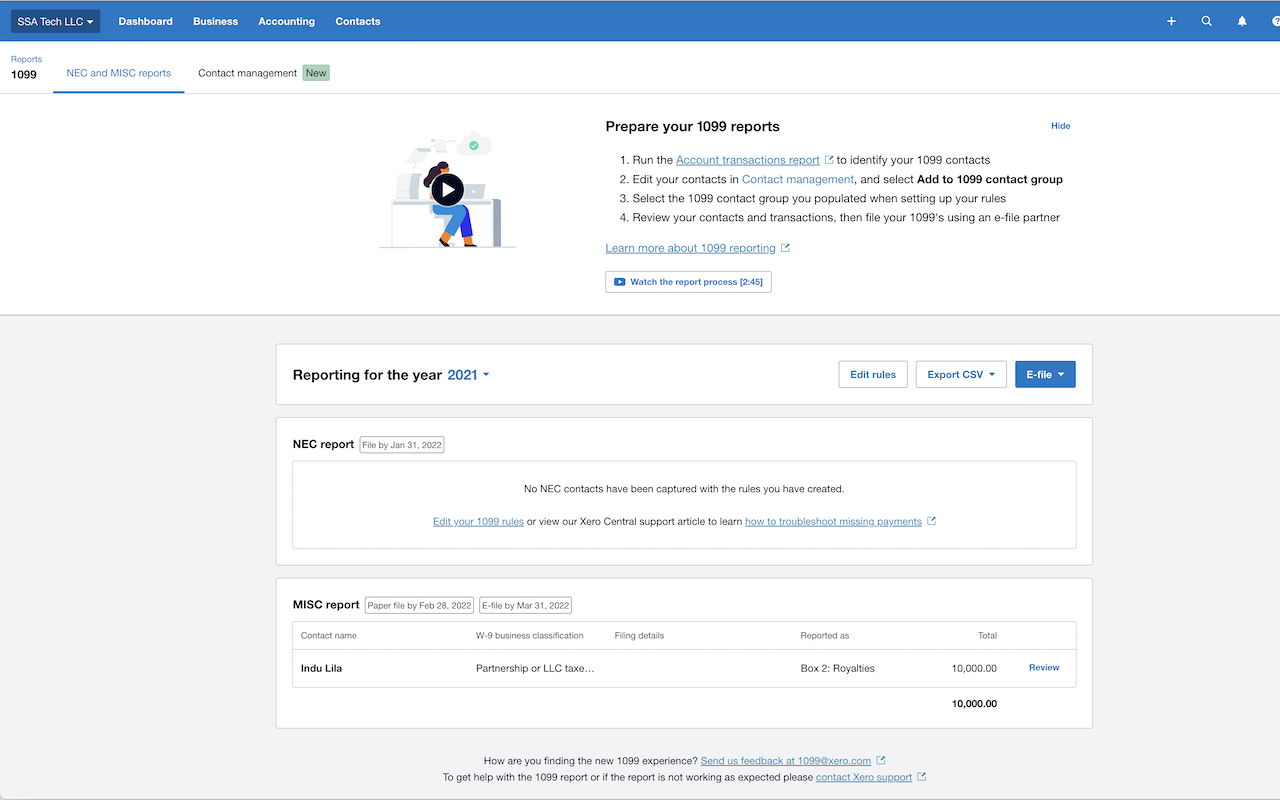

1099SmartFile integration with Xero saves time and avoids costly data entry errors by automatically pulling the vendors and 1099 filing data from Xero's 1099 report.

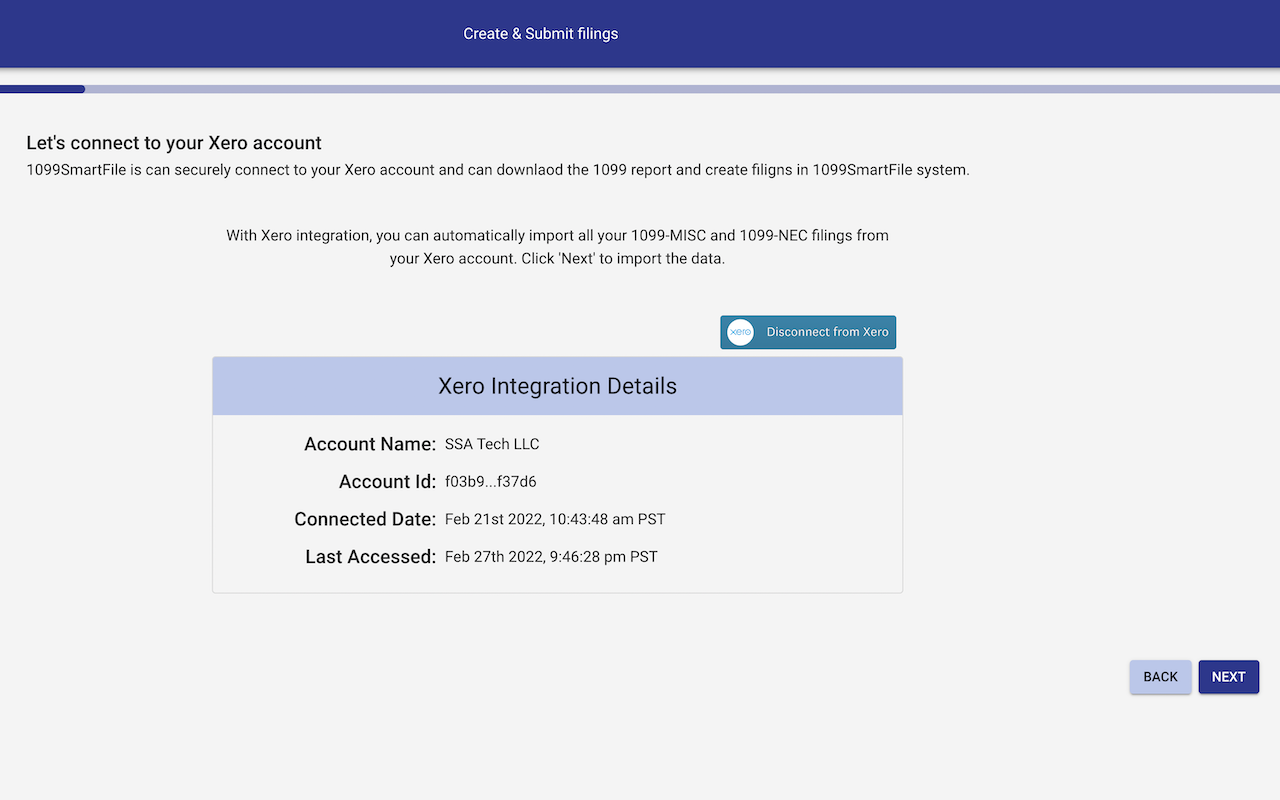

Accountants can manage 1099 filings for all their clients by connecting clients to their respective Xero organizations. Each client keeps a persistent connection to their Xero organization. No need to disconnect and reconnect to another Xero organization to file for multiple clients.

Getting started

Sign Up for 1099SmartFile using the “Get this app” and we automatically create a 1099SmartFile and connect it to your Xero organization. Once connected, our step by step guided flow will walk through to importing the 1099 report from Xero and submitting your filings to the IRS.