Overview

BAS Ready was built by accountants who understand the chaos of managing quarterly BAS for dozens or even hundreds of clients in Xero. Juggling deadlines, chasing documents, and checking each file one by one? We’ve lived it. That’s why we created a better way.

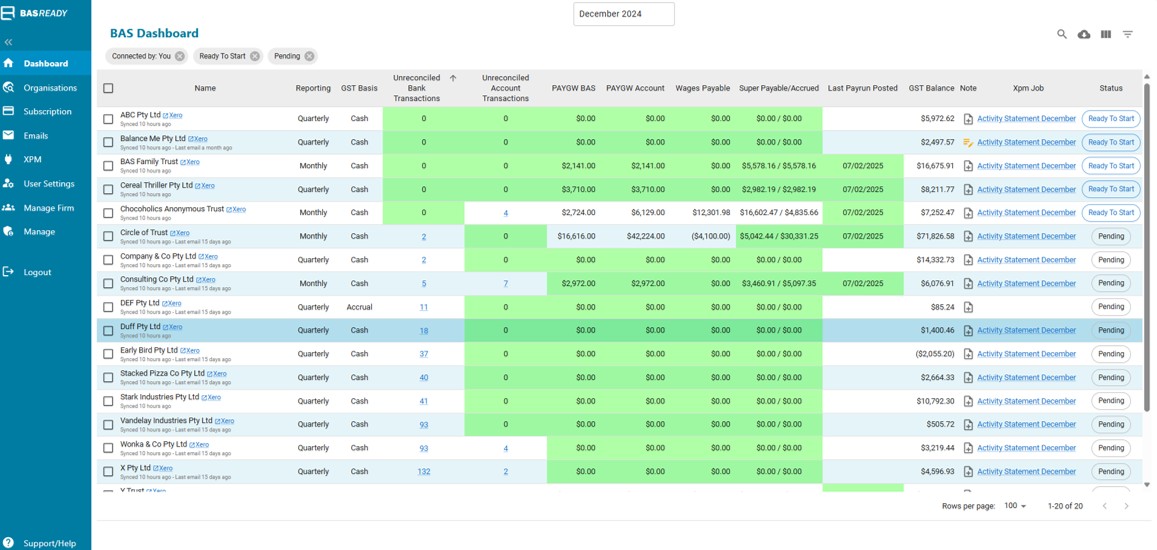

BAS Ready gives accountants and bookkeepers a single, powerful dashboard to track the BAS status of every Xero client in one place. No more spreadsheets, no more missed lodgements, and no more mental overload. Just clear, confident control over your BAS workflow.

Why firms love BAS Ready:

One dashboard for all clients Instantly see which clients have BAS due, what’s been started, what areas need attention, and what’s already complete.

Real-time BAS status from Xero We pull BAS data straight from Xero, so you’re always looking at the most up-to-date view of each client’s progress.

Set your preferred dashboard view with filters Organise your dashboard to show what's important, whether that's focusing on jobs to complete, or which clients to follow up. Prioritise the work that matters most right now.

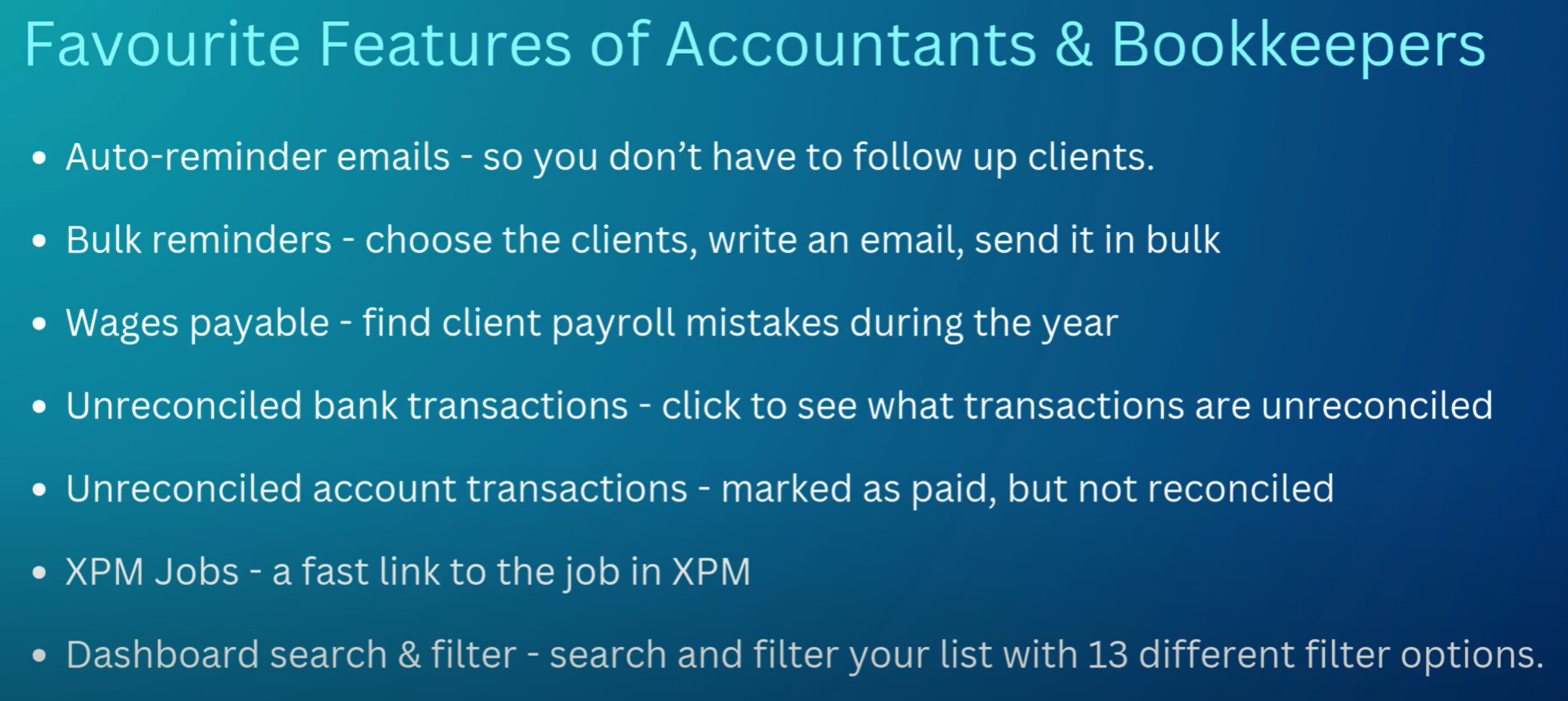

See what’s outstanding at a glance Review unreconciled bank transactions, unmatched account transactions, payroll process date, wages payable balance, so you can chase what’s needed faster.

Simple team collaboration Everyone on your team can log in and work from the same page, reducing double handling and back-and-forth, including a simple job notes feature.

Auto and bulk client reminder emails Set up auto-reminders so that clients are reminder if they have unreconciled bank transactions. Send bulk reminders for those who need an extra nudge to get their transaction, payroll or super up to date.

Built by accountants, for accountants We know the real-life workflow of BAS prep. BAS Ready makes that work smoother, more predictable, and easier to manage.

BAS Ready doesn’t replace your BAS workflow, it supports it. Think of it like your BAS command centre. Whether you're a solo BAS agent or managing a team, you’ll save time, reduce stress, and gain full visibility with BAS Ready.

BAS Ready + Xero

BAS Ready integrates directly with Xero via a secure API connection. Once connected, the app pulls key BAS data across all your Xero client files—so you can view and manage everything in one place. Our XPM integration also allows XPM Job Links and staff /manager roles to show in the dashboard.

Here’s how the integration works: Connect BAS Ready to your Xero clients in bulk using secure OAuth 2.0 authentication.

BAS Ready fetches BAS-related data from each linked Xero organisation, including unreconciled bank transactions, key payroll data, superannuation accrued in payroll vs super payable account (Balance Sheet), GST balance (Cash/Accrual from Balance Sheet).

This data is displayed in your BAS Ready dashboard in real time, giving you a single source of truth.

BAS Ready does not alter any data inside Xero. It’s read-only. We surface the information you need to manage deadlines and workflows, without changing your clients’ Xero files.

We use the latest security protocols to protect your firm and client data. All data is encrypted in transit and at rest. We follow best practices for API usage and do not store any credentials.

The integration supports:

Accrual and Cash GST reporting methods

Monthly and quarterly BAS cycles

Multi-user access and team collaboration

BAS Ready helps you spend less time jumping between Xero files and more time getting work done. We show you what’s important, so you can act faster, lodge on time, and feel confident everything’s under control.

Getting started

Getting started with BAS Ready is quick and easy—so you can gain control of your BAS workflow within minutes.

The easiest way to begin is by clicking the “Get this app” button on the Xero App Store listing or visit our website. You’ll be guided through a simple setup process that takes just a few minutes.

Setup steps: Click “Get this app” This will take you to BAS Ready where you’ll be prompted to connect your Xero account.

Log in with your Xero credentials We use secure Xero OAuth login. No need to create a separate BAS Ready password.

Authorise access Choose the Xero organisations (clients) you want to connect. You can connect multiple client files at once.

View your BAS dashboard Once connected, you’ll see a live dashboard of all connected clients’ unreconciled transactions, key payroll data, and job status.

Navigate to the Organisation tax to set the PAYGW period for any clients with a monthly PAYGW period, and fill out the client email and client managers to use the auto and bulk reminder email function .

No training required. If you can use Xero, you can use BAS Ready. It’s designed to feel familiar, intuitive, and practical—just like the rest of your tech stack.

Need help? Our friendly support team is just a message away. We offer chat and email support from real humans who understand how your firm works.

You’ll also find tooltips and guidance throughout the app, so you never feel lost.

Trust and support: Built by accountants, for accountants

Hosted securely in Australia

Read-only access—no changes made to client Xero files

Affordable pricing with a 14 day free trial available for the Starter subscription.

Ongoing updates and new features based on feedback

With BAS Ready, you can finally ditch the spreadsheet chaos and manage your entire BAS workload with calm confidence.