Overview

PayrollPanda is Malaysia’s leading payroll and HR software, designed to make running payroll simple, accurate, and fully compliant with local regulations. Trusted by thousands of Malaysian businesses, PayrollPanda automates every step of payroll processing, from calculating statutory contributions to generating tax forms and syncing payroll data seamlessly with Xero.

With PayrollPanda, businesses can eliminate manual spreadsheets, reduce errors, and save hours each month, all while ensuring full compliance with Malaysia’s labor and tax regulations. PayrollPanda is designed to be intuitive and flexible, making it easy for businesses of all sizes, from small startups to established SMEs, to manage payroll efficiently and confidently.

Key Features:

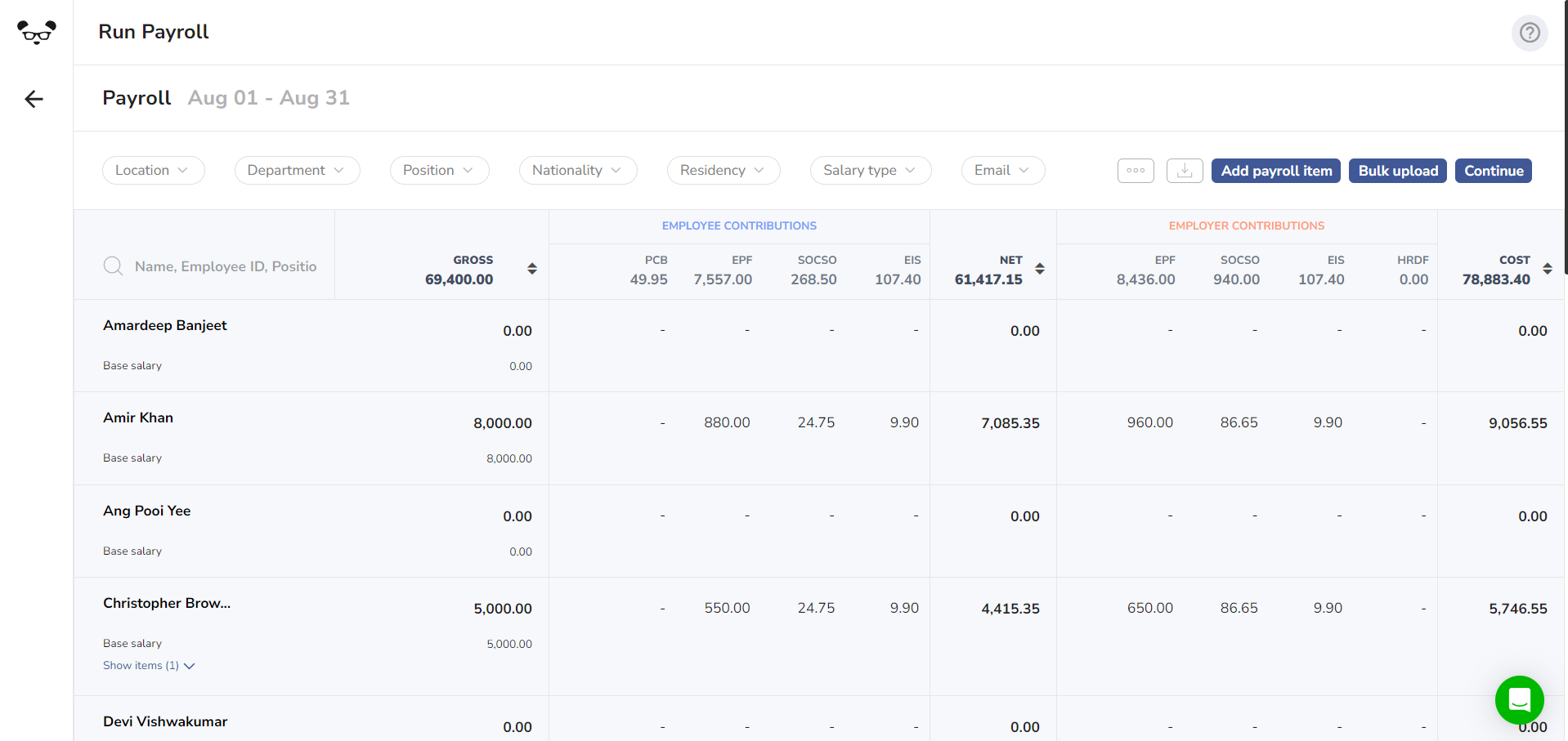

- LHDN-approved payroll: Run payroll that is fully compliant with Malaysian laws, including automatic calculation of PCB, EPF, SOCSO, and EIS contributions.

- Automated statutory calculations: PayrollPanda calculates all statutory deductions and employer contributions automatically, keeping your payroll aligned with the latest legal requirements.

- Accurate payslips: Generate payslips automatically for each employee, ensuring transparency and accuracy for salaries and deductions.

- Form E & EA generation: Automatically generate employer and employee tax forms, ready for submission to LHDN.

- Detailed payroll reports: Gain full visibility into your payroll history, statutory contributions, and employee data. Generate detailed reports for audits, internal analysis, or management review, ensuring transparency and control.

- Multi-user access: Allow multiple team members to manage payroll with role-based access, ensuring secure collaboration and efficient payroll processing across your organization.

- Leave management: Track leave balances, approve or reject leave requests, and have all leave data automatically reflected in payroll calculations.

- Seamless Xero integration: Sync payroll data directly with Xero, eliminating manual data entry and ensuring accurate financial records.

- Dedicated local support: Get expert guidance from Malaysian payroll specialists and ensure your payroll remains fully compliant with the latest regulations.

PayrollPanda is built to deliver a reliable, efficient, and fully compliant payroll solution that saves time, minimizes errors, and empowers your team. Whether you’re using PayrollPanda’s free plan to explore core payroll features or a paid plan with advanced features, PayrollPanda provides an all-in-one platform for Malaysian businesses looking to simplify payroll and HR management.

PayrollPanda + Xero

PayrollPanda’s integration with Xero provides Malaysian businesses with a seamless, end-to-end payroll and accounting workflow. By connecting PayrollPanda directly to Xero, businesses can eliminate duplicate data entry, reduce errors, and ensure that payroll and accounting records are always accurate and up to date. This integration allows for smooth synchronization of payroll data, statutory contributions, and employee payments, streamlining your financial operations and saving valuable time each month.

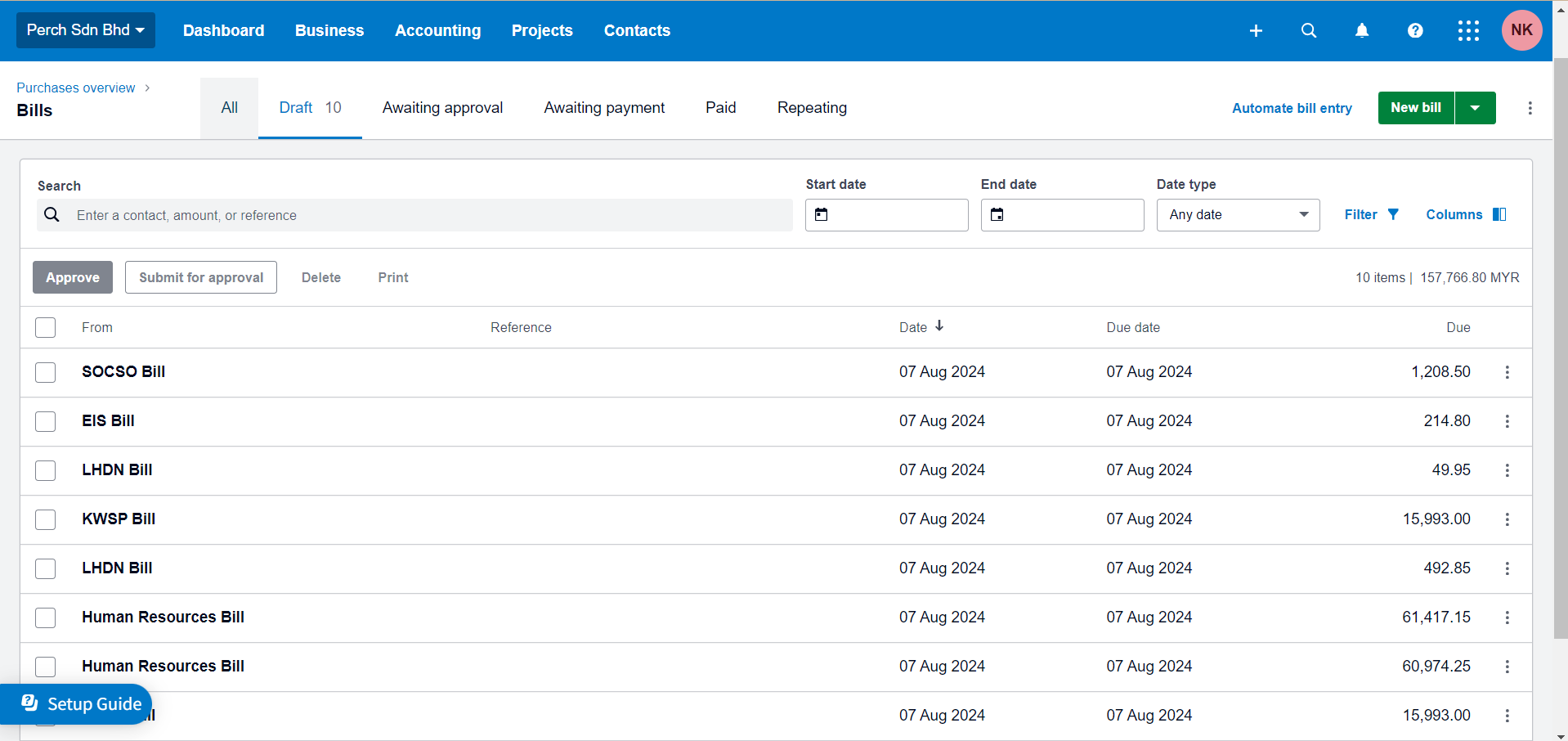

Once payroll is approved in PayrollPanda, all data posts directly into Xero, creating a Bill for approval. This automatically populates your Xero general ledger with salaries, allowances, deductions, and statutory contributions without any manual input. Every payroll run is reflected correctly, ensuring accounting records remain precise and reliable.

Integration Highlights:

- Automatic payroll sync: All payroll data, including salaries, allowances, deductions, and statutory contributions, posts automatically to Xero as Bills, eliminating hours of manual work.

- Flexible account mapping: Map payroll components such as Basic Salary, EPF employer contributions, SOCSO and Allowances to the correct Xero expense accounts, ensuring precise cost allocation.

- Configurable bill creation: Choose to consolidate all payroll liabilities under a single Xero contact or generate separate bills for different contacts, giving you granular control over payable tracking and payment workflows.

- Accurate, itemised bills: Each Bill provides a detailed breakdown of salaries, allowances, deductions, and statutory contributions for full transparency.

- Streamlined bank reconciliation: Bills created by PayrollPanda are ready to match in your Xero bank feed, making salary and statutory payment reconciliation fast and simple.

- Accurate & error-free accounting: Reduce human errors, ensure precise accounting records, and maintain full transparency across payroll and financial reporting.

With PayrollPanda and Xero working together, Malaysian businesses gain a powerful, reliable solution that simplifies payroll and accounting in one connected system. This powerful connection empowers teams to save time, maintain compliance, and make smarter financial decisions, all while keeping payroll and accounts fully aligned.

Getting started

Getting started with PayrollPanda’s seamless Xero integration is straightforward and designed to have you processing payroll faster than ever. This guide will walk you through the key steps to set up the connection and configure your settings for optimal efficiency.

Step 1: Create or log in to your PayrollPanda account If you don’t have a PayrollPanda account yet, sign up to get started. If you already have an account, simply log in.

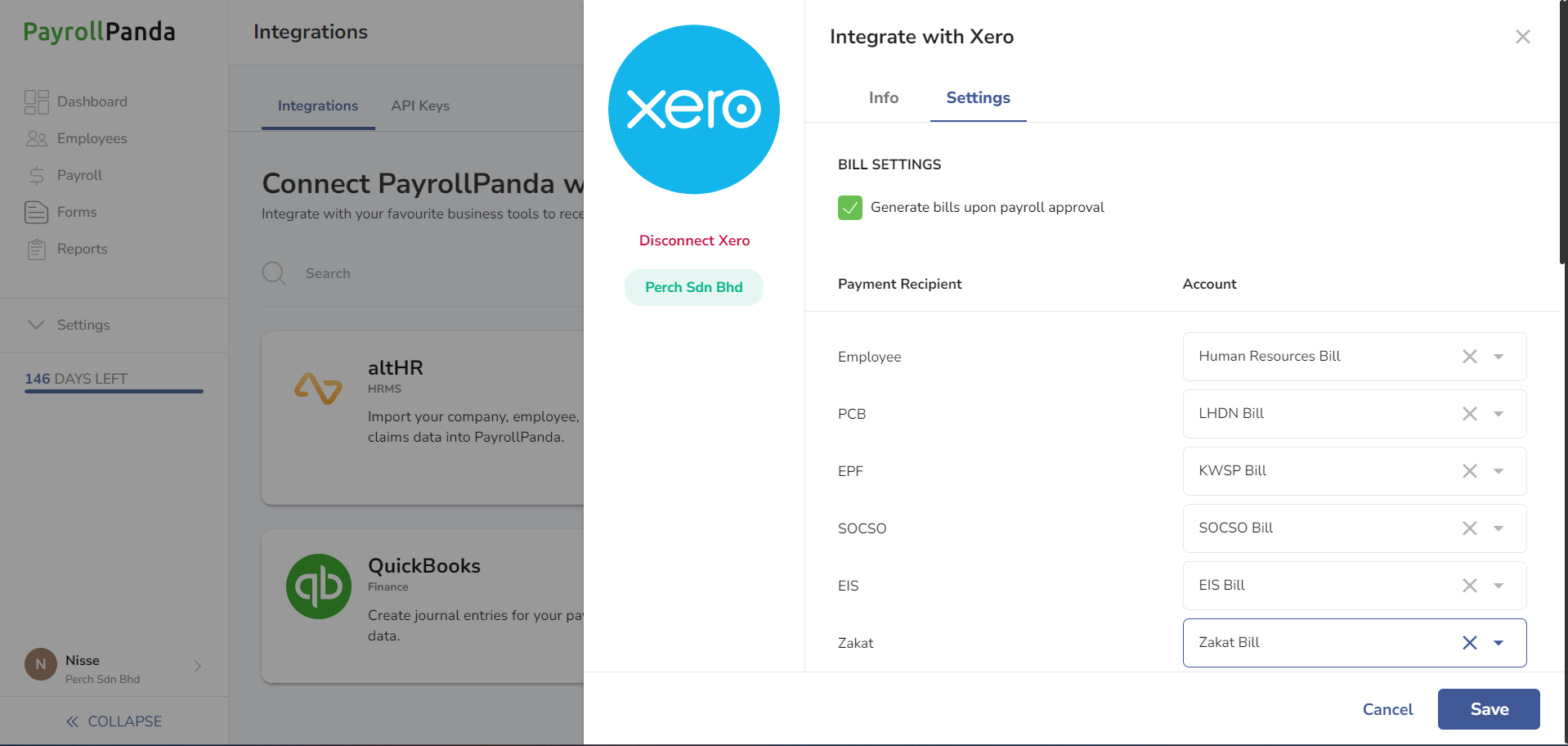

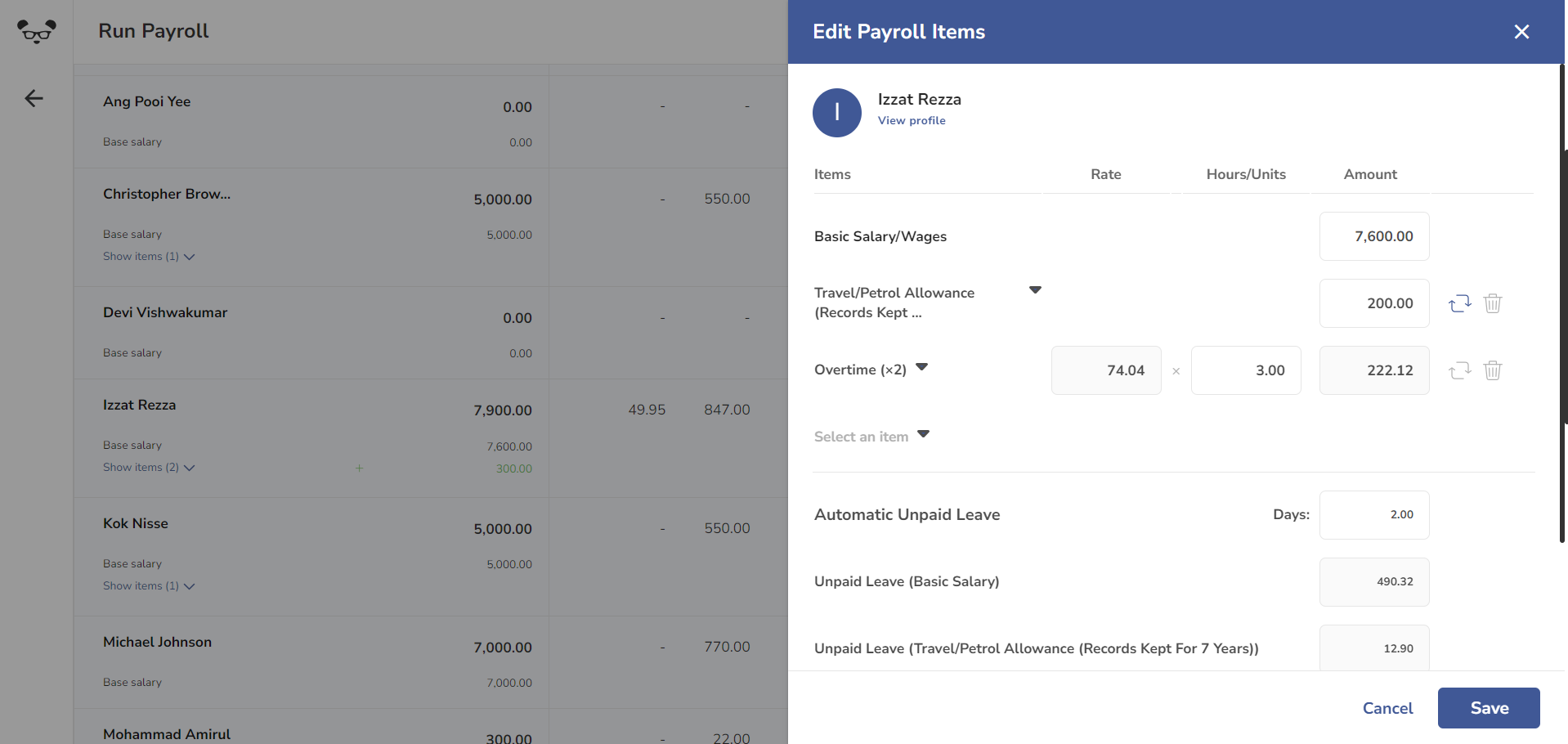

Step 2: Connect PayrollPanda to Xero Go to Settings > Integrations in PayrollPanda, select Xero, and click Connect with Xero. Step 3: Authorise the connection You’ll be redirected to the Xero login page. Log in and click Allow access to authorize PayrollPanda to connect to your Xero organization securely. Step 4: Configure your sync settings Choose your sync preferences. We recommend enabling Generate bills upon payroll approval, which automatically syncs your payroll data every time you approve payroll. You can leave it unticked to sync manually from your payroll history if you prefer. Step 5: Configure payroll mapping This is the most important step for your accounting. You can map PayrollPanda payroll components to the correct Xero accounts and tracking categories. Map Payment Recipients to Xero Contacts: Match items like "EPF" and "PCB" to your Xero contacts (e.g., "EPF Payable," "PCB Payable"). Map Payroll Items to Xero Expense Accounts: Match payroll items like "Basic Salary" and "Employer EPF" to your expense accounts in Xero (e.g., "Wages & Salaries," "Employer Contributions"). Step 6: Approve payroll in PayrollPanda Run payroll as usual. If Generate bills upon payroll approval is enabled, PayrollPanda will automatically post the payroll data to Xero. If not, you can manually sync individual payroll runs via Run Payroll > Select Payroll Month > Sync Data to Xero.

Step 7: Review and reconcile in Xero Once synced, bills appear instantly in Xero for review, approval, and bank matching. Each bill provides a detailed, itemized breakdown of salaries and statutory contributions, ensuring transparency and accuracy in your accounting.

With these steps, your PayrollPanda and Xero accounts will work together seamlessly, transforming payroll from a manual, error-prone task into an automated and reliable workflow that keeps your financial data perfectly synchronized.

If you need any help along the way, our comprehensive Help Center and dedicated local support team, available 5 days a week from 8am-6pm, are here to guide you, ensuring your integration is set up smoothly and mapped accurately from day one.